Question: Please round all computations to two decimal points. Please explain your answers fully. 1. (8 pts) Suppose we determine that we need $30,000 each year

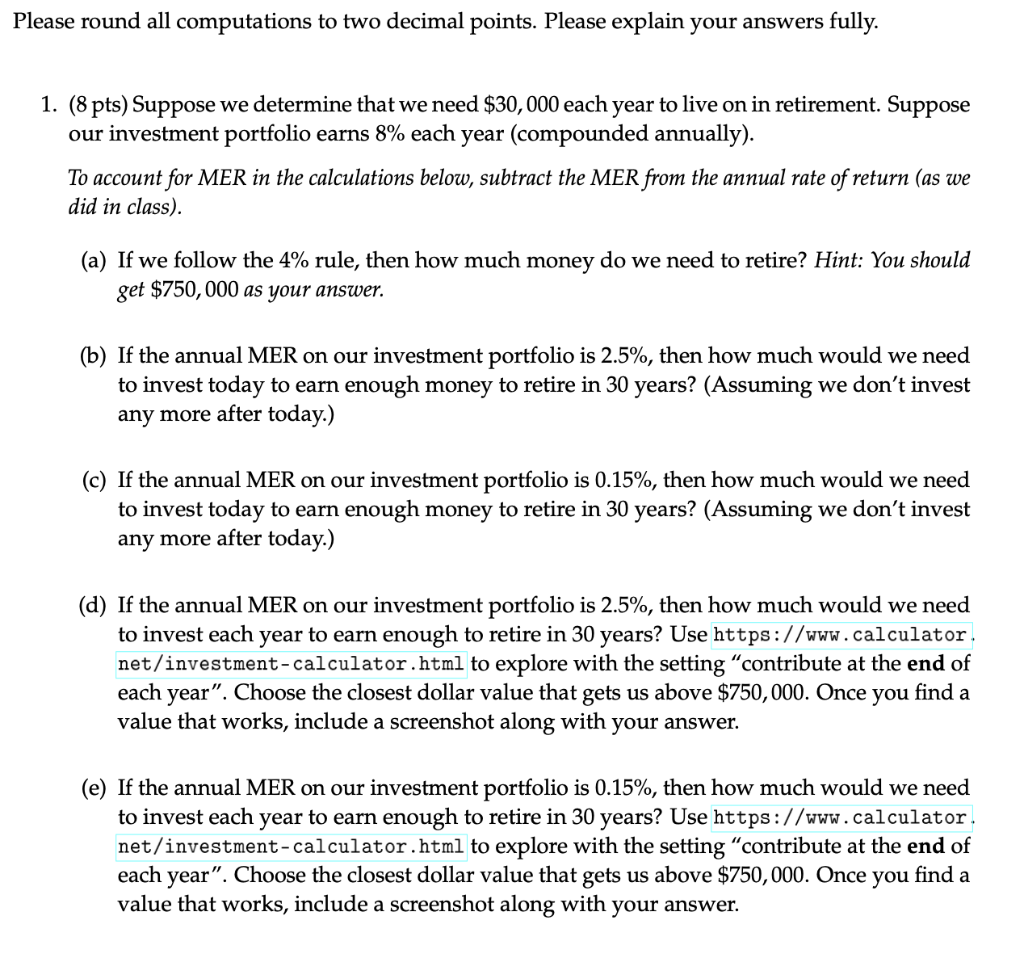

Please round all computations to two decimal points. Please explain your answers fully. 1. (8 pts) Suppose we determine that we need $30,000 each year to live on in retirement. Suppose our investment portfolio earns 8% each year (compounded annually). To account for MER in the calculations below, subtract the MER from the annual rate of return (as we did in class). (a) If we follow the 4% rule, then how much money do we need to retire? Hint: You should get $750,000 as your answer. (b) If the annual MER on our investment portfolio is 2.5%, then how much would we need to invest today to earn enough money to retire in 30 years? (Assuming we don't invest any more after today.) (c) If the annual MER on our investment portfolio is 0.15%, then how much would we need to invest today to earn enough money to retire in 30 years? (Assuming we don't invest any more after today.) (d) If the annual MER on our investment portfolio is 2.5%, then how much would we need to invest each year to earn enough to retire in 30 years? Use https://www.calculator. net/investment-calculator.html to explore with the setting "contribute at the end of each year". Choose the closest dollar value that gets us above $750,000. Once you find a value that works, include a screenshot along with your answer. (e) If the annual MER on our investment portfolio is 0.15%, then how much would we need to invest each year to earn enough to retire in 30 years? Use https://www.calculator. net/investment-calculator.html to explore with the setting contribute at the end of each year. Choose the closest dollar value that gets us above $750,000. Once you find a value that works, include a screenshot along with your answer. Please round all computations to two decimal points. Please explain your answers fully. 1. (8 pts) Suppose we determine that we need $30,000 each year to live on in retirement. Suppose our investment portfolio earns 8% each year (compounded annually). To account for MER in the calculations below, subtract the MER from the annual rate of return (as we did in class). (a) If we follow the 4% rule, then how much money do we need to retire? Hint: You should get $750,000 as your answer. (b) If the annual MER on our investment portfolio is 2.5%, then how much would we need to invest today to earn enough money to retire in 30 years? (Assuming we don't invest any more after today.) (c) If the annual MER on our investment portfolio is 0.15%, then how much would we need to invest today to earn enough money to retire in 30 years? (Assuming we don't invest any more after today.) (d) If the annual MER on our investment portfolio is 2.5%, then how much would we need to invest each year to earn enough to retire in 30 years? Use https://www.calculator. net/investment-calculator.html to explore with the setting "contribute at the end of each year". Choose the closest dollar value that gets us above $750,000. Once you find a value that works, include a screenshot along with your answer. (e) If the annual MER on our investment portfolio is 0.15%, then how much would we need to invest each year to earn enough to retire in 30 years? Use https://www.calculator. net/investment-calculator.html to explore with the setting contribute at the end of each year. Choose the closest dollar value that gets us above $750,000. Once you find a value that works, include a screenshot along with your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts