Question: Please represent values accordingly ( Rate , Nper, PMT PV etc...). . A stock pays $100 in dividends quarterly. Annual discount rate is 5%. If

Please represent values accordingly ( Rate , Nper, PMT PV etc...).

Please represent values accordingly ( Rate , Nper, PMT PV etc...).

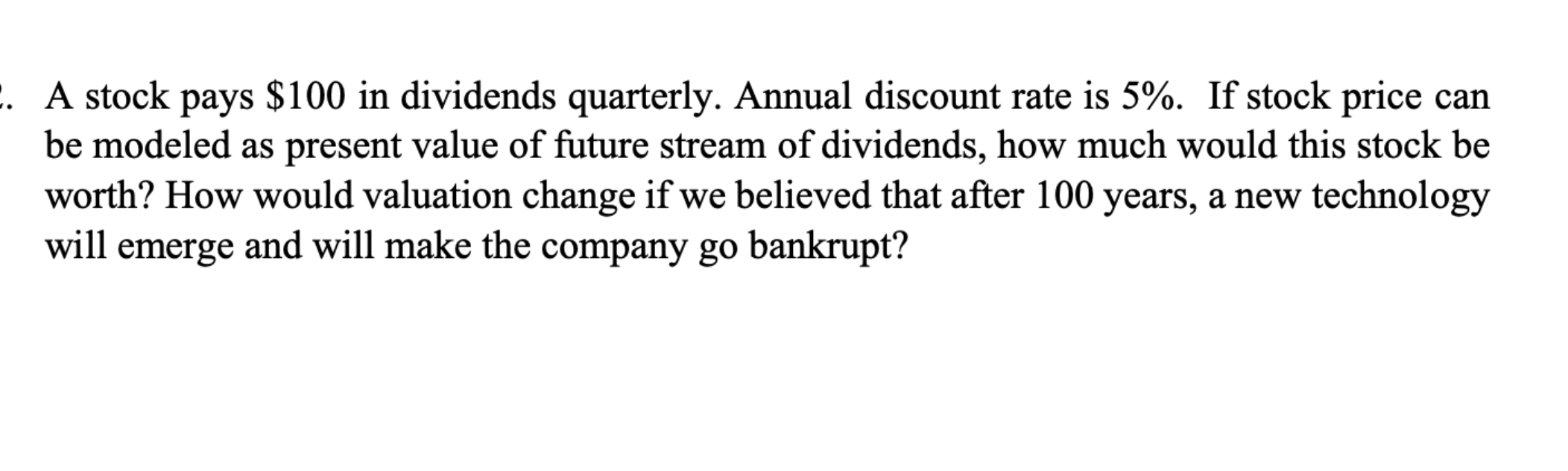

. A stock pays $100 in dividends quarterly. Annual discount rate is 5%. If stock price can be modeled as present value of future stream of dividends, how much would this stock be worth? How would valuation change if we believed that after 100 years, a new technology will emerge and will make the company go bankrupt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts