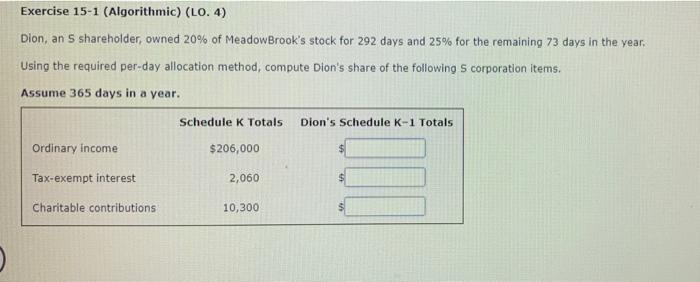

Question: please see attached Exercise 15-1 (Algorithmic) (LO. 4) Dion, an 5 shareholder, owned 20% of MeadowBrook's stock for 292 days and 25% for the remaining

Exercise 15-1 (Algorithmic) (LO. 4) Dion, an 5 shareholder, owned 20% of MeadowBrook's stock for 292 days and 25% for the remaining 73 days in the year. Using the required per-day allocation method, compute Dion's share of the following 5 corporation items. Assume 365 days in a year. Schedule K Totals Dion's Schedule K-1 Totals Ordinary income $206,000 Tax-exempt interest 2,060 Charitable contributions 10,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts