Question: please round to the nearest cent. (Comprehensive Problem) Suppose that you are in the fall of your senior year and are faced with the choice

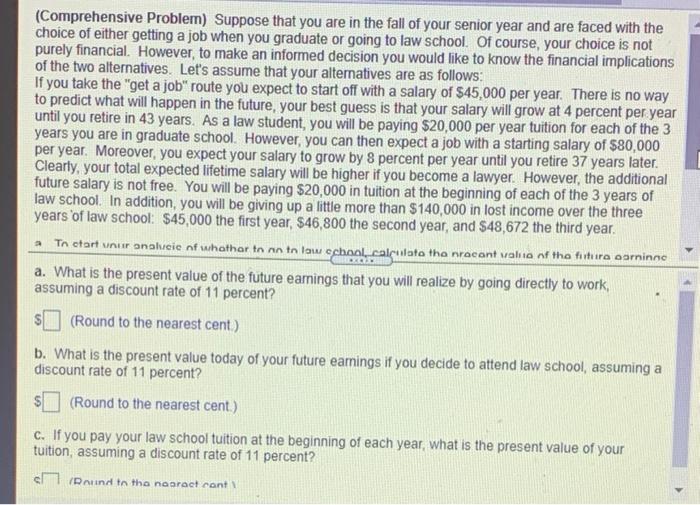

(Comprehensive Problem) Suppose that you are in the fall of your senior year and are faced with the choice of either getting a job when you graduate or going to law school. Of course, your choice is not purely financial. However, to make an informed decision you would like to know the financial implications of the two alternatives. Let's assume that your alternatives are as follows: If you take the "get a job" route you expect to start off with a salary of $45,000 per year. There is no way to predict what will happen in the future, your best guess is that your salary will grow at 4 percent per year until you retire in 43 years. As a law student, you will be paying $20,000 per year tuition for each of the 3 years you are in graduate school. However, you can then expect a job with a starting salary of $80,000 per year. Moreover, you expect your salary to grow by 8 percent per year until you retire 37 years later. Clearly, your total expected lifetime salary will be higher if you become a lawyer. However, the additional future salary is not free. You will be paying $20,000 in tuition at the beginning of each of the 3 years of law school . In addition, you will be giving up a little more than $140,000 in lost income over the three years of law school: $45,000 the first year, $46,800 the second year, and $48,672 the third year. Tn tartunur analveie of whothar to nn to low echool calculate the nracont valita of the future asrninn a. What is the present value of the future earnings that you will realize by going directly to work, assuming a discount rate of 11 percent? (Round to the nearest cent) 2 BELE b. What is the present value today of your future eamings if you decide to attend law school, assuming a discount rate of 11 percent? (Round to the nearest cent.) C. If you pay your law school tuition at the beginning of each year, what is the present value of your tuition, assuming a discount rate of 11 percent? (Round in the nearact cont

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts