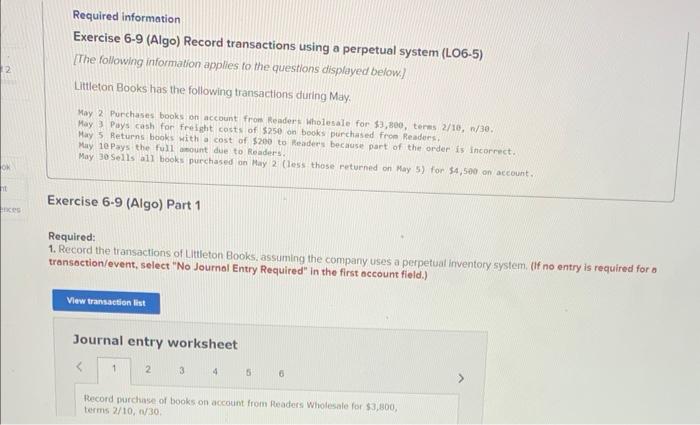

Question: Please record the Journal Entries using the following information! 7) Required information Exercise 6-9 (Algo) Record transactions using a perpetual system (LO6-5) [The following information

![applies to the questions displayed below.] Littleton Books has the following transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7da1b8ec23_68366e7da1b336e5.jpg)

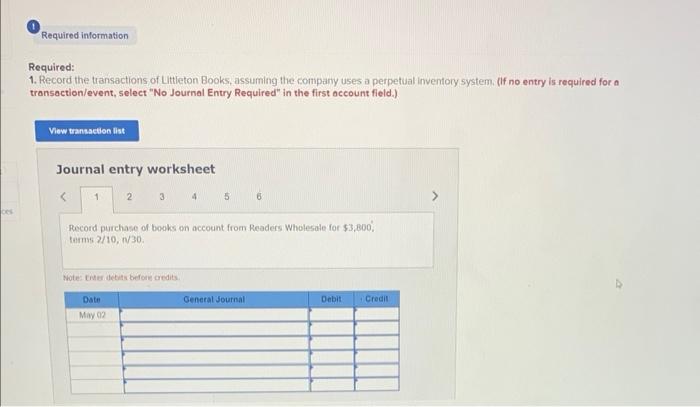

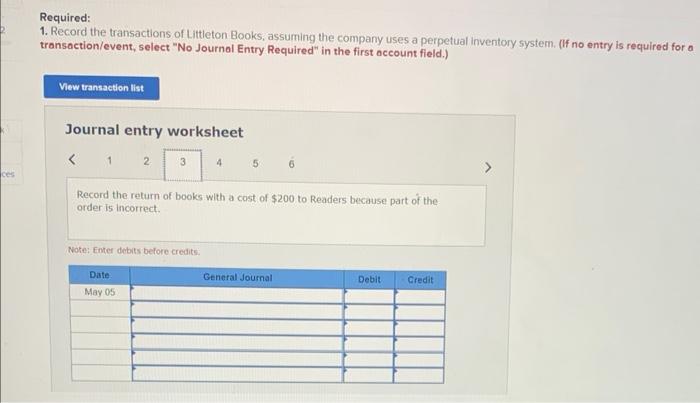

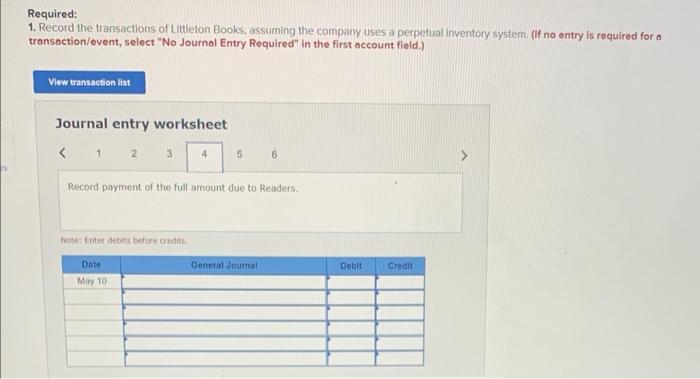

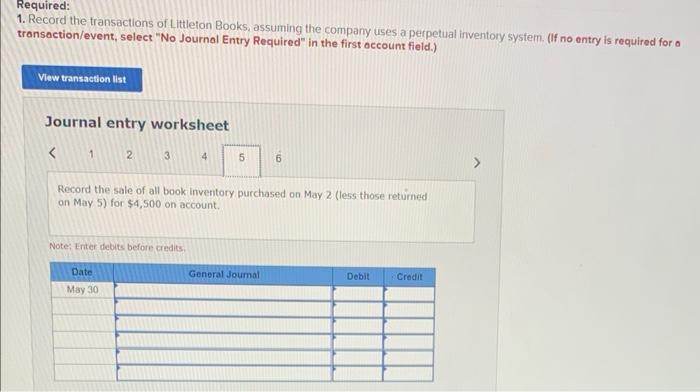

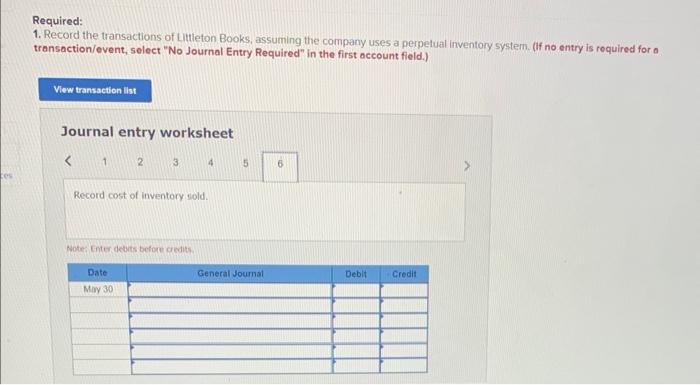

Required information Exercise 6-9 (Algo) Record transactions using a perpetual system (LO6-5) [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May, May 2 Purchases books on account from Readers wholesale for 33,300 , terms 2/10,N/30. May 3 Pays cash for fresshit costs of $250 on books purctiased froe Readers, May 5 Returns books with a cost of $200 to Readers bechuse part of the order is incorrect. May 10 Pays the full owount due to keaders. May 30 sells a11 books purchased on May 2 . (less those returned on May 5) for \$4,500 on account, xercise 6-9 (Algo) Part 1 tequired: - Record the transactions of Littieton Books, assuming the company uses a perpetual inventory system, (If no entry is required for o ransoction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record marchase of books on account from Readers Wholesale for $3,1300, terms 2/10, 1/30. Required: 1. Record the transactions of Littieton Books, assuming the company uses a perpetual inventory system, (If no entry is required for a transoction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record purchase of boaks on account from Readers Wholesale for $3,800, tatmine 7/10,/30 Notes timen detits befone credits Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is required for a tronsaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record payment of cash for freight costs of $250 on books purchased from Readers. Note: Iinter sebits before credits. Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the return of books with a cost of $200 to Readers because part of the order is incorrect. Note: Enter debits before credits. Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is required for o transaction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet 12 1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is required for o transaction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Record the sale of all book inventory purchased on May 2 (less those returned on May 5) for $4,500 on account. Note; Enter debits before credits. Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpelual inventory system. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts