Question: Please see below. I need help with this asap please and thank you. A review of the ledger of Flint Co. at December 31, 2022,

Please see below. I need help with this asap please and thank you.

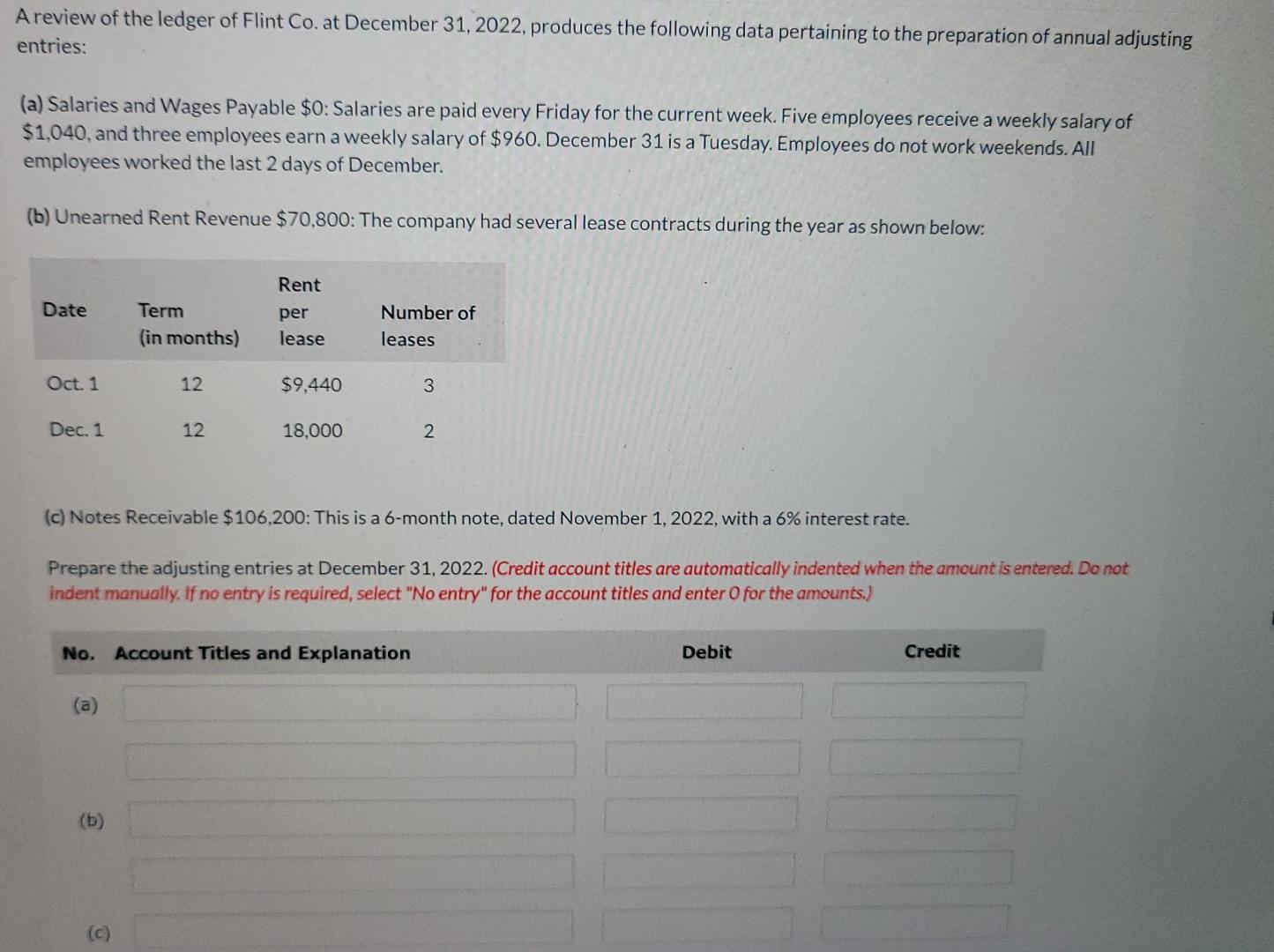

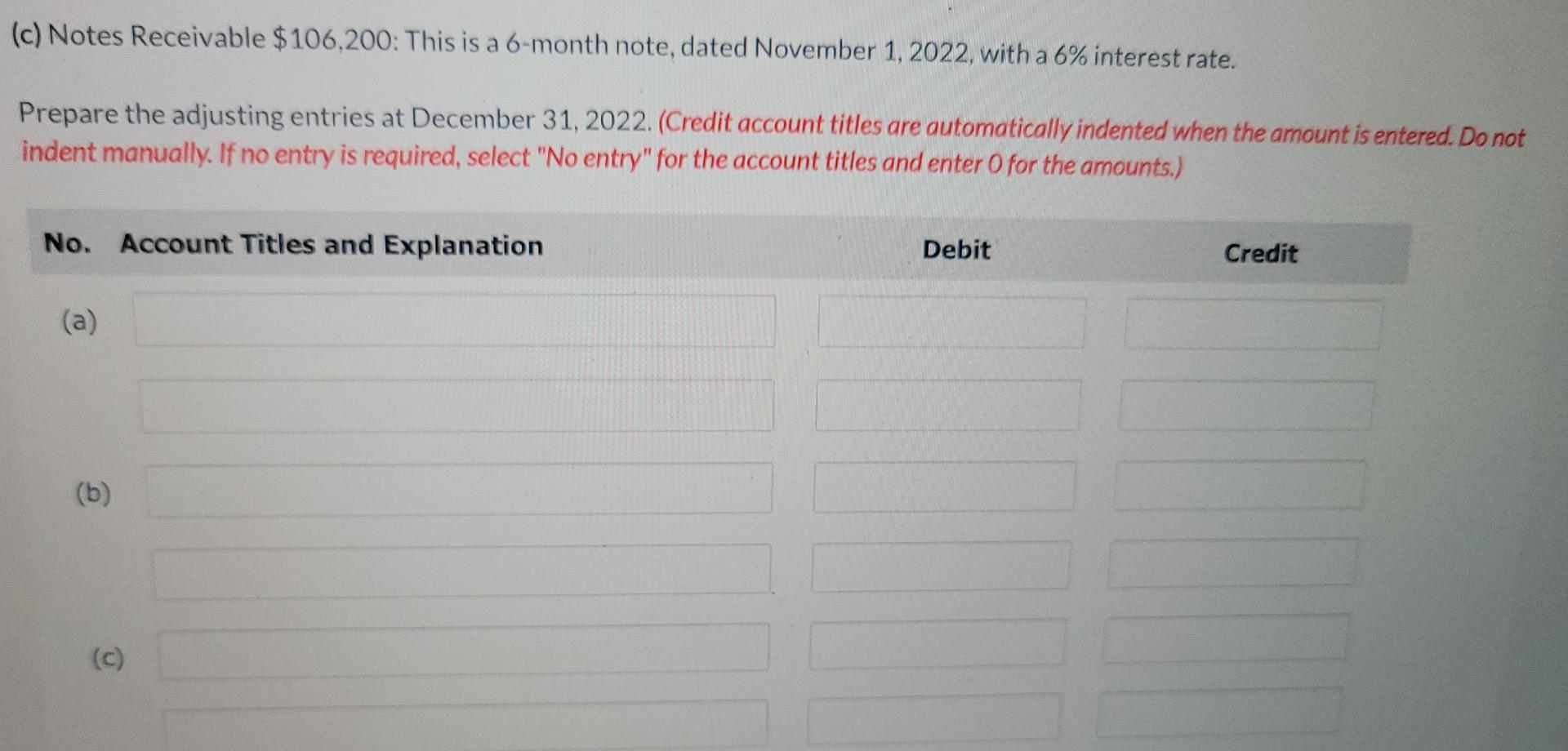

A review of the ledger of Flint Co. at December 31, 2022, produces the following data pertaining to the preparation of annual adjusting entries: (a) Salaries and Wages Payable $0: Salaries are paid every Friday for the current week. Five employees receive a weekly salary of $1,040, and three employees earn a weekly salary of $960. December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December (b) Unearned Rent Revenue $70,800: The company had several lease contracts during the year as shown below: Rent Date Term (in months) per lease Number of leases Oct. 1 12 $9.440 3 Dec. 1 12 18,000 2 (c) Notes Receivable $106.200: This is a 6-month note, dated November 1, 2022, with a 6% interest rate. Prepare the adjusting entries at December 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No, Account Titles and Explanation Debit Credit (a) (b) (C) (c) Notes Receivable $106,200: This is a 6-month note, dated November 1, 2022, with a 6% interest rate. Prepare the adjusting entries at December 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) ) (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts