Question: Please reply if you can answer completely and in full detail with good handwriting. COMM 24. What is the purpose in calculating the expected value

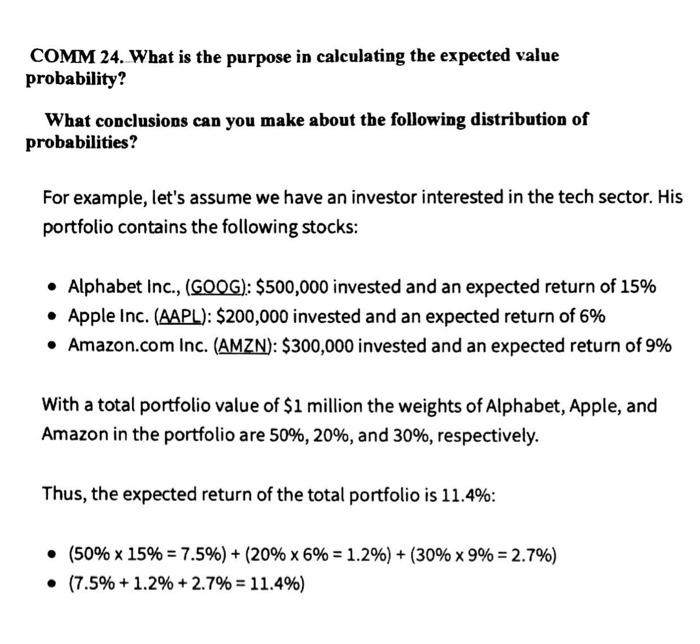

COMM 24. What is the purpose in calculating the expected value probability? What conclusions can you make about the following distribution of probabilities? For example, let's assume we have an investor interested in the tech sector. His portfolio contains the following stocks: Alphabet Inc., (GOOG): $500,000 invested and an expected return of 15% Apple Inc. (AAPL): $200,000 invested and an expected return of 6% Amazon.com Inc. (AMZN): $300,000 invested and an expected return of 9% With a total portfolio value of $1 million the weights of Alphabet, Apple, and Amazon in the portfolio are 50%, 20%, and 30%, respectively. Thus, the expected return of the total portfolio is 11.4%: (50% x 15% = 7.5%) + (20% x 6% = 1.2%) + (30% x 9% = 2.7%) (7.5% +1.2% + 2.7% = 11.4%) COMM 24. What is the purpose in calculating the expected value probability? What conclusions can you make about the following distribution of probabilities? For example, let's assume we have an investor interested in the tech sector. His portfolio contains the following stocks: Alphabet Inc., (GOOG): $500,000 invested and an expected return of 15% Apple Inc. (AAPL): $200,000 invested and an expected return of 6% Amazon.com Inc. (AMZN): $300,000 invested and an expected return of 9% With a total portfolio value of $1 million the weights of Alphabet, Apple, and Amazon in the portfolio are 50%, 20%, and 30%, respectively. Thus, the expected return of the total portfolio is 11.4%: (50% x 15% = 7.5%) + (20% x 6% = 1.2%) + (30% x 9% = 2.7%) (7.5% +1.2% + 2.7% = 11.4%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts