Question: please see attached How would a 10% reduction in personal income tax rates affect aggregate demand and short-run aggregate supply? a) Show the affect by

please see attached

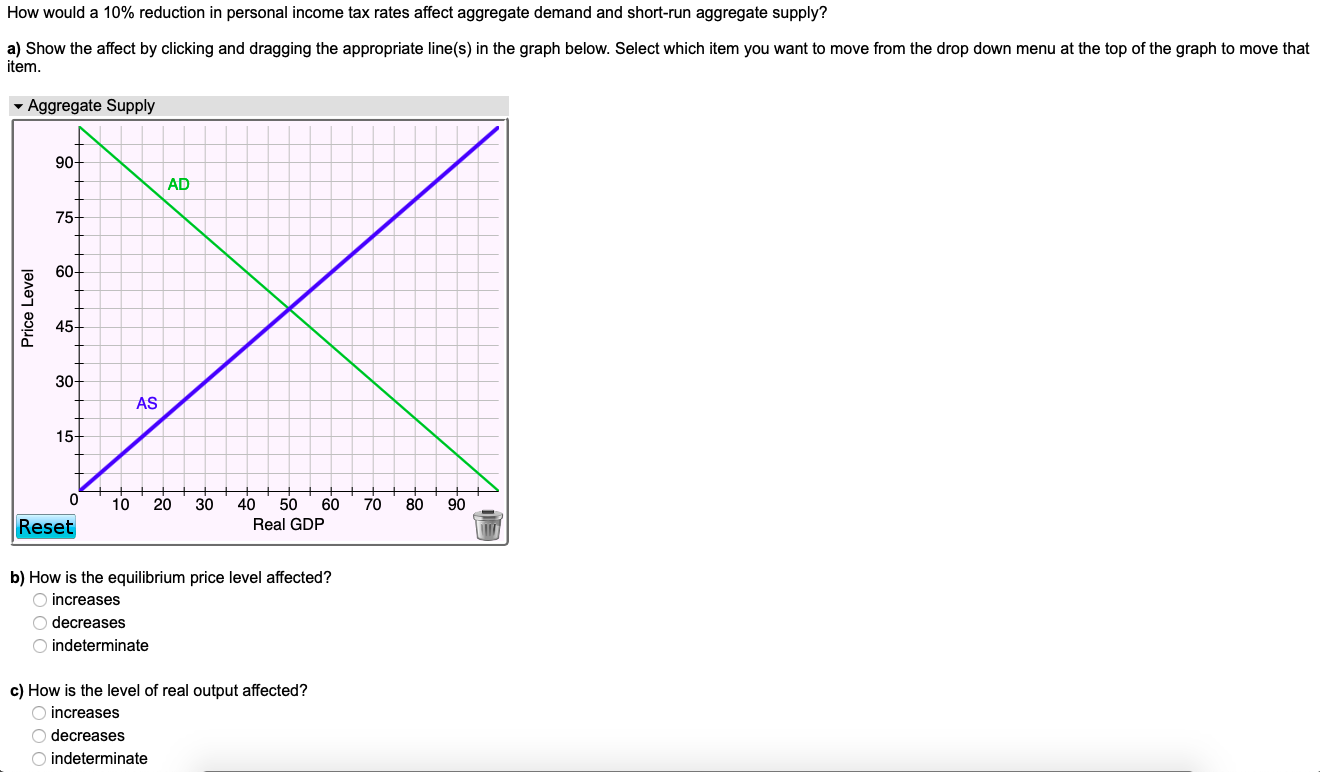

How would a 10% reduction in personal income tax rates affect aggregate demand and short-run aggregate supply? a) Show the affect by clicking and dragging the appropriate line(s) in the graph below. Select which item you want to move from the drop down menu at the top of the graph to move that item. Aggregate Supply 90- AD 75- Price Level 60- 45- 30- AS 15 0 10 20 30 40 50 60 70 80 90 Reset Real GDP b) How is the equilibrium price level affected? O increases O decreases O indeterminate c) How is the level of real output affected? O increases O decreases O indeterminate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock