Question: Please see below for Two - Two Corporation's information. Debt: 9 , 7 0 0 7 . 2 percent coupon bonds outstanding, with 2 3

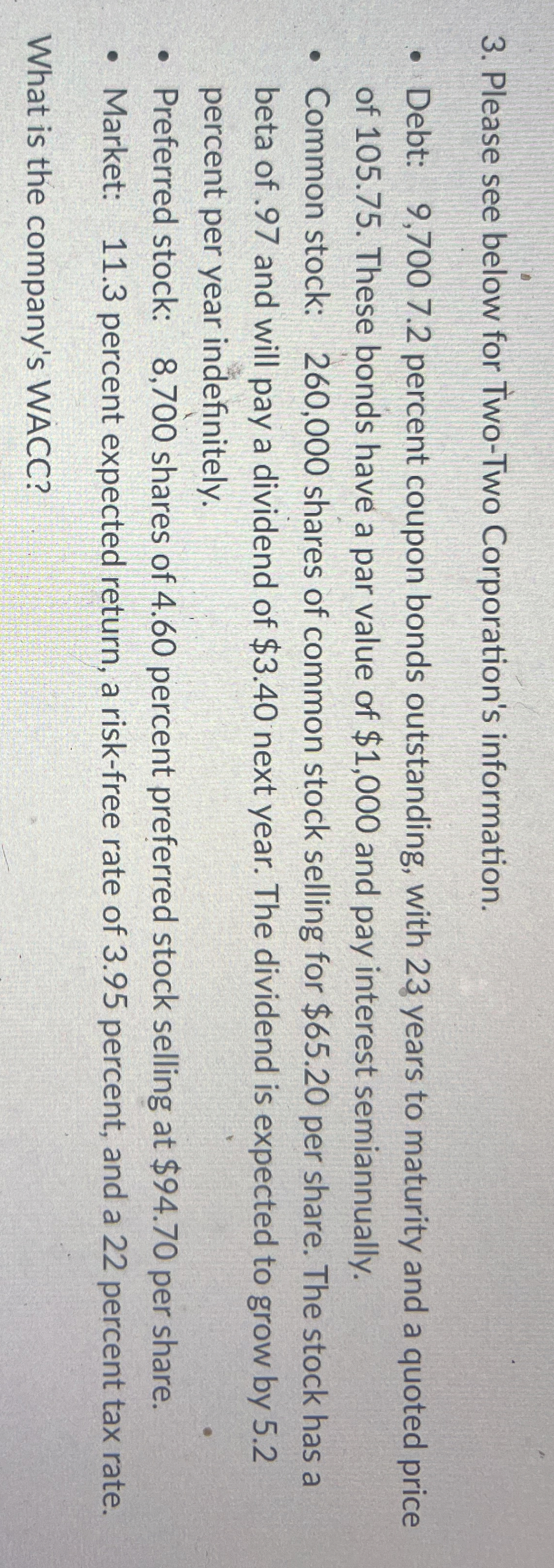

Please see below for TwoTwo Corporation's information.

Debt: percent coupon bonds outstanding, with years to maturity and a quoted price of These bonds have a par value of $ and pay interest semiannually.

Common stock: shares of common stock selling for $ per share. The stock has a beta of and will pay a dividend of $ next year. The dividend is expected to grow by percent per year indefinitely.

Preferred stock: shares of percent preferred stock selling at $ per share.

Market: percent expected return, a riskfree rate of percent, and a percent tax rate.

What is the company's WACC?

Help me solve this using a texas instrument BA II plus finacial calculator

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock