Question: PLEASE READ THE QUESTION CAREFULLY AND DOUBLE CHECK ANSWER. I will thumbs up if correct thanks. The current price of a non-dividend-paying stock is 30.

PLEASE READ THE QUESTION CAREFULLY AND DOUBLE CHECK ANSWER. I will thumbs up if correct thanks.

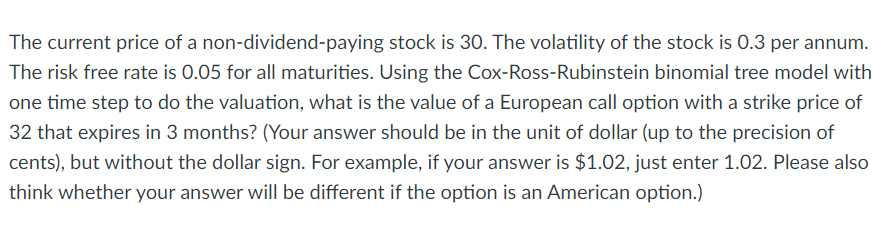

The current price of a non-dividend-paying stock is 30. The volatility of the stock is 0.3 per annum. The risk free rate is 0.05 for all maturities. Using the Cox-Ross-Rubinstein binomial tree model with one time step to do the valuation, what is the value of a European call option with a strike price of 32 that expires in 3 months? (Your answer should be in the unit of dollar (up to the precision of cents), but without the dollar sign. For example, if your answer is $1.02, just enter 1.02. Please also think whether your answer will be different if the option is an American option.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts