Question: Please record journal entry for each transaction 21. During YR01 and YR02, Macy's Inc. had the following sales-related activity. REQUIRED: Prepare formal journal entries to

Please record journal entry for each transaction

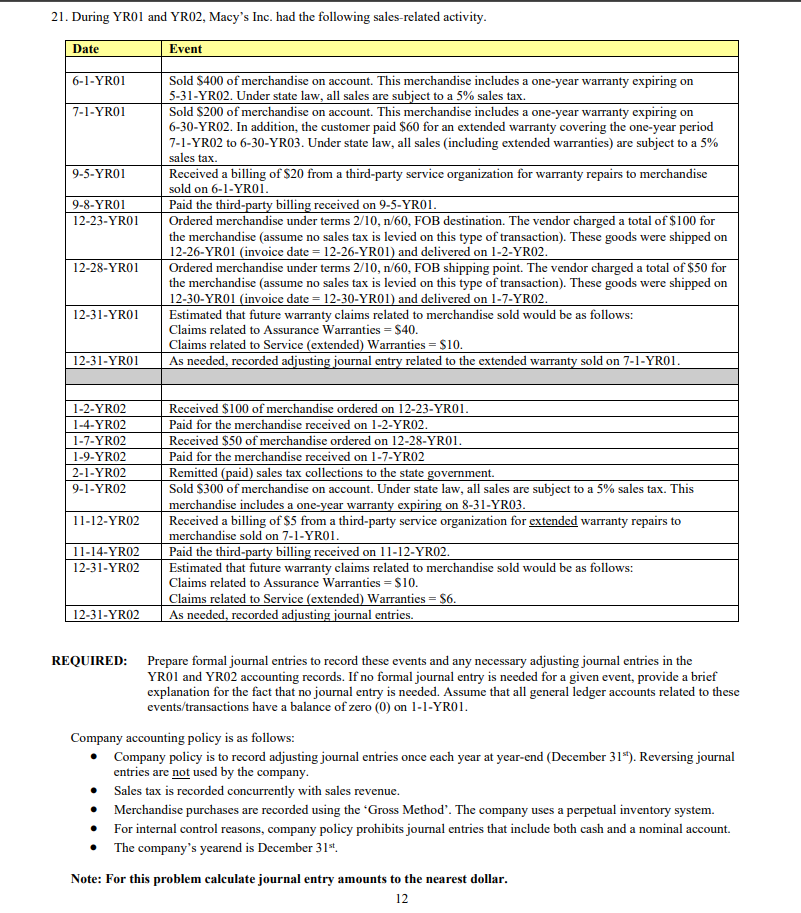

21. During YR01 and YR02, Macy's Inc. had the following sales-related activity. REQUIRED: Prepare formal journal entries to record these events and any necessary adjusting journal entries in the YR01 and YR02 accounting records. If no formal journal entry is needed for a given event, provide a brief explanation for the fact that no journal entry is needed. Assume that all general ledger accounts related to these events/transactions have a balance of zero (0) on 1-1-YR01. Company accounting policy is as follows: - Company policy is to record adjusting journal entries once each year at year-end (December 31st ). Reversing journal entries are not used by the company. - Sales tax is recorded concurrently with sales revenue. - Merchandise purchases are recorded using the 'Gross Method'. The company uses a perpetual inventory system. - For internal control reasons, company policy prohibits journal entries that include both cash and a nominal account. - The company's yearend is December 31st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts