Question: Please round the final answers at least into two decimal places Two stocks: stock D and stock E are trading in the stock market. Stock

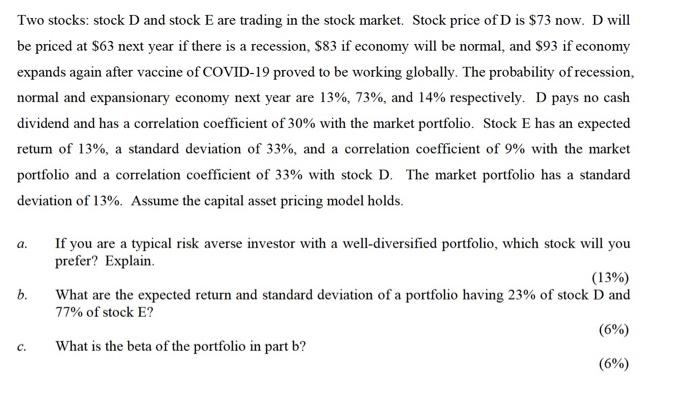

Two stocks: stock D and stock E are trading in the stock market. Stock price of D is $73 now. Dwill be priced at $63 next year if there is a recession, $83 if economy will be normal, and 893 if economy expands again after vaccine of COVID-19 proved to be working globally. The probability of recession, normal and expansionary economy next year are 13%, 73%, and 14% respectively. D pays no cash dividend and has a correlation coefficient of 30% with the market portfolio. Stock E has an expected return of 13%, a standard deviation of 33%, and a correlation coefficient of 9% with the market portfolio and a correlation coefficient of 33% with stock D. The market portfolio has a standard deviation of 13%. Assume the capital asset pricing model holds. a. b. If you are a typical risk averse investor with a well-diversified portfolio, which stock will you prefer? Explain. (13%) What are the expected return and standard deviation of a portfolio having 23% of stock D and 77% of stock E? (6%) What is the beta of the portfolio in part b? (6%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts