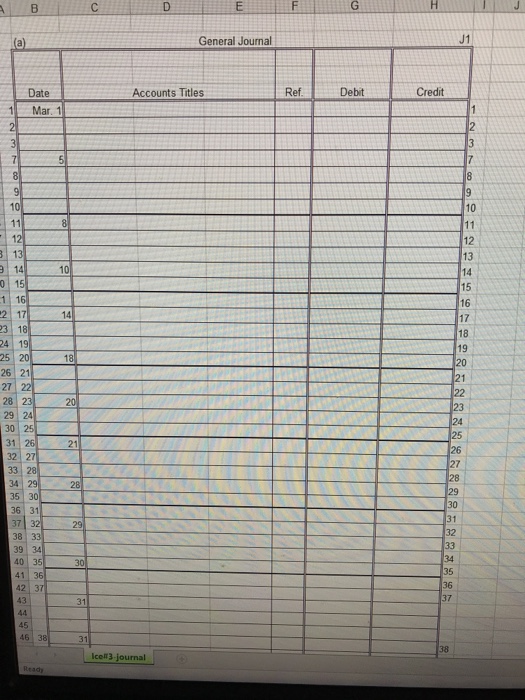

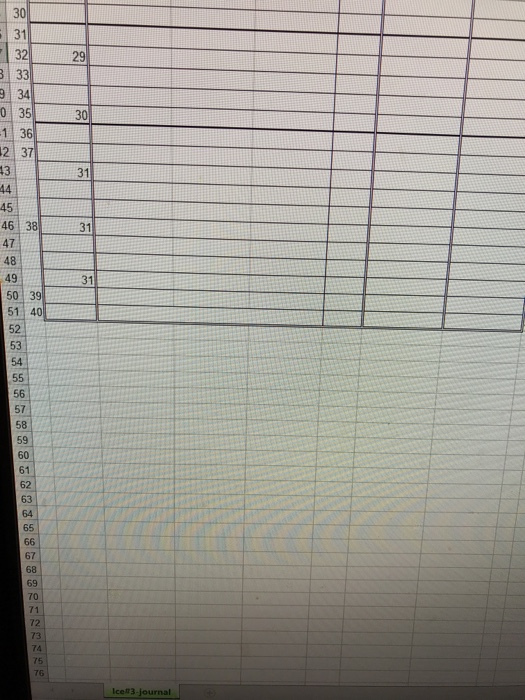

Question: Please record the March 1-31 entries from problem below in the journal provided(in excel file) Problem information: Bill Werner opened Werner Carpet Cleaners on March

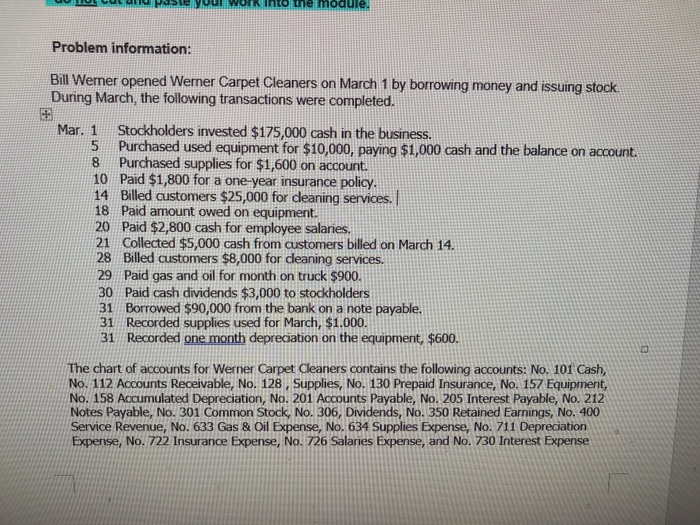

Problem information: Bill Werner opened Werner Carpet Cleaners on March 1 by borrowing money and issuing stock. During March, the following transactions were completed. Stockholders invested $175,000 cash in the business. 5 Purchased used equipment for $10,000, paying $1,000 cash and the balance on account. 8 Purchased supplies for $1,600 on account. 10 Paid $1,800 for a one-year insurance policy 14 Billed customers $25,000 for dleaning services. 18 Paid amount owed on equipment. 20 Paid $2,800 cash for employee salaries 21 Collected $5,000 cash from customers billed on March 14 28 Billed customers $8,000 for cleaning services. 29 Paid gas and oil for month on truck $900. 30 Paid cash dividends $3,000 to stockholders 31 Borrowed $90,000 from the bank on a note payable. 31 Recorded supplies used for March, $1.000. 31 Recorded one month depreciation on the equipment, $600. Mar. 1 The chart of accounts for Werner Carpet Cleaners contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 128, Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation, No. 201 Accounts Payable, No. 205 Interest Payable, No. 212 Notes Payable, No. 301 Common Stock, No. 306, Dividends, No. 350 Retained Earnings, No. 400 Service Revenue, No. 633 Gas & Oil Expense, No. 634 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, No. 726 Salaries Expense, and No. 730 Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts