Question: Please revise and complete the question given below in the same approximate format. *I believe I have the correct answers for parts b) and c)

Please revise and complete the question given below in the same approximate format.

*I believe I have the correct answers for parts b) and c) but cannot show my answer, if you can do so it would be greatly appreciated, Thank you.*

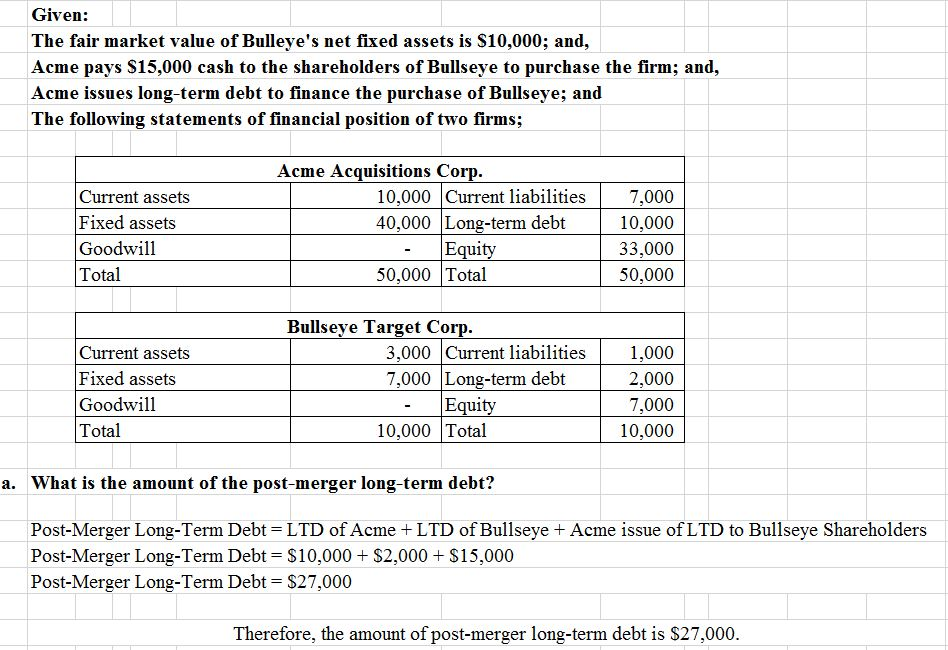

Given: The fair market value of Bulleye's net fixed assets is S10,000; and, Acme pays S15,000 cash to the shareholders of Bullseye to purchase the firm; and, Acme issues long-term debt to finance the purchase of Bullseye; and The following statements of financial position of two firms; Acme Acquisitions Corp. Current assets 7,000 10,000 Current liabilities Fixed assets 10,000 40,000 Long-term debt 33,000 Goodwill Equity 50,000 Total 50,000 Total Bullseye Target Corp. 3,000 Current liabilities 1,000 Current assets 7,000 Long-term debt 2,000 Fixed assets 7,000 Goodwill Equity 10,000 Total 10,000 Total a. What is the amount of the post-merger long-term debt? Post-Merger Long-Term Debt LTD of Acme LTD of Bullseye Acme issue of LTD to Bullseye Shareholders Post-Merger Long-Term Debt $10,000 $2,000 $15,000 Therefore, the amount of post-merger long-term debt is $27,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts