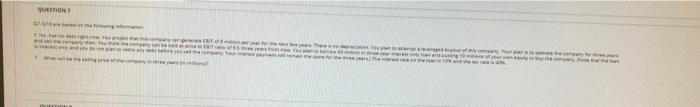

Question: please scroll down for updated picture i couldnt remove the old once Y, Inc. has no debt right now. You project that this company can

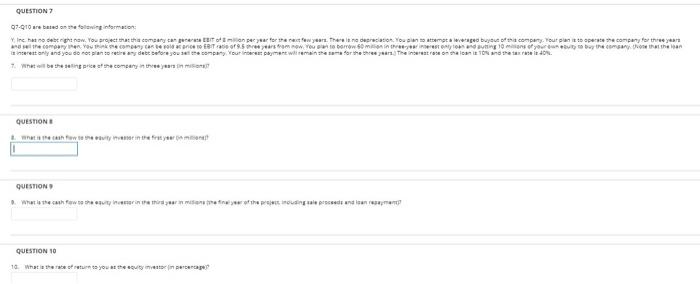

OTION QUESTIONS What is the cash flow to the equity investor in the first year in millions? QUESTION 9 9. What is the cash Tow to the timester in the third year in mins the final year of the project, including sal proceeds and loan repayment QUESTION 10 10 there from you the internet QUESTION 03-10 ure but do normation Ine han det now. You project that this company at one year for the new year. There is no reason. You can attempted by the company. Toutant to spestre company for three years the compararen Towerwings of the month Interest only and you do not plan to retirer det before you see company your payment wiiremains for the three The reason to another 7 Wethepencomenyinin QUESTIONE new very QUESTION What is the cathew the the three of the proposes and are QUESTION 10 10 Wyou they vetrne OTION QUESTIONS What is the cash flow to the equity investor in the first year in millions? QUESTION 9 9. What is the cash Tow to the timester in the third year in mins the final year of the project, including sal proceeds and loan repayment QUESTION 10 10 there from you the internet QUESTION 03-10 ure but do normation Ine han det now. You project that this company at one year for the new year. There is no reason. You can attempted by the company. Toutant to spestre company for three years the compararen Towerwings of the month Interest only and you do not plan to retirer det before you see company your payment wiiremains for the three The reason to another 7 Wethepencomenyinin QUESTIONE new very QUESTION What is the cathew the the three of the proposes and are QUESTION 10 10 Wyou they vetrne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts