Question: Please read the question carefully and answer sincerely, and answer as soon as you can. A partial answer would be rated negative. But, a Complete

Please read the question carefully and answer sincerely, and answer as soon as you can. A partial answer would be rated negative. But, a Complete and sincere answer would be rated positive instantly. Thank you

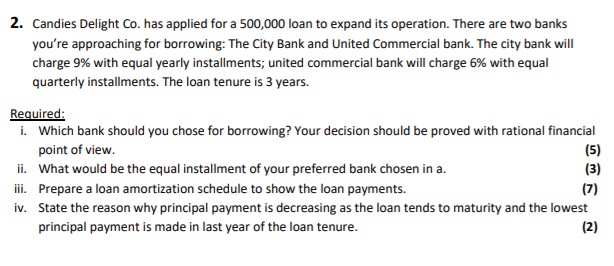

2. Candies Delight Co. has applied for a 500,000 loan to expand its operation. There are two banks you're approaching for borrowing: The City Bank and United Commercial bank. The city bank will charge 9% with equal yearly installments; united commercial bank will charge 6% with equal quarterly installments. The loan tenure is 3 years. Required: i. Which bank should you chose for borrowing? Your decision should be proved with rational financial point of view. (5) ii. What would be the equal installment of your preferred bank chosen in a. (3) iii. Prepare a loan amortization schedule to show the loan payments. (7) iv. State the reason why principal payment is decreasing as the loan tends to maturity and the lowest principal payment is made in last year of the loan tenure. (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts