Question: Please read the statements provided and correct the income statement for each transaction on a running basis. After you make all the corrections then state

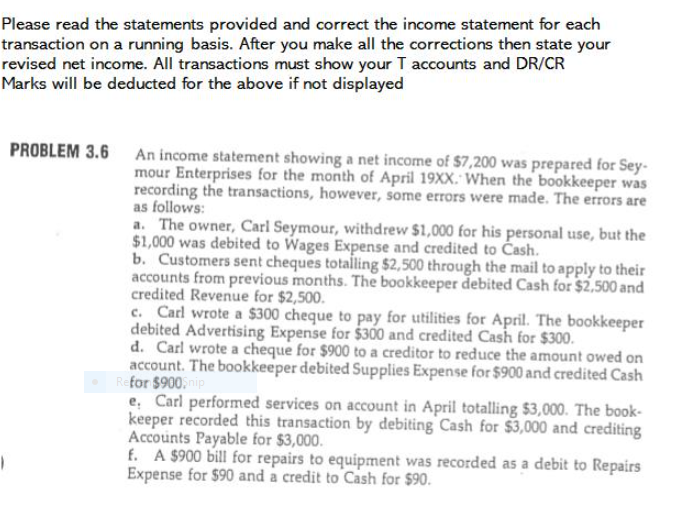

Please read the statements provided and correct the income statement for each transaction on a running basis. After you make all the corrections then state your revised net income. All transactions must show your T accounts and DRCR Marks will be deducted for the above if not displayed

PROBLEM An income statement showing a net income of $ was prepared for Seymour Enterprises for the month of April XX When the bookkeeper was recording the transactions, however, some errors were made. The errors are as follows:

a The owner, Carl Seymour, withdrew $ for his personal use, but the $ was debited to Wages Expense and credited to Cash.

b Customers sent cheques totalling $ through the mail to apply to their accounts from previous months. The bookkeeper debited Cash for $ and credited Revenue for $

c Carl wrote a $ cheque to pay for utilities for April. The bookkeeper debited Advertising Expense for $ and credited Cash for $

d Carl wrote a cheque for $ to a creditor to reduce the amount owed on account. The bookkeeper debited Supplies Expense for $ and credited Cash for $

e Carl performed services on account in April totalling $ The bookkeeper recorded this transaction by debiting Cash for $ and crediting Accounts Payable for $

f A $ bill for repairs to equipment was recorded as a debit to Repairs Expense for $ and a credit to Cash for $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock