Question: please see attachment for question 12-4. There is a part a, b, and C to this question. 12-4: At your company, sales and their probabilities

please see attachment for question 12-4. There is a part a, b, and C to this question.

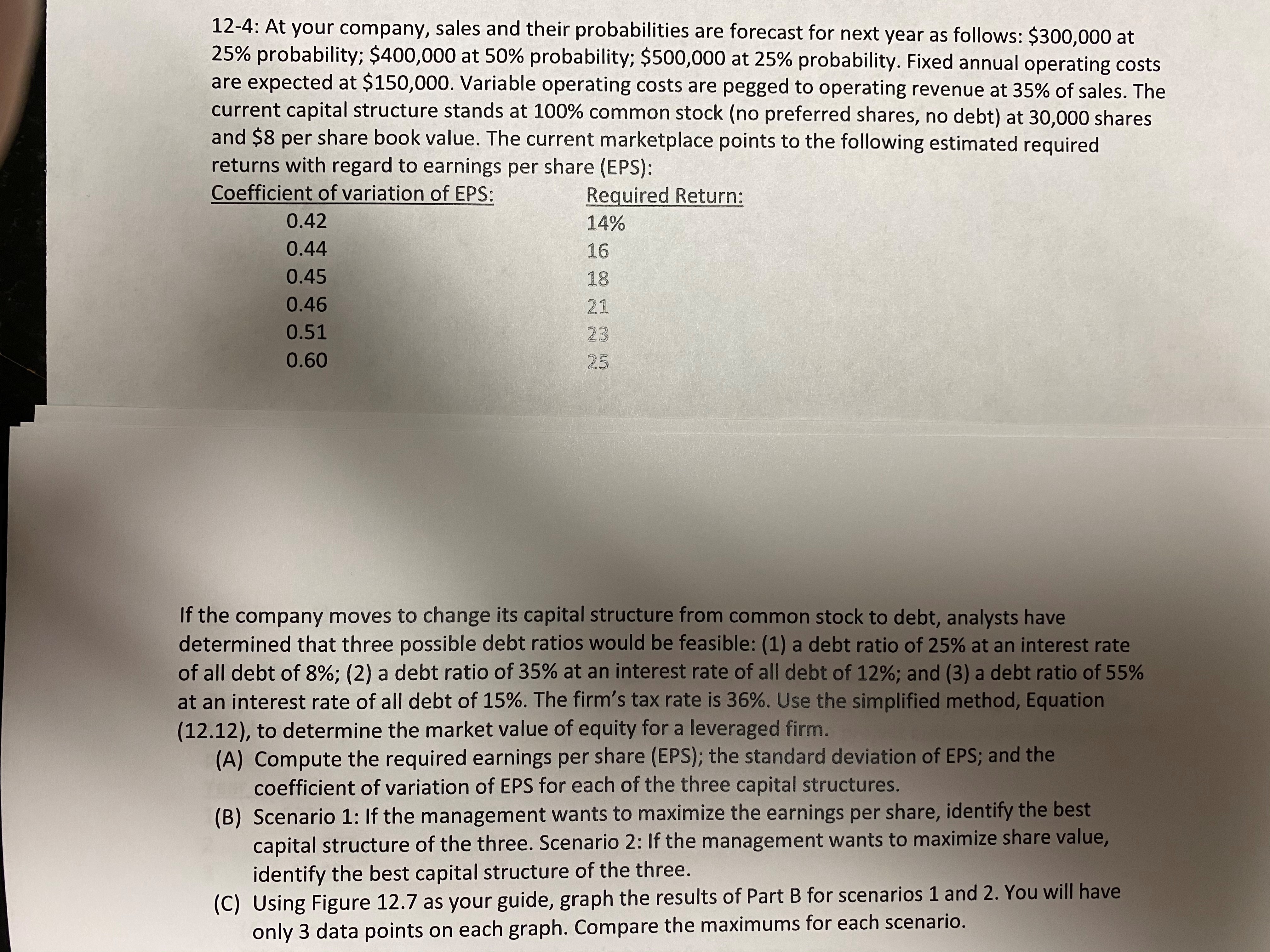

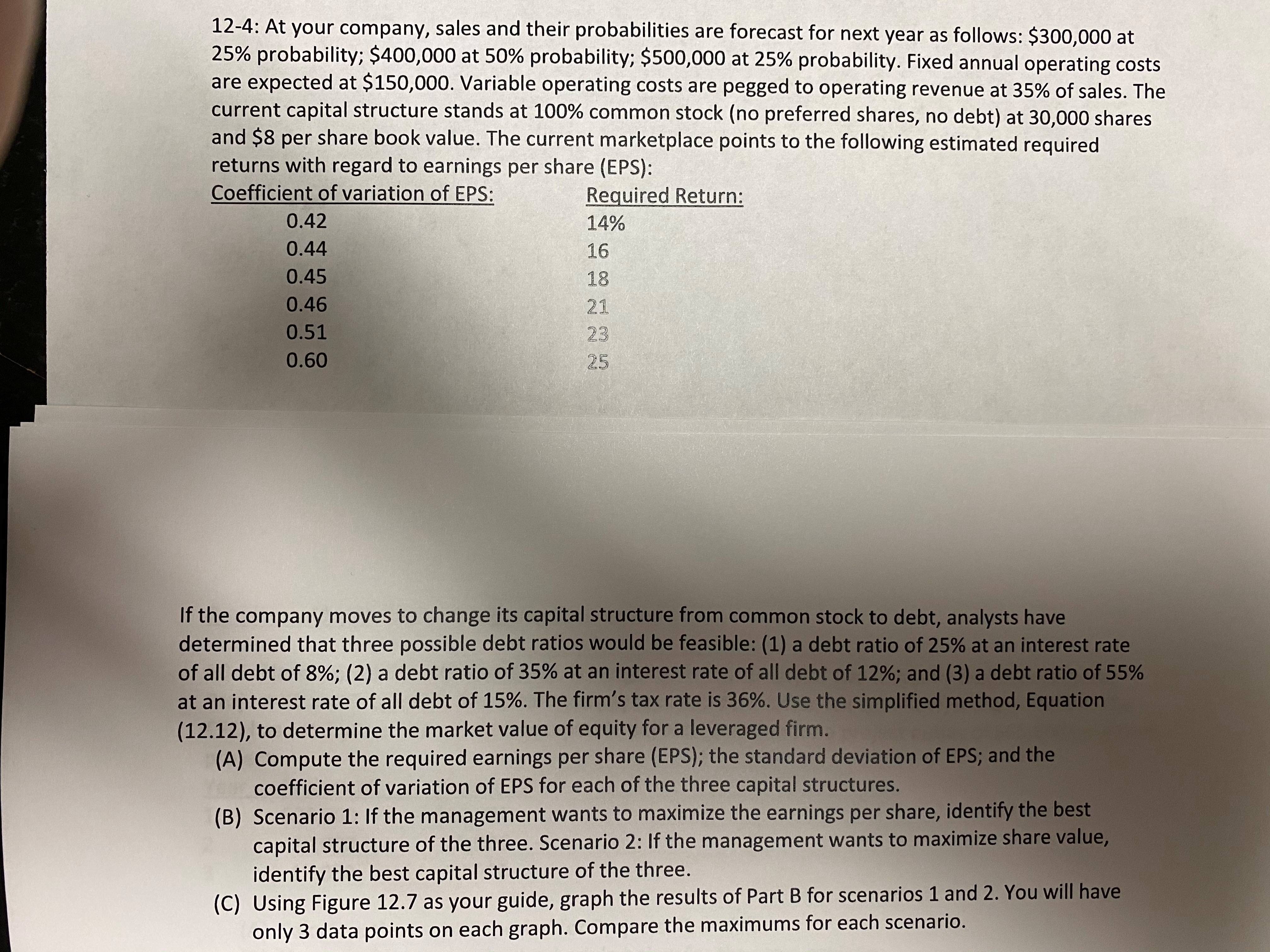

12-4: At your company, sales and their probabilities are forecast for next year as follows: $300,000 at 25% probability; $400,000 at 50% probability; $500,000 at 25% probability. Fixed annual operating costs are expected at $150,000. Variable operating costs are pegged to operating revenue at 35% of sales. The current capital structure stands at 100% common stock (no preferred shares, no debt) at 30,000 shares and $8 per share book value. The current marketplace points to the following estimated required returns with regard to earnings per share (EPS): Coefficient of variation of EPS: Required Return: 0.42 14% 0.44 16 0.45 18 0.46 21 0.51 23 0.60 25 If the company moves to change its capital structure from common stock to debt, analysts have determined that three possible debt ratios would be feasible: (1) a debt ratio of 25% at an interest rate of all debt of 8%; (2) a debt ratio of 35% at an interest rate of all debt of 12%; and (3) a debt ratio of 55% at an interest rate of all debt of 15%. The firm's tax rate is 36%. Use the simplified method, Equation (12.12), to determine the market value of equity for a leveraged firm. (A) Compute the required earnings per share (EPS); the standard deviation of EPS; and the coefficient of variation of EPS for each of the three capital structures. (B) Scenario 1: If the management wants to maximize the earnings per share, identify the best capital structure of the three. Scenario 2: If the management wants to maximize share value, identify the best capital structure of the three. (C) Using Figure 12.7 as your guide, graph the results of Part B for scenarios 1 and 2. You will have only 3 data points on each graph. Compare the maximums for each scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts