Question: Please reply without details, just tell me the correct answer QUESTION 7 Lambert Corporation reported net income of $60 million for last year. Depreciation expense

Please reply without details, just tell me the correct answer

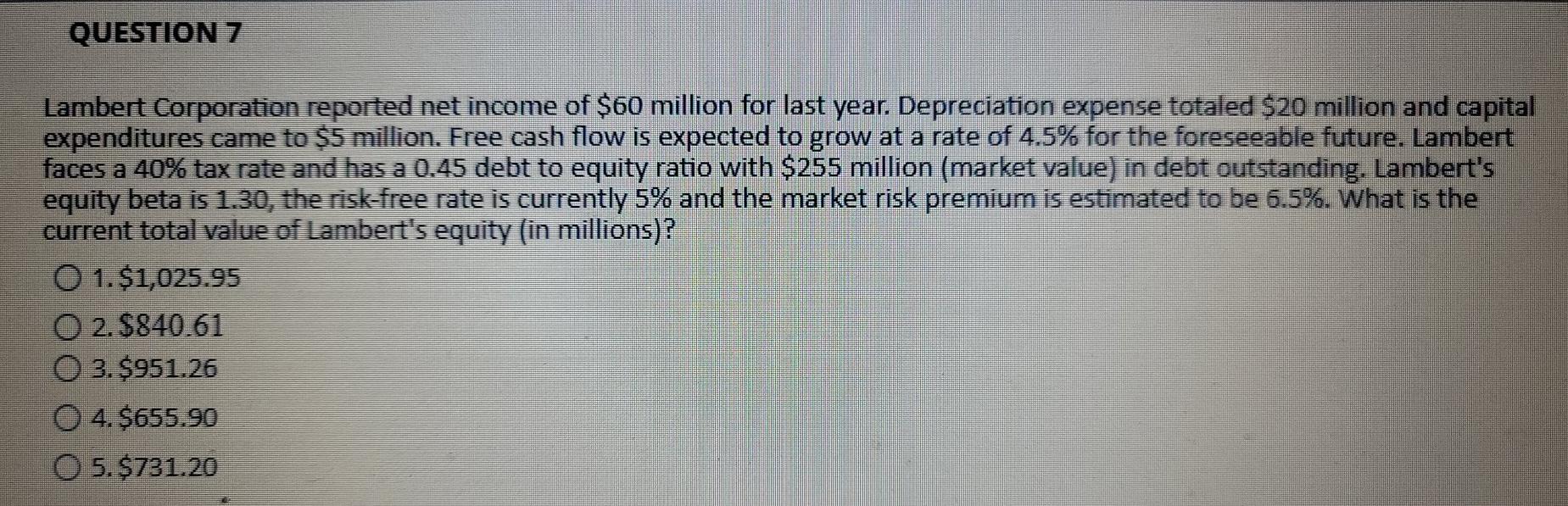

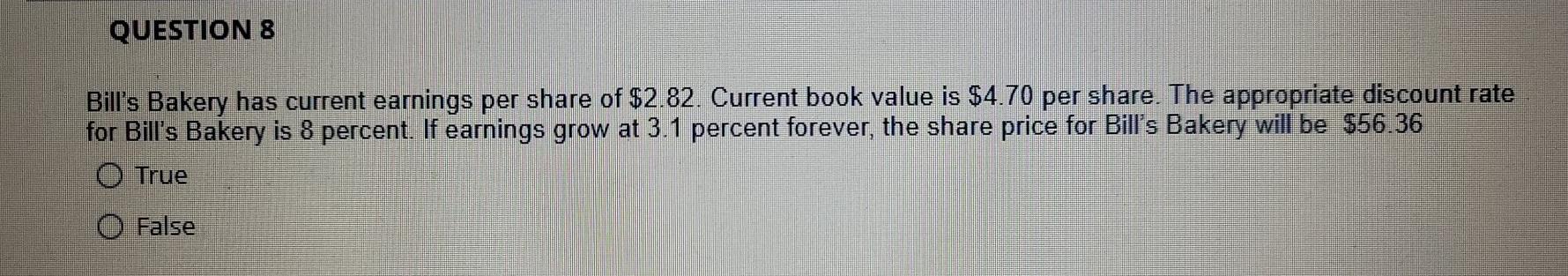

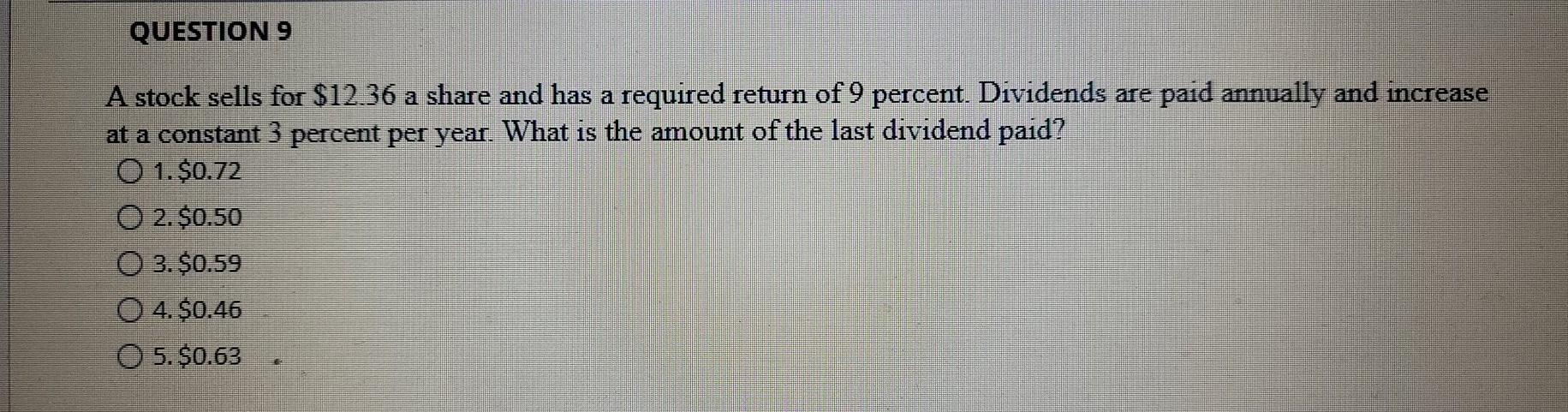

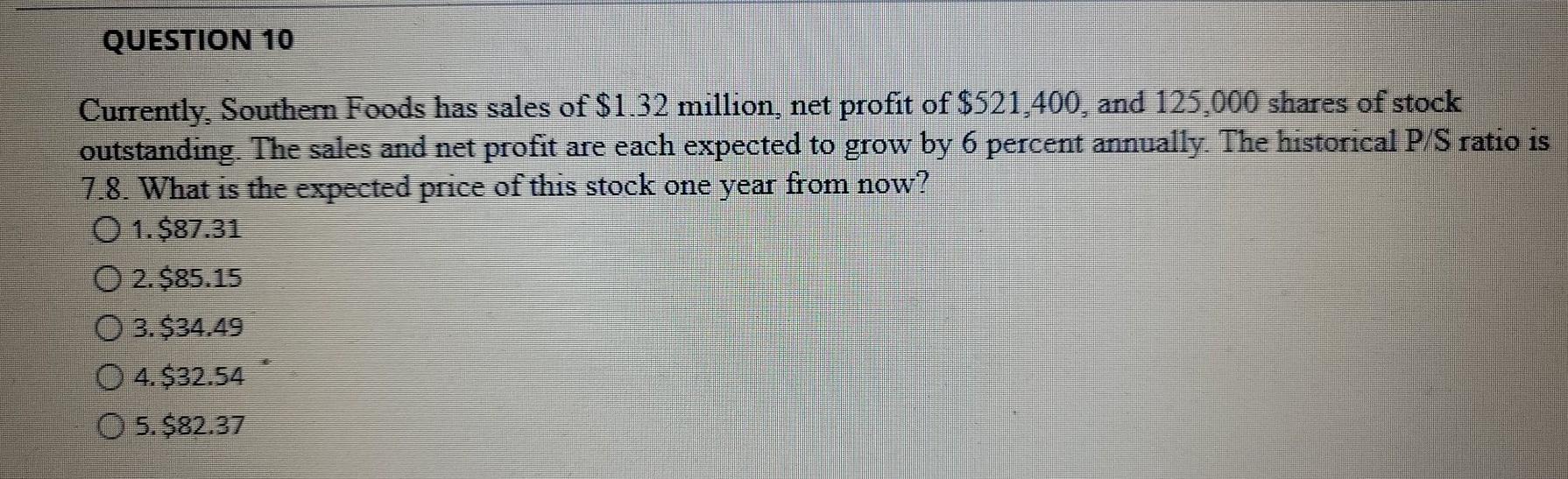

QUESTION 7 Lambert Corporation reported net income of $60 million for last year. Depreciation expense totaled $20 million and capital expenditures came to $5 million. Free cash flow is expected to grow at a rate of 4.5% for the foreseeable future. Lambert faces a 40% tax rate and has a 0.45 debt to equity ratio with $255 million (market value) in debt outstanding. Lambert's equity beta is 1.30, the risk-free rate is currently 5% and the market risk premium is estimated to be 6.5%. What is the current total value of Lambert's equity (in millions)? O 1.$1,025.95 O 2. $840.61 O 3. $951.26 O 4.$655.90 O 5. $731.20 QUESTION 8 Bill's Bakery has current earnings per share of $2.82. Current book value is $4.70 per share. The appropriate discount rate for Bill's Bakery is 8 percent. If earnings grow at 3.1 percent forever, the share price for Bill's Bakery will be $56.36 O True O False QUESTION 9 A stock sells for $12.36 a share and has a required return of 9 percent. Dividends are paid annually and increase at a constant 3 percent per year. What is the amount of the last dividend paid? O 1.$0.72 O 2. $0.50 O 3. $0.59 O 4. $0.46 O 5.$0.63 QUESTION 10 Currently, Southern Foods has sales of $1.32 million, net profit of $521,400, and 125,000 shares of stock outstanding. The sales and net profit are each expected to grow by 6 percent annually. The historical P/S ratio is 7.8. What is the expected price of this stock one year from now? O 1.$87.31 O 2.$85.15 O 3. $34,49 O 4.$32.54 O 5. $82.37 QUESTION 7 Lambert Corporation reported net income of $60 million for last year. Depreciation expense totaled $20 million and capital expenditures came to $5 million. Free cash flow is expected to grow at a rate of 4.5% for the foreseeable future. Lambert faces a 40% tax rate and has a 0.45 debt to equity ratio with $255 million (market value) in debt outstanding. Lambert's equity beta is 1.30, the risk-free rate is currently 5% and the market risk premium is estimated to be 6.5%. What is the current total value of Lambert's equity (in millions)? O 1.$1,025.95 O 2. $840.61 O 3. $951.26 O 4.$655.90 O 5. $731.20 QUESTION 8 Bill's Bakery has current earnings per share of $2.82. Current book value is $4.70 per share. The appropriate discount rate for Bill's Bakery is 8 percent. If earnings grow at 3.1 percent forever, the share price for Bill's Bakery will be $56.36 O True O False QUESTION 9 A stock sells for $12.36 a share and has a required return of 9 percent. Dividends are paid annually and increase at a constant 3 percent per year. What is the amount of the last dividend paid? O 1.$0.72 O 2. $0.50 O 3. $0.59 O 4. $0.46 O 5.$0.63 QUESTION 10 Currently, Southern Foods has sales of $1.32 million, net profit of $521,400, and 125,000 shares of stock outstanding. The sales and net profit are each expected to grow by 6 percent annually. The historical P/S ratio is 7.8. What is the expected price of this stock one year from now? O 1.$87.31 O 2.$85.15 O 3. $34,49 O 4.$32.54 O 5. $82.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts