Question: Please Review and write down the ' Rationale ', ' Basic Features ', and ' Security & Documentary Requirements ' for Banks / DFIs to

Please Review and write down the 'Rationale', 'Basic Features', and 'Security & Documentary Requirements' for Banks / DFIs to avail this facility from the state bank.

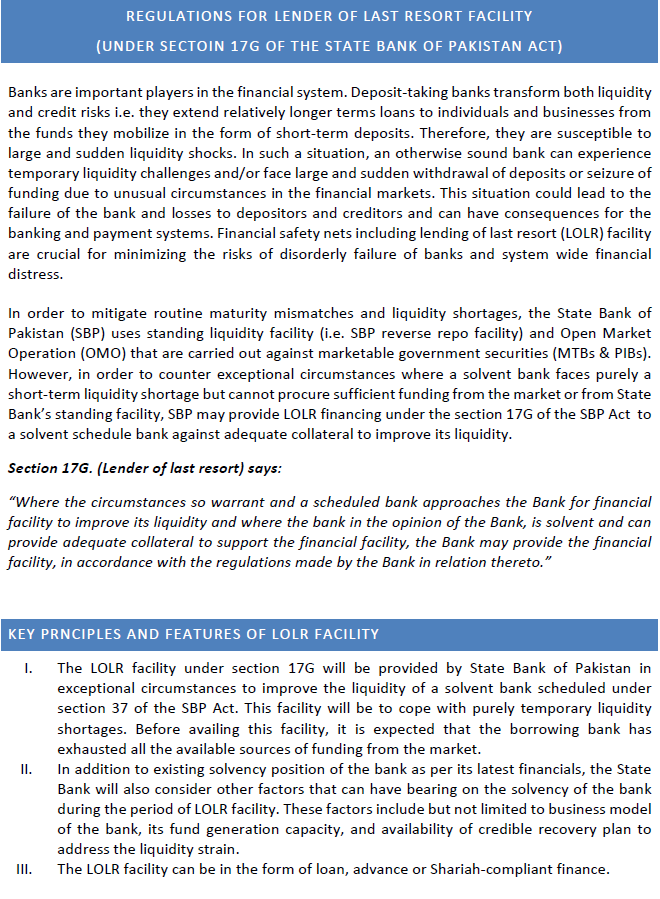

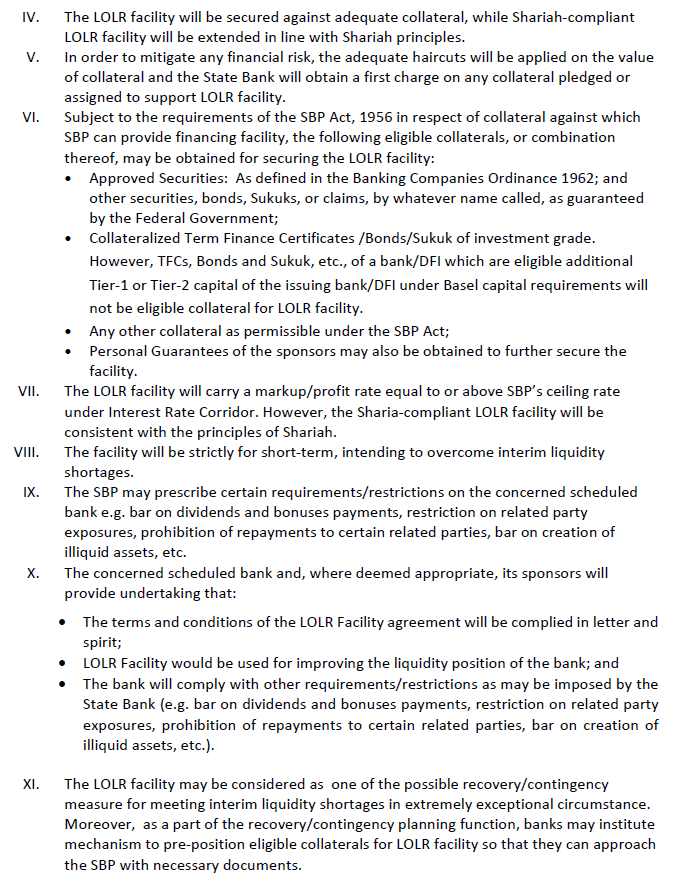

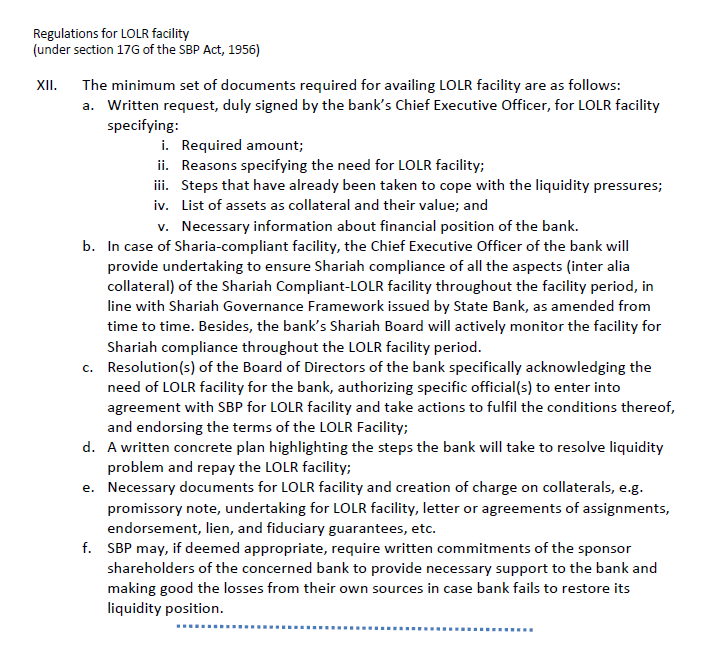

REGULATIONS FOR LENDER OF LAST RESORT FACILITY (UNDER SECTOIN 17G OF THE STATE BANK OF PAKISTAN ACT) Banks are important players in the financial system. Deposit-taking banks transform both liquidity and credit risks i.e. they extend relatively longer terms loans to individuals and businesses from the funds they mobilize in the form of short-term deposits. Therefore, they are susceptible to large and sudden liquidity shocks. In such a situation, an otherwise sound bank can experience temporary liquidity challenges and/or face large and sudden withdrawal of deposits or seizure of funding due to unusual circumstances in the financial markets. This situation could lead to the failure of the bank and losses to depositors and creditors and can have consequences for the banking and payment systems. Financial safety nets including lending of last resort (LOLR) facility are crucial for minimizing the risks of disorderly failure of banks and system wide financial distress. In order to mitigate routine maturity mismatches and liquidity shortages, the State Bank of Pakistan (SBP) uses standing liquidity facility (i.e. SBP reverse repo facility) and Open Market Operation (OMO) that are carried out against marketable government securities (MTBs & PIBs). However, in order to counter exceptional circumstances where a solvent bank faces purely a short-term liquidity shortage but cannot procure sufficient funding from the market or from State Bank's standing facility, SBP may provide LOLR financing under the section 176 of the SBP Act to a solvent schedule bank against adequate collateral to improve its liquidity. Section 176. (Lender of last resort) says: "Where the circumstances so warrant and a scheduled bank approaches the Bank for financial facility to improve its liquidity and where the bank in the opinion of the Bank, is solvent and can provide adequate collateral to support the financial facility, the Bank may provide the financial facility, in accordance with the regulations made by the Bank in relation thereto." KEY PRNCIPLES AND FEATURES OF LOLR FACILITY 1. II. The LOLR facility under section 176 will be provided by State Bank of Pakistan in exceptional circumstances to improve the liquidity of a solvent bank scheduled under section 37 of the SBP Act. This facility will be to cope with purely temporary liquidity shortages. Before availing this facility, it is expected that the borrowing bank has exhausted all the available sources of funding from the market. In addition to existing solvency position of the bank as per its latest financials, the State Bank will also consider other factors that can have bearing on the solvency of the bank during the period of LOLR facility. These factors include but not limited to business model of the bank, its fund generation capacity, and availability of credible recovery plan to address the liquidity strain. The LOLR facility can be in the form of loan, advance or Shariah-compliant finance. III. IV. VI. The LOLR facility will be secured against adequate collateral, while Shariah-compliant LOLR facility will be extended in line with Shariah principles. v. In order to mitigate any financial risk, the adequate haircuts will be applied on the value of collateral and the State Bank will obtain a first charge on any collateral pledged or assigned to support LOLR facility. Subject to the requirements of the SBP Act, 1956 in respect of collateral against which SBP can provide financing facility, the following eligible collaterals, or combination thereof, may be obtained for securing the LOLR facility: Approved Securities: As defined in the Banking Companies Ordinance 1962; and other securities, bonds, Sukuks, or claims, by whatever name called, as guaranteed by the Federal Government; Collateralized Term Finance Certificates /Bonds/Sukuk of investment grade. However, TFCs, Bonds and Sukuk, etc., of a bank/DFl which are eligible additional Tier-1 or Tier-2 capital of the issuing bank/DFI under Basel capital requirements will not be eligible collateral for LOLR facility. Any other collateral as permissible under the SBP Act; Personal Guarantees of the sponsors may also be obtained to further secure the facility. VII. The LOLR facility will carry a markup/profit rate equal to or above SBP's ceiling rate under Interest Rate Corridor. However, the Sharia-compliant LOLR facility will be consistent with the principles of Shariah. VIII. The facility will be strictly for short-term, intending to overcome interim liquidity shortages. The SBP may prescribe certain requirements/restrictions on the concerned scheduled bank e.g. bar on dividends and bonuses payments, restriction on related party exposures, prohibition of repayments to certain related parties, bar on creation of illiquid assets, etc. X. The concerned scheduled bank and, where deemed appropriate, its sponsors will provide undertaking that: The terms and conditions of the LOLR Facility agreement will be complied in letter and spirit; LOLR Facility would be used for improving the liquidity position of the bank; and The bank will comply with other requirements/restrictions as may be imposed by the State Bank (e.g. bar on dividends and bonuses payments, restriction on related party exposures, prohibition of repayments to certain related parties, bar on creation of illiquid assets, etc.). IX. XI. The LOLR facility may be considered as one of the possible recovery/contingency measure for meeting interim liquidity shortages in extremely exceptional circumstance. Moreover, as a part of the recovery/contingency planning function, banks may institute mechanism to pre-position eligible collaterals for LOLR facility so that they can approach the SBP with necessary documents. Regulations for LOLR facility (under section 176 of the SBP Act, 1956) XII. The minimum set of documents required for availing LOLR facility are as follows: a. Written request, duly signed by the bank's Chief Executive Officer, for LOLR facility specifying: i. Required amount; ii. Reasons specifying the need for LOLR facility; iii. Steps that have already been taken to cope with the liquidity pressures; iv. List of assets as collateral and their value; and v. Necessary information about financial position of the bank. b. In case of Sharia-compliant facility, the Chief Executive Officer of the bank will provide undertaking to ensure Shariah compliance of all the aspects (inter alia collateral) of the Shariah Compliant-LOLR facility throughout the facility period, in line with Shariah Governance Framework issued by State Bank, as amended from time to time. Besides, the bank's Shariah Board will actively monitor the facility for Shariah compliance throughout the LOLR facility period. C. Resolution(s) of the Board of Directors of the bank specifically acknowledging the need of LOLR facility for the bank, authorizing specific official(s) to enter into agreement with SBP for LOLR facility and take actions to fulfil the conditions thereof, and endorsing the terms of the LOLR Facility; d. A written concrete plan highlighting the steps the bank will take to resolve liquidity problem and repay the LOLR facility; e. Necessary documents for LOLR facility and creation of charge on collaterals, e.g. promissory note, undertaking for LOLR facility, letter or agreements of assignments, endorsement, lien, and fiduciary guarantees, etc. f. SBP may, if deemed appropriate, require written commitments of the sponsor shareholders of the concerned bank to provide necessary support to the bank and making good the losses from their own sources in case bank fails to restore its liquidity position. REGULATIONS FOR LENDER OF LAST RESORT FACILITY (UNDER SECTOIN 17G OF THE STATE BANK OF PAKISTAN ACT) Banks are important players in the financial system. Deposit-taking banks transform both liquidity and credit risks i.e. they extend relatively longer terms loans to individuals and businesses from the funds they mobilize in the form of short-term deposits. Therefore, they are susceptible to large and sudden liquidity shocks. In such a situation, an otherwise sound bank can experience temporary liquidity challenges and/or face large and sudden withdrawal of deposits or seizure of funding due to unusual circumstances in the financial markets. This situation could lead to the failure of the bank and losses to depositors and creditors and can have consequences for the banking and payment systems. Financial safety nets including lending of last resort (LOLR) facility are crucial for minimizing the risks of disorderly failure of banks and system wide financial distress. In order to mitigate routine maturity mismatches and liquidity shortages, the State Bank of Pakistan (SBP) uses standing liquidity facility (i.e. SBP reverse repo facility) and Open Market Operation (OMO) that are carried out against marketable government securities (MTBs & PIBs). However, in order to counter exceptional circumstances where a solvent bank faces purely a short-term liquidity shortage but cannot procure sufficient funding from the market or from State Bank's standing facility, SBP may provide LOLR financing under the section 176 of the SBP Act to a solvent schedule bank against adequate collateral to improve its liquidity. Section 176. (Lender of last resort) says: "Where the circumstances so warrant and a scheduled bank approaches the Bank for financial facility to improve its liquidity and where the bank in the opinion of the Bank, is solvent and can provide adequate collateral to support the financial facility, the Bank may provide the financial facility, in accordance with the regulations made by the Bank in relation thereto." KEY PRNCIPLES AND FEATURES OF LOLR FACILITY 1. II. The LOLR facility under section 176 will be provided by State Bank of Pakistan in exceptional circumstances to improve the liquidity of a solvent bank scheduled under section 37 of the SBP Act. This facility will be to cope with purely temporary liquidity shortages. Before availing this facility, it is expected that the borrowing bank has exhausted all the available sources of funding from the market. In addition to existing solvency position of the bank as per its latest financials, the State Bank will also consider other factors that can have bearing on the solvency of the bank during the period of LOLR facility. These factors include but not limited to business model of the bank, its fund generation capacity, and availability of credible recovery plan to address the liquidity strain. The LOLR facility can be in the form of loan, advance or Shariah-compliant finance. III. IV. VI. The LOLR facility will be secured against adequate collateral, while Shariah-compliant LOLR facility will be extended in line with Shariah principles. v. In order to mitigate any financial risk, the adequate haircuts will be applied on the value of collateral and the State Bank will obtain a first charge on any collateral pledged or assigned to support LOLR facility. Subject to the requirements of the SBP Act, 1956 in respect of collateral against which SBP can provide financing facility, the following eligible collaterals, or combination thereof, may be obtained for securing the LOLR facility: Approved Securities: As defined in the Banking Companies Ordinance 1962; and other securities, bonds, Sukuks, or claims, by whatever name called, as guaranteed by the Federal Government; Collateralized Term Finance Certificates /Bonds/Sukuk of investment grade. However, TFCs, Bonds and Sukuk, etc., of a bank/DFl which are eligible additional Tier-1 or Tier-2 capital of the issuing bank/DFI under Basel capital requirements will not be eligible collateral for LOLR facility. Any other collateral as permissible under the SBP Act; Personal Guarantees of the sponsors may also be obtained to further secure the facility. VII. The LOLR facility will carry a markup/profit rate equal to or above SBP's ceiling rate under Interest Rate Corridor. However, the Sharia-compliant LOLR facility will be consistent with the principles of Shariah. VIII. The facility will be strictly for short-term, intending to overcome interim liquidity shortages. The SBP may prescribe certain requirements/restrictions on the concerned scheduled bank e.g. bar on dividends and bonuses payments, restriction on related party exposures, prohibition of repayments to certain related parties, bar on creation of illiquid assets, etc. X. The concerned scheduled bank and, where deemed appropriate, its sponsors will provide undertaking that: The terms and conditions of the LOLR Facility agreement will be complied in letter and spirit; LOLR Facility would be used for improving the liquidity position of the bank; and The bank will comply with other requirements/restrictions as may be imposed by the State Bank (e.g. bar on dividends and bonuses payments, restriction on related party exposures, prohibition of repayments to certain related parties, bar on creation of illiquid assets, etc.). IX. XI. The LOLR facility may be considered as one of the possible recovery/contingency measure for meeting interim liquidity shortages in extremely exceptional circumstance. Moreover, as a part of the recovery/contingency planning function, banks may institute mechanism to pre-position eligible collaterals for LOLR facility so that they can approach the SBP with necessary documents. Regulations for LOLR facility (under section 176 of the SBP Act, 1956) XII. The minimum set of documents required for availing LOLR facility are as follows: a. Written request, duly signed by the bank's Chief Executive Officer, for LOLR facility specifying: i. Required amount; ii. Reasons specifying the need for LOLR facility; iii. Steps that have already been taken to cope with the liquidity pressures; iv. List of assets as collateral and their value; and v. Necessary information about financial position of the bank. b. In case of Sharia-compliant facility, the Chief Executive Officer of the bank will provide undertaking to ensure Shariah compliance of all the aspects (inter alia collateral) of the Shariah Compliant-LOLR facility throughout the facility period, in line with Shariah Governance Framework issued by State Bank, as amended from time to time. Besides, the bank's Shariah Board will actively monitor the facility for Shariah compliance throughout the LOLR facility period. C. Resolution(s) of the Board of Directors of the bank specifically acknowledging the need of LOLR facility for the bank, authorizing specific official(s) to enter into agreement with SBP for LOLR facility and take actions to fulfil the conditions thereof, and endorsing the terms of the LOLR Facility; d. A written concrete plan highlighting the steps the bank will take to resolve liquidity problem and repay the LOLR facility; e. Necessary documents for LOLR facility and creation of charge on collaterals, e.g. promissory note, undertaking for LOLR facility, letter or agreements of assignments, endorsement, lien, and fiduciary guarantees, etc. f. SBP may, if deemed appropriate, require written commitments of the sponsor shareholders of the concerned bank to provide necessary support to the bank and making good the losses from their own sources in case bank fails to restore its liquidity position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts