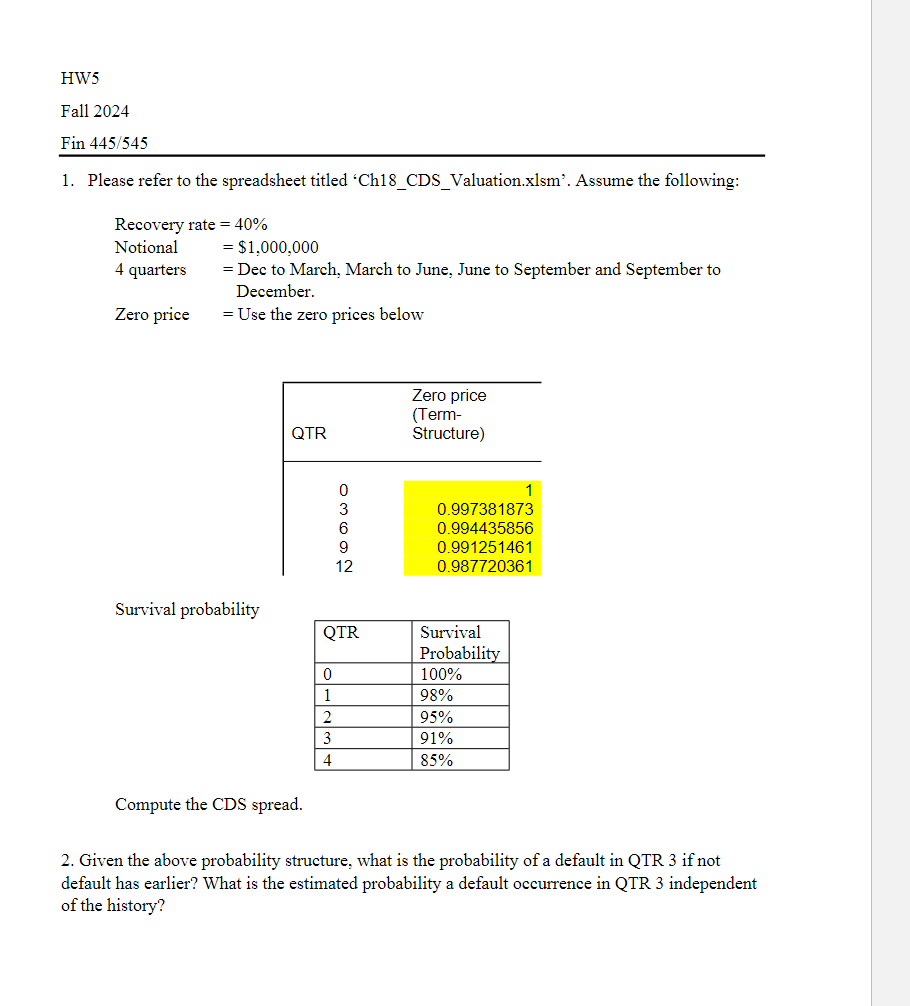

Question: Please refer to the spreadsheet titled Ch 1 8 _ CDS _ Valuation.xlsm . Assume the following: Recovery rate = 4 0 % Notional =

Please refer to the spreadsheet titled ChCDSValuation.xlsm Assume the following:

Recovery rate

Notional $

quarters Dec to March, March to June, June to September and September to

December.

Zero price Use the zero prices below

QTR

Zero price

Term

Structure

Survival probability

QTR Survival

Probability

Compute the CDS spread.

Given the above probability structure, what is the probability of a default in QTR if not

default has earlier? What is the estimated probability a default occurrence in QTR independent

of the history? HW

Fall

Fin

Please refer to the spreadsheet titled ChCDSValuation.xlsm Assume the following:

Recovery rate

Notional quad$

quarters Dec to March, March to June, June to September and September to December.

Zero price quad Use the zero prices below

Survival probability

Compute the CDS spread.

Given the above probability structure, what is the probability of a default in QTR if not default has earlier? What is the estimated probability a default occurrence in QTR independent of the history?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock