Question: please reply ASAP a. Question 2 Bear Bear Bakery just paid an amual dividend of RM2.85 on its common stock. The fimmincreases its dividend to

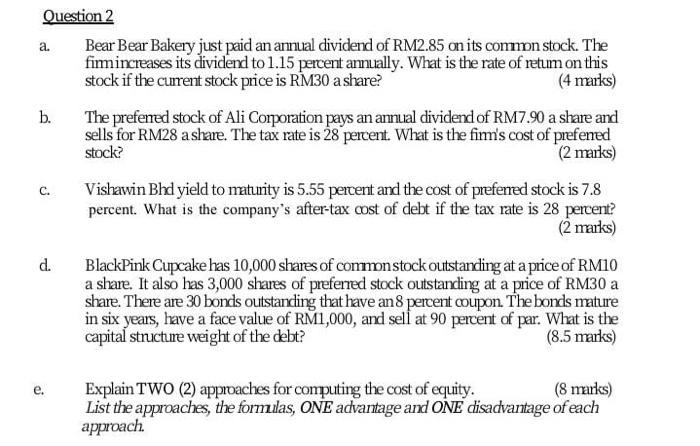

a. Question 2 Bear Bear Bakery just paid an amual dividend of RM2.85 on its common stock. The fimmincreases its dividend to 1.15 percent amuually. What is the rate of retum on this stock if the current stock price is RM30 a share? (4 marks) b. The preferred stock of Ali Corporation pays an annual dividend of RM7.90 a share and sells for RM28 a share. The tax rate is 28 percent. What is the finn's cost of prefened stock? (2 marks) Vishawin Bhd yield to maturity is 5.55 percent and the cost of preferred stock is 7.8 percent. What is the company's after-tax cost of debt if the tax rate is 28 percent? (2 marks) C. d. BlackPink Cupcake has 10,000 shares of common stock outstanding at a price of RM10 a share. It also has 3,000 shares of preferred stock outstanding at a price of RM30 a share. There are 30 bonds outstanding that have an 8 percent coupon. The bonds mature in six years, have a face value of RM1,000, and sell at 90 percent of par. What is the capital structure weight of the debt? (8.5 marks) e. Explain TWO (2) approaches for computing the cost of equity. (8 marks) List the approaches, the formulas, ONE advantage and ONE disadvantage of each approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts