Question: Please review a potential development project, a 50,000 SF office project with the following assumptions: land costs -$10M Hard and soft costs -$25M Operating expenses-

Please review a potential development project, a 50,000 SF office project with the following assumptions:

land costs -$10M

Hard and soft costs -$25M

Operating expenses- $12 PSF annually

Required hurdle rate (yield on cost) 7%

what rent PSF is required to achieve a 7% yield on cost;

whats the value of the property and yield on cost after completed and leased based on market rents;

whats the projected profit (or loss) based on market rents?

The market rent to be $55 PSF and market cap rate to be 5%

What price do you recommend we pay to purchase the land if our investors require an 8% yield on cost?

use Excel format

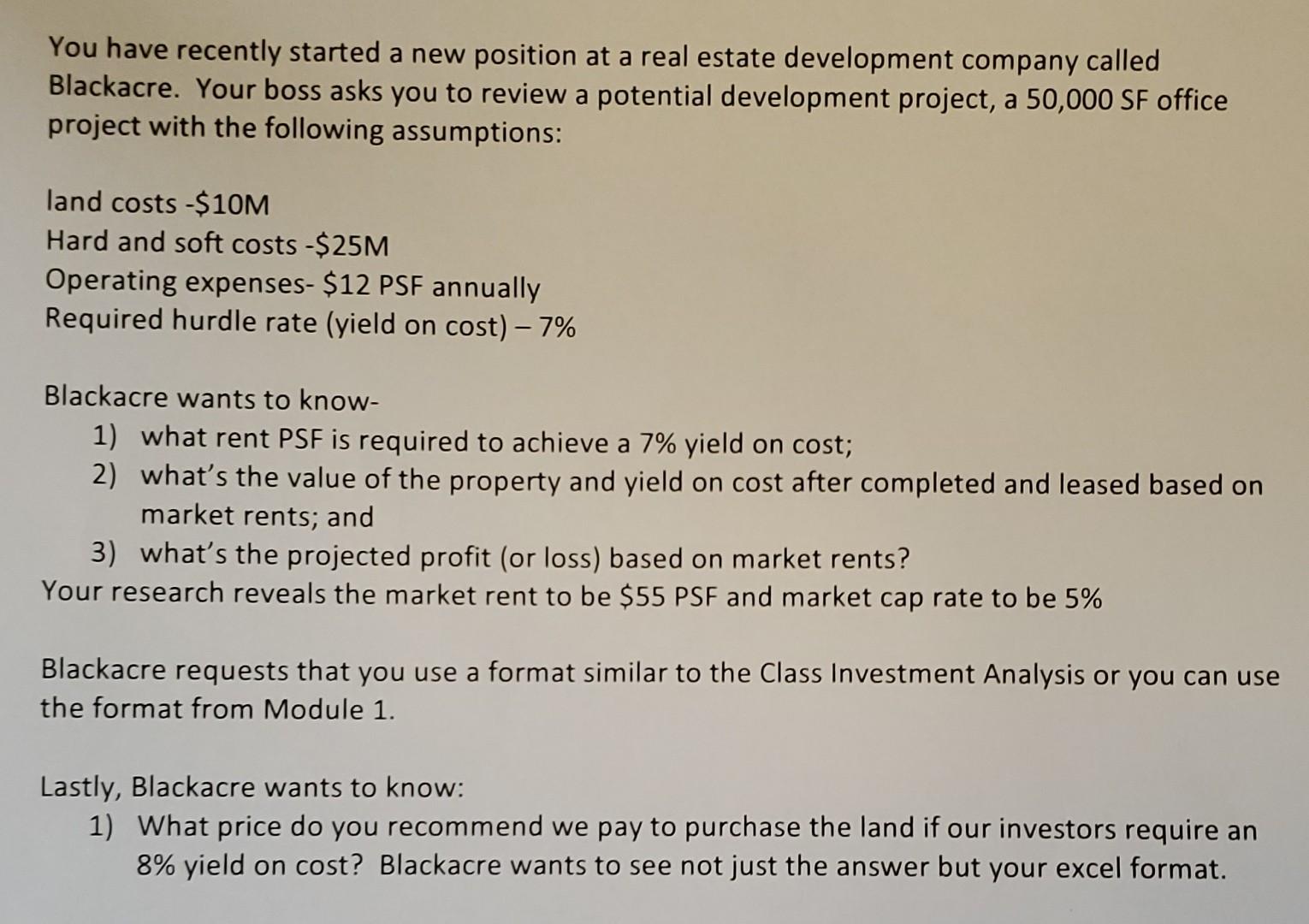

You have recently started a new position at a real estate development company called Blackacre. Your boss asks you to review a potential development project, a 50,000 SF office project with the following assumptions: land costs -$10M Hard and soft costs -$25M Operating expenses- $12 PSF annually Required hurdle rate (yield on cost) - 7% Blackacre wants to know- 1) what rent PSF is required to achieve a 7% yield on cost; 2) what's the value of the property and yield on cost after completed and leased based on market rents; and 3) what's the projected profit (or loss) based on market rents? Your research reveals the market rent to be $55 PSF and market cap rate to be 5% Blackacre requests that you use a format similar to the Class Investment Analysis or you can use the format from Module 1. Lastly, Blackacre wants to know: 1) What price do you recommend we pay to purchase the land if our investors require an 8% yield on cost? Blackacre wants to see not just the answer but your excel format. You have recently started a new position at a real estate development company called Blackacre. Your boss asks you to review a potential development project, a 50,000 SF office project with the following assumptions: land costs -$10M Hard and soft costs -$25M Operating expenses- $12 PSF annually Required hurdle rate (yield on cost) - 7% Blackacre wants to know- 1) what rent PSF is required to achieve a 7% yield on cost; 2) what's the value of the property and yield on cost after completed and leased based on market rents; and 3) what's the projected profit (or loss) based on market rents? Your research reveals the market rent to be $55 PSF and market cap rate to be 5% Blackacre requests that you use a format similar to the Class Investment Analysis or you can use the format from Module 1. Lastly, Blackacre wants to know: 1) What price do you recommend we pay to purchase the land if our investors require an 8% yield on cost? Blackacre wants to see not just the answer but your excel format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts