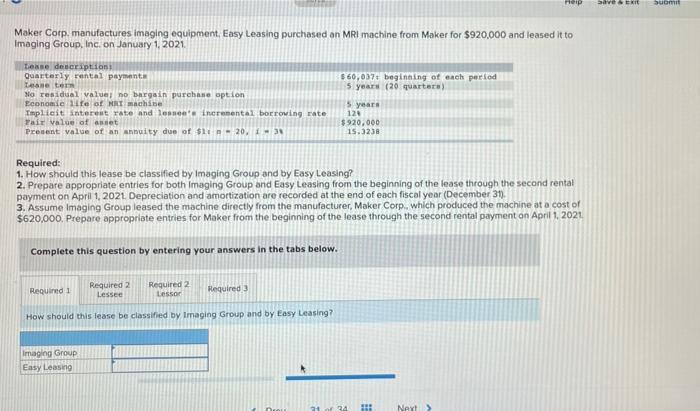

Question: please rep Sve & ERIC Maker Corp. manufactures imaging equipment, Easy Leasing purchased an MRI machine from Maker for $920,000 and leased it to Imaging

rep Sve & ERIC Maker Corp. manufactures imaging equipment, Easy Leasing purchased an MRI machine from Maker for $920,000 and leased it to Imaging Group, Inc. on January 1, 2021 Lease decription Quarterly rental payments Le ter No residual values no bargain purchase option Economic life of NRT machine Timplicit interest rate and loss incremental borrowing rate Zair value of att Present value of an annuity due of $it - 2013 $60,0371 beginning of each period 5 years (20 quartera 5 years 120 $920,000 15.5238 Required: 1. How should this lease be classified by Imaging Group and by Easy Leasing? 2. Prepare appropriate entries for both Imaging Group and Easy Leasing from the beginning of the lease through the second rental payment on April 1, 2021 Depreciation and amortization are recorded at the end of each fiscal year (December 31). 3. Assume Imaging Group leased the machine directly from the manufacturer, Maker Corp, which produced the machine at a cost of $620,000. Prepare appropriate entries for Maker from the beginning of the lease through the second rental payment on April 1, 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Lessee Required 2 Lessor Required 3 How should this lease be classified by Imaging Group and by Easy Leasing? Imaging Group Easy Leasing 134 HA Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts