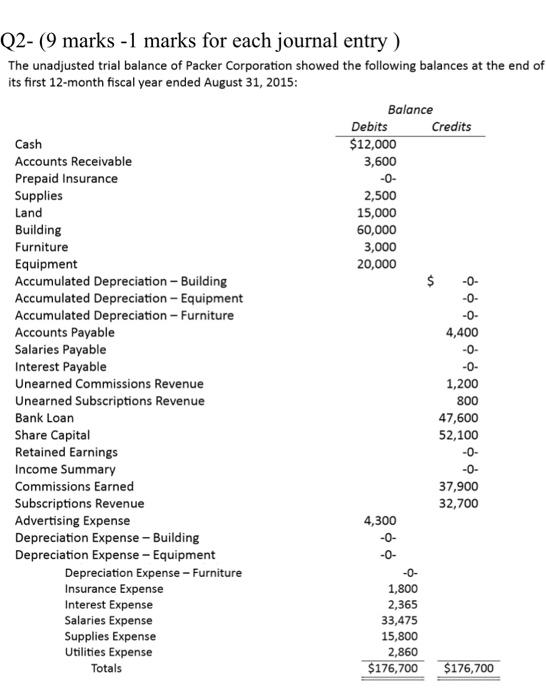

Question: please scroll down for new question pages Q2- (9 marks - 1 marks for each journal entry ) The unadjusted trial balance of Packer Corporation

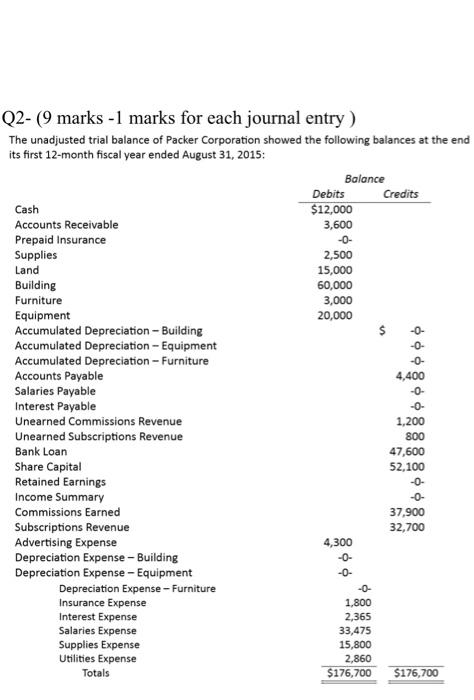

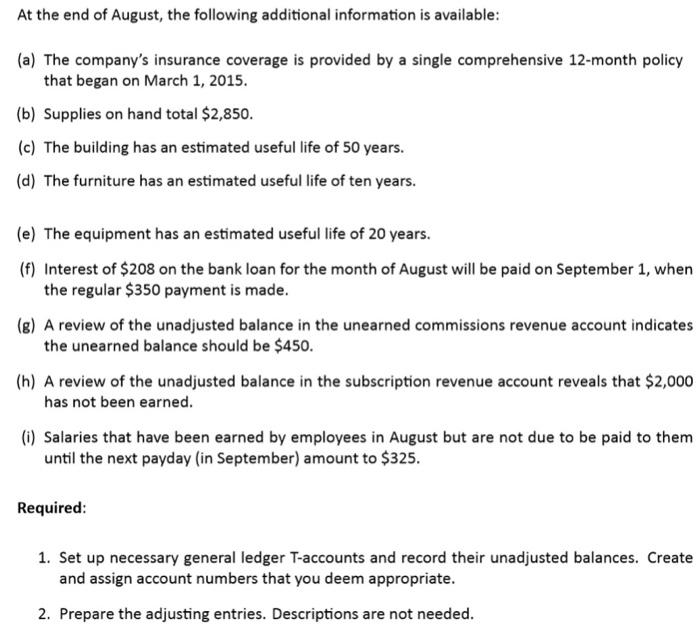

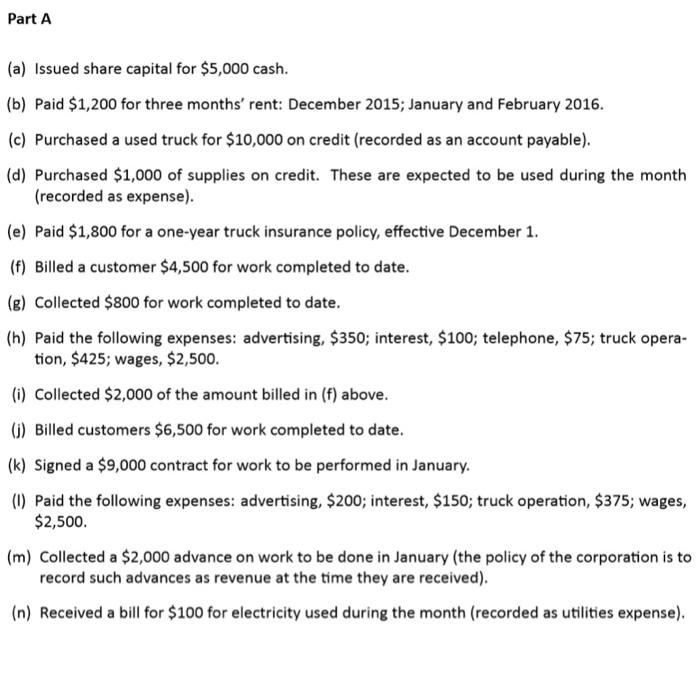

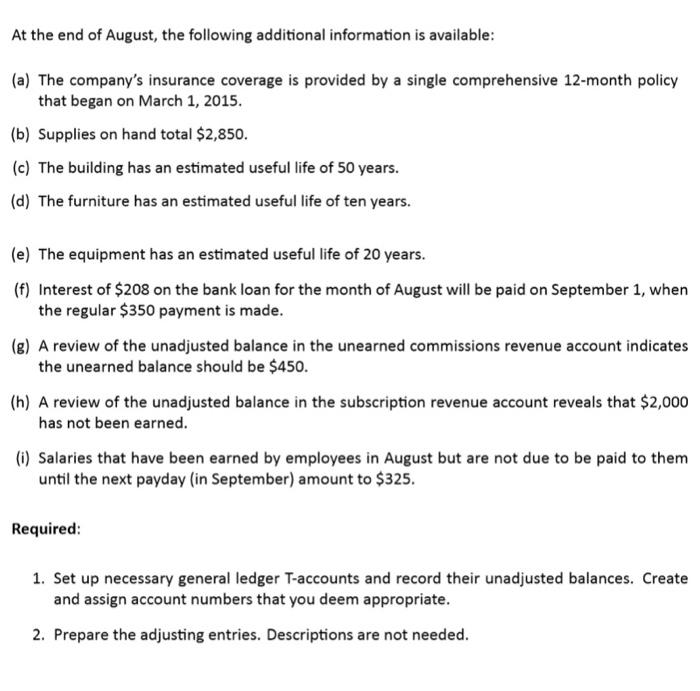

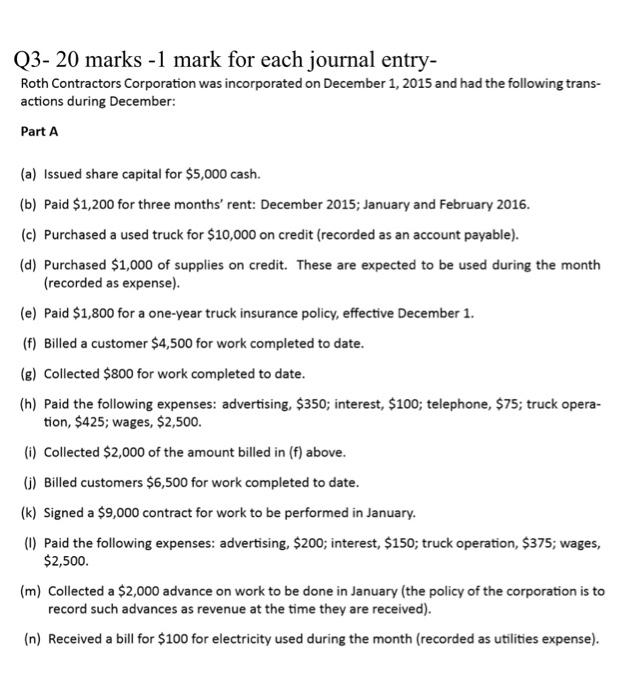

Q2- (9 marks - 1 marks for each journal entry ) The unadjusted trial balance of Packer Corporation showed the following balances at the end of its first 12-month fiscal year ended August 31, 2015: At the end of August, the following addational information is avaliable: (a) The company's insurance coverage is provided by a single comprehensive 12 moath policy that began on March 1. 2015, (b) Supplies on hand total $2,850. (c) The buliding has an estimated uneful ife of 50 vears. (d) The furniture has an estimated useful ide of teri years. (t) The equipment has an estimated useful life of 20 years. (f) Interest of $205 on the bank loan for the month of August will be paid on September 1. when the regular $350 payment is made. (c) A review of the unadjated balance in the unearned commissions revenue acobunt indicates the uneamed balance should be $450. [n] A review of the unadjusted balance in the subscription revenve account reveals that $2,000 has not been earned. (4) Salaries that have been earned by employees in August but are not due to be paid to them unai the next payday (in September] anount to 5325. Required: 1. Set up necessary general ledger Faccounts and record their unadjusted bulances. Create and assign account numbers that you deem appropriate. 2. Prepare the adjusting entries. Descriptions are not needed. Q2- (9 marks 1 marks for each journal entry ) The unadjusted trial balance of Packer Corporation showed the following balances at the end its first 12-month fiscal year ended August 31, 2015: At the end of August, the following additional information is available: (a) The company's insurance coverage is provided by a single comprehensive 12-month policy that began on March 1, 2015. (b) Supplies on hand total $2,850. (c) The building has an estimated useful life of 50 years. (d) The furniture has an estimated useful life of ten years. (e) The equipment has an estimated useful life of 20 years. (f) Interest of $208 on the bank loan for the month of August will be paid on September 1 , when the regular $350 payment is made. (g) A review of the unadjusted balance in the unearned commissions revenue account indicates the unearned balance should be $450. (h) A review of the unadjusted balance in the subscription revenue account reveals that $2,000 has not been earned. (i) Salaries that have been earned by employees in August but are not due to be paid to them until the next payday (in September) amount to $325. Required: 1. Set up necessary general ledger T-accounts and record their unadjusted balances. Create and assign account numbers that you deem appropriate. 2. Prepare the adjusting entries. Descriptions are not needed. (a) Issued share capital for $5,000 cash. (b) Paid \$1,200 for three months' rent: December 2015; January and February 2016. (c) Purchased a used truck for $10,000 on credit (recorded as an account payable). (d) Purchased $1,000 of supplies on credit. These are expected to be used during the month (recorded as expense). (e) Paid $1,800 for a one-year truck insurance policy, effective December 1. (f) Billed a customer $4,500 for work completed to date. (g) Collected $800 for work completed to date. (h) Paid the following expenses: advertising, $350; interest, $100; telephone, $75; truck operation, \$425; wages, $2,500. (i) Collected $2,000 of the amount billed in (f) above. (j) Billed customers $6,500 for work completed to date. (k) Signed a $9,000 contract for work to be performed in January. (I) Paid the following expenses: advertising, \$200; interest, \$150; truck operation, \$375; wages, $2,500. (m) Collected a $2,000 advance on work to be done in January (the policy of the corporation is to record such advances as revenue at the time they are received). (n) Received a bill for $100 for electricity used during the month (recorded as utilities expense). Q2- ( 9 marks 1 marks for each journal entry ) The unadjusted trial balance of Packer Corporation showed the following balances at the end of its first 12-month fiscal year ended August 31, 2015: At the end of August, the following additional information is available: (a) The company's insurance coverage is provided by a single comprehensive 12-month policy that began on March 1, 2015. (b) Supplies on hand total $2,850. (c) The building has an estimated useful life of 50 years. (d) The furniture has an estimated useful life of ten years. (e) The equipment has an estimated useful life of 20 years. (f) Interest of \$208 on the bank loan for the month of August will be paid on September 1 , when the regular $350 payment is made. (g) A review of the unadjusted balance in the unearned commissions revenue account indicates the unearned balance should be $450. (h) A review of the unadjusted balance in the subscription revenue account reveals that $2,000 has not been earned. (i) Salaries that have been earned by employees in August but are not due to be paid to them until the next payday (in September) amount to $325. Required: 1. Set up necessary general ledger T-accounts and record their unadjusted balances. Create and assign account numbers that you deem appropriate. 2. Prepare the adjusting entries. Descriptions are not needed. Q3- 20 marks 1 mark for each journal entry- Roth Contractors Corporation was incorporated on December 1,2015 and had the following transactions during December: PartA (a) Issued share capital for $5,000 cash. (b) Paid \$1,200 for three months' rent: December 2015; January and February 2016. (c) Purchased a used truck for $10,000 on credit (recorded as an account payable). (d) Purchased $1,000 of supplies on credit. These are expected to be used during the month (recorded as expense). (e) Paid $1,800 for a one-year truck insurance policy, effective December 1 . (f) Billed a customer $4,500 for work completed to date. (g) Collected $800 for work completed to date. (h) Paid the following expenses: advertising, $350; interest, $100; telephone, $75; truck operation, $425; wages, $2,500. (i) Collected $2,000 of the amount billed in (f) above. (j) Billed customers $6,500 for work completed to date. (k) Signed a $9,000 contract for work to be performed in January. (I) Paid the following expenses: advertising, \$200; interest, \$150; truck operation, \$375; wages, $2,500. (m) Collected a $2,000 advance on work to be done in January (the policy of the corporation is to record such advances as revenue at the time they are received). (n) Received a bill for $100 for electricity used during the month (recorded as utilities expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts