Question: Please read the question below and then provide your response in your reply. Your response must meet the following criteria. Quality of Post: Fully answers

Please read the question below and then provide your response in your reply. Your response must meet the following criteria. Quality of Post: Fully answers the question(s): Post is substantive and shows a deep level of understanding of the concepts; Post synthesizes, applies, and/or integrates concepts effectively.

Connections to Content: Post includes obvious and direct connections to competency content; May include direct/indirect quotes and references the content from the competency.

Originality: Post is original and demonstrates an independent thought process that is creative and individualized. Post adds value by raising novel points or providing new perspectives.

Writing Mechanics: Post is concise and clearly written in an academic tone; Sentences are complete; spelling, grammar and punctuation are correct.

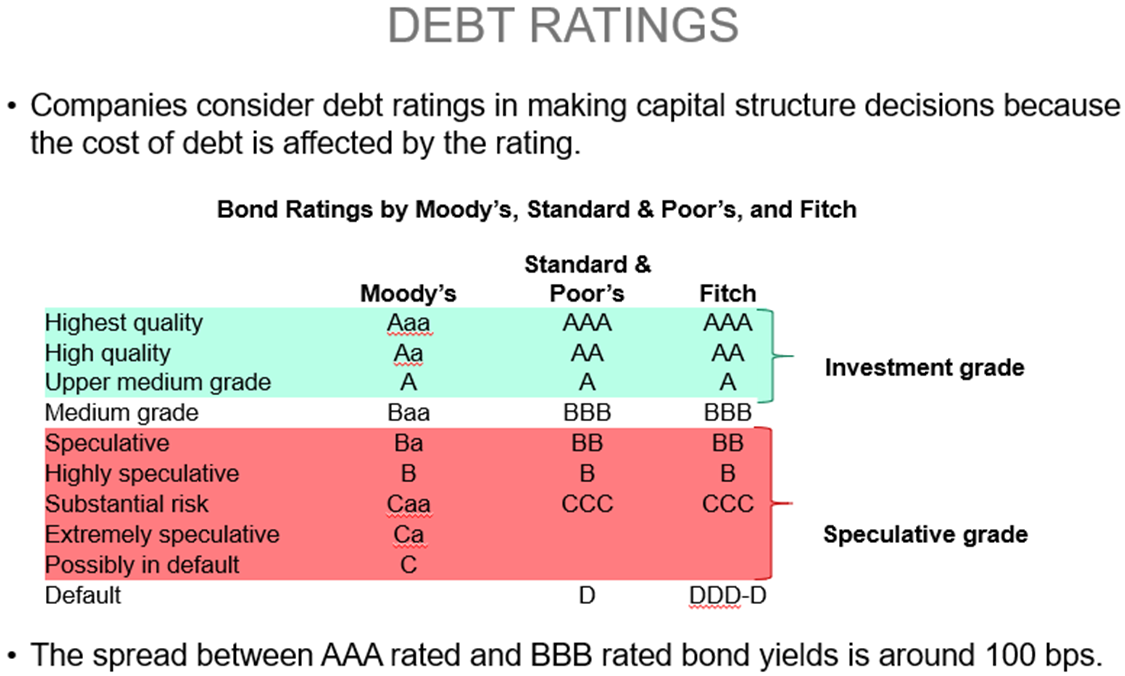

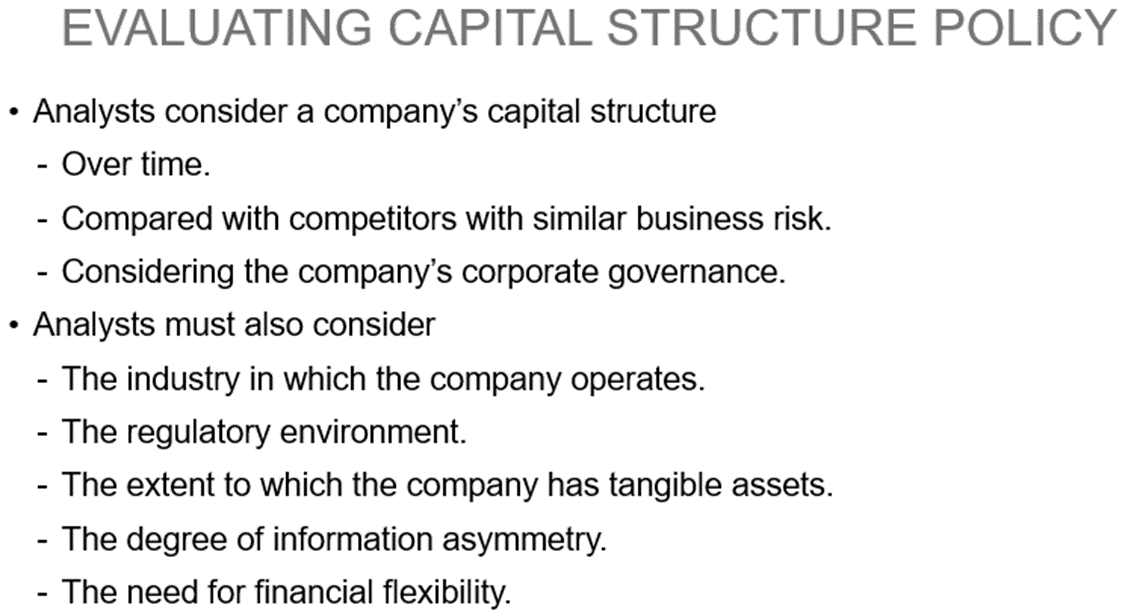

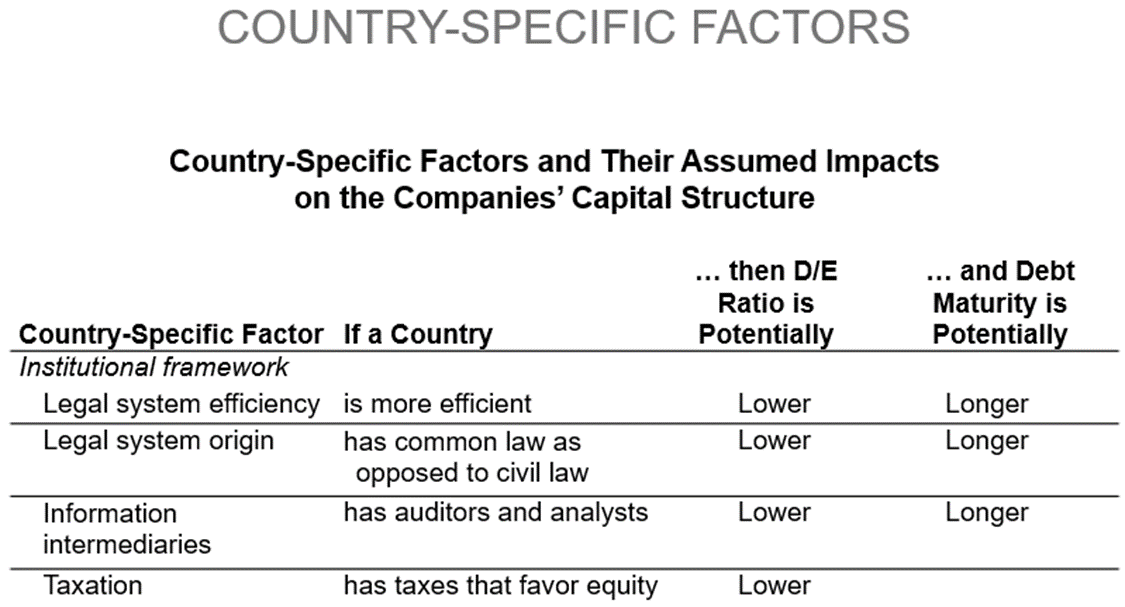

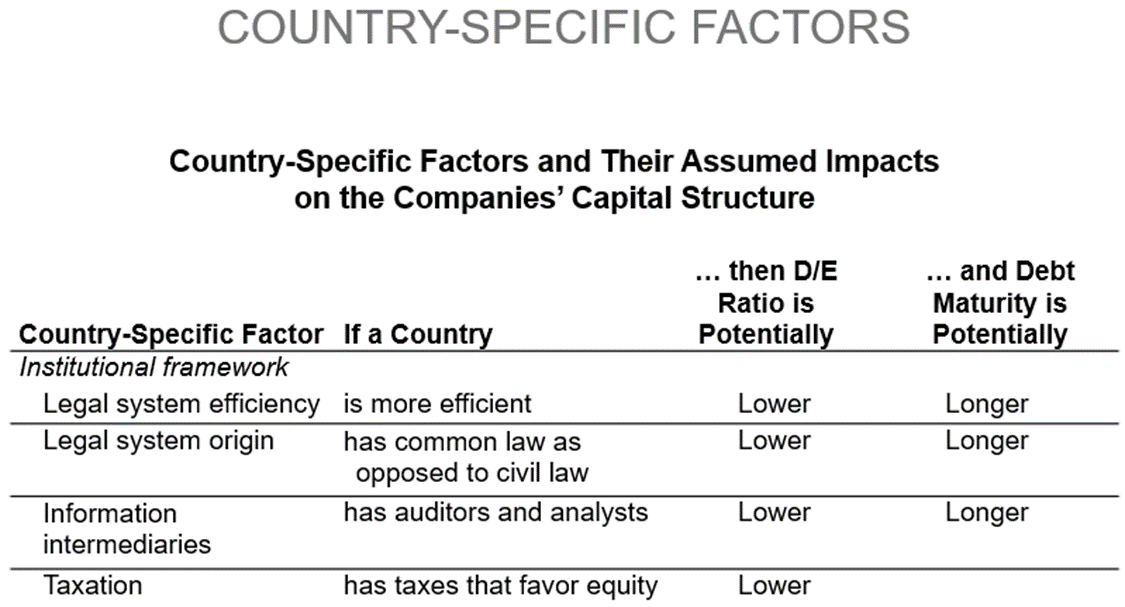

Question 1: The optimal capital structure is governed by a variety of factors, including taxes and the costs of financial distress. Compare and contrast the capital structure of JP Morgan Chase with one other non-banking member of the Dow Jones Industrial Average (DJIA) usingat least fivedifferent factors described in the images. ex) Types of factors to consider: -Institutional and legal environments -Financial markets and banking sector -Macroeconomic factors

-Country-Specific Factors

For the question 1, I think it's a good idea to cite information from the following online articles. http://www.investopedia.com/walkthrough/corporate-finance/5/capital-structure/bankruptcy-optimal-structure.aspx http://www.investopedia.com/exam-guide/cfa-level-1/corporate-finance/capital-structure-decision-factors.asp

Please let me give you an example. The capital structures of DJIA-listed companies Apple Inc. and JP Morgan Chase to better understand the many aspects that affect the ideal capital structure. While JP Morgan's capital structure is mostly debt-financed, Apple Inc.'s is primarily equity-financed. Legislation is crucial to capital structure because it mandates that banks follow stringent capital structure requirements. Due to Apple Inc.'s larger capitalization of debt and JP Morgan's higher net income, the latter company pays higher taxes. When you answer this question, please do not use Apple as a comparison to JP Morgan Chase. Choose the other DJIA-listed company. Please also add a table similar to the following:

| JP Morgan Chase's case: | Apple's case |

| (in $ millions) December 31, 2019 | (in $ millions) September 26, 2020 |

| Deposits 1,562,431 | Total current liabilities 105,392 |

| Federal funds 183,675 | Total non-current liabilities 153157 |

| Short term borrowings 40,920 | Total liabilities 258,549 |

| Trading liabilities 119,277 | |

| Beneficial interests 17,841 | |

| Long term debt 291,498 | |

| Total liabilities 2,426,049 | |

| Equity | Equity |

| Preferred stock 26,993 | Common stock 50779 |

| Common stock 4,105 | Retained earnings 14966 |

| Additional paid-in capital 88,522 | Accumulated other income -406 |

| Retained earnings 223,211 | Total equity 65,339 |

| Accumulated other income 1569 | |

| Treasury stock 83,049 | |

| Total equity 261,330 | |

| Total liabilities and equity 2,687,379 | Total liabilities and equity 323,888 |

| For JP Morgan Chase: debt ratio = total debt/total assets = 2426049/2687379 =90.28% | For Apple debt ratio = total debt/total assets = 258549/323888 = 79.83% |

| Debt to equity ratio = total debt/total equity = 2426049/261330 = 9.28 | Debt to equity ratio = total debt/total equity = 258549/65339 = 3.96 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts