Question: PLEASE READ THIS BEFORE ANSWERING THE QUESTION! The question is already solved I just need clarification on finding the residual income. I don't entirely understand

PLEASE READ THIS BEFORE ANSWERING THE QUESTION!

The question is already solved I just need clarification on finding the residual income. I don't entirely understand where each number came from and why it was placed there. I know the formula is Divisional profit - Imputed charge for divisional investment. (hurdle rate% x Controllable assets), but I don't get how to use it. Thank You.

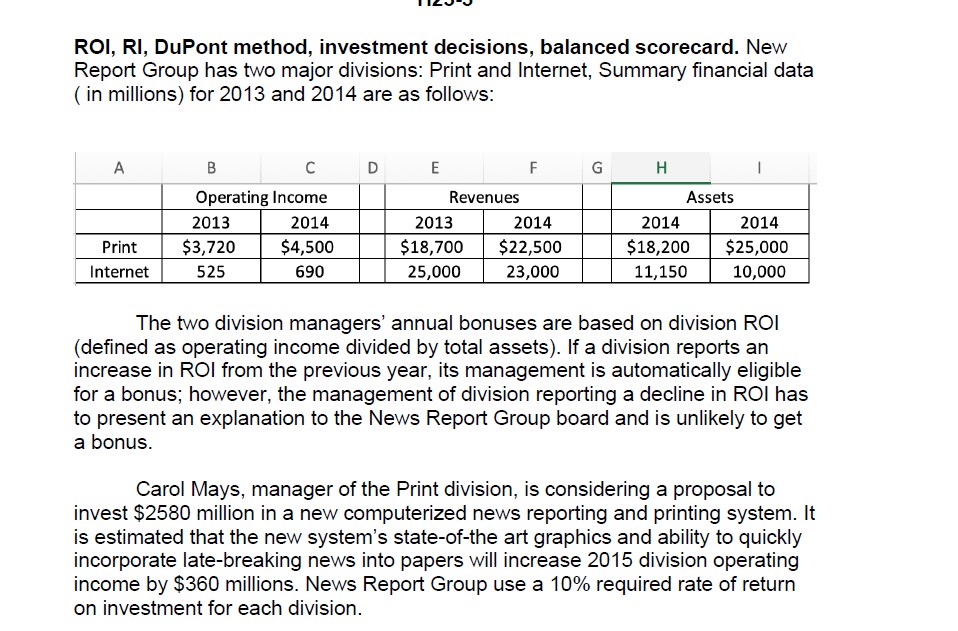

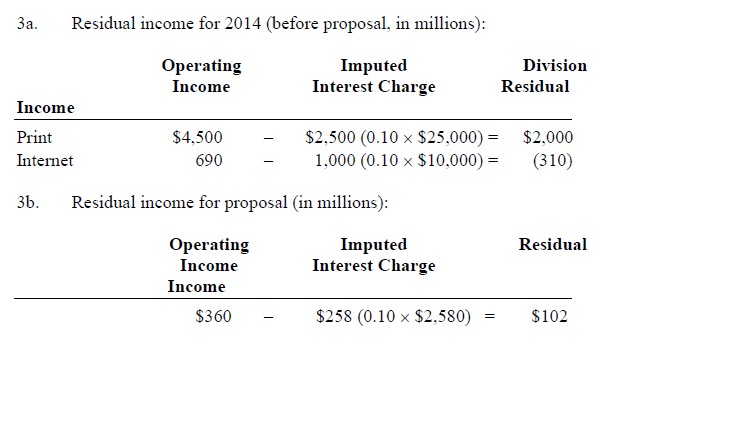

I I'd-J ROI, RI, DuPont method, investment decisions, balanced scorecard. New Report Group has two major divisions: Print and Internet, Summary nancial data ( in millions) for 2013 and 2014 are as follows: A B C D E F G H | Operating Income Revenues Assets 2013 2014 2013 2014 2014 2014 $4,500 $18,200 $25,000 690 11,150 10,000 The two division managers' annual bonuses are based on division ROI (dened as operating income divided by total assets). If a division reports an increase in ROI from the previous year, its management is automatically eligible for a bonus; however. the management of division reporting a decline in ROI has to present an explanation to the News Report Group board and is unlikely to get a bonus. Carol Mays, manager of the Print division, is considering a proposal to invest $2580 million in a new computerized news reporting and printing system. It is estimated that the new system's state-ofthe art graphics and ability to quickly incorporate late-breaking news into papers will increase 2015 division operating income by $360 millions. News Report Group use a 10% required rate of return on investment for each division. 3a. Residual income for 2014 (before proposal, in millions): Operating Imputed Division Income Interest Charge Residual Income Print $4.500 - $2.500 (0.10 x $25,000) = $2,000 Internet 690 - 1,000 (0.10 x $10,000) = (310) 3b. Residual income for proposal (in millions): Operating Imputed Residual Income Interest Charge Income $360 $258 (0.10 x $2,580) = $102

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts