Question: Please read the summary, and answer question a-c each part has directions on how to answer the question Your friend John asks you for advice

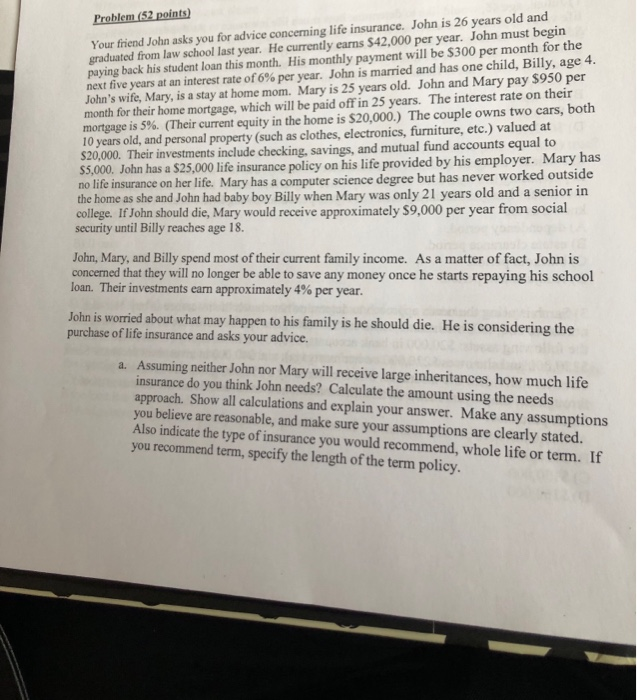

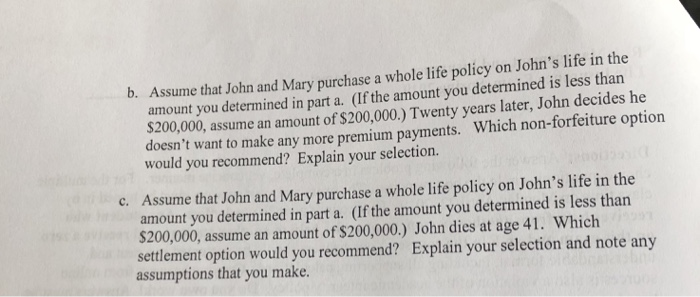

Your friend John asks you for advice concerning life insurance. John is 26 years old and graduated from law school last year. He currently earns $42,000 per year. John must begin paying back his student loan this month. His monthly payment will be $300 per month for the next five years at an interest rate of 6% per year. John is married and has one child, Billy, age 4. John's wife, Mary, is a stay at home mom. Mary is 25 years old. John and Mary pay $950 per month for their home mortgage, which will be paid off in 25 years. The interest rate on their mortgage is 5%. (Their current equity in the home is $20,000.) The couple owns two cars, both 10 years old, and personal property (such as clothes, electronics, furniture, etc.) valued at S20000. Their investments include checking. savings, and mutual fund accounts equal to a $25,000 life insurance policy on his life provided by his employer. Mary has on her life. Mary has a computer science degree but has never worked outside $5,000. John has no life insurance the home as she and John had baby boy Billy when Mary was only 21 years old and a senior in college. If John should die, Mary would receive approximately $9,000 per year from social security until Billy reaches age 18. John, Mary, and Billy spend most of their current family income. As a matter of fact, John is concerned that they will no longer be able to save any money once he starts repaying his school loan. Their investments earn approximately 4% per year. John is worried about what may happen to his family is he should die. He is considering the purchase of life insurance and asks your advice. Assuming neither John nor Mary will receive large inheritances, how much life insurance do you think John needs? Calculate the amount using the needs approach. Show all calculations and explain your answer. Make any assumptions you believe are reasonable, and make sure your assumptions are clearly stated Also indicate the type of insurance you would recommend, whole life or term. If you recommend term, specify the length of the term policy a. Assume that John and Mary purchase a whole life policy on John's life in the amount you determined in part a. (If the amount you determined is less than $200 b. ,000, assume an amount of $200,000.) Twenty years later, John decides he doesn't want to make any more premium payments. Which non-forf would you recommend? Explain your selection. Assume that John and Mary purchase a whole life policy on John's life in the amount you determined in part a. (If the amount you determined is less than S200,000, assume an amount of $200,000.) John dies at age 41. Which settlement option would you recommend? Explain your selection and note any assumptions that you make. c. Your friend John asks you for advice concerning life insurance. John is 26 years old and graduated from law school last year. He currently earns $42,000 per year. John must begin paying back his student loan this month. His monthly payment will be $300 per month for the next five years at an interest rate of 6% per year. John is married and has one child, Billy, age 4. John's wife, Mary, is a stay at home mom. Mary is 25 years old. John and Mary pay $950 per month for their home mortgage, which will be paid off in 25 years. The interest rate on their mortgage is 5%. (Their current equity in the home is $20,000.) The couple owns two cars, both 10 years old, and personal property (such as clothes, electronics, furniture, etc.) valued at S20000. Their investments include checking. savings, and mutual fund accounts equal to a $25,000 life insurance policy on his life provided by his employer. Mary has on her life. Mary has a computer science degree but has never worked outside $5,000. John has no life insurance the home as she and John had baby boy Billy when Mary was only 21 years old and a senior in college. If John should die, Mary would receive approximately $9,000 per year from social security until Billy reaches age 18. John, Mary, and Billy spend most of their current family income. As a matter of fact, John is concerned that they will no longer be able to save any money once he starts repaying his school loan. Their investments earn approximately 4% per year. John is worried about what may happen to his family is he should die. He is considering the purchase of life insurance and asks your advice. Assuming neither John nor Mary will receive large inheritances, how much life insurance do you think John needs? Calculate the amount using the needs approach. Show all calculations and explain your answer. Make any assumptions you believe are reasonable, and make sure your assumptions are clearly stated Also indicate the type of insurance you would recommend, whole life or term. If you recommend term, specify the length of the term policy a. Assume that John and Mary purchase a whole life policy on John's life in the amount you determined in part a. (If the amount you determined is less than $200 b. ,000, assume an amount of $200,000.) Twenty years later, John decides he doesn't want to make any more premium payments. Which non-forf would you recommend? Explain your selection. Assume that John and Mary purchase a whole life policy on John's life in the amount you determined in part a. (If the amount you determined is less than S200,000, assume an amount of $200,000.) John dies at age 41. Which settlement option would you recommend? Explain your selection and note any assumptions that you make. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts