Question: Please see below: Jim began his investing program with a $10M initial investment. At beginning of the next two years, he deposits $5M and $6M

Please see below:

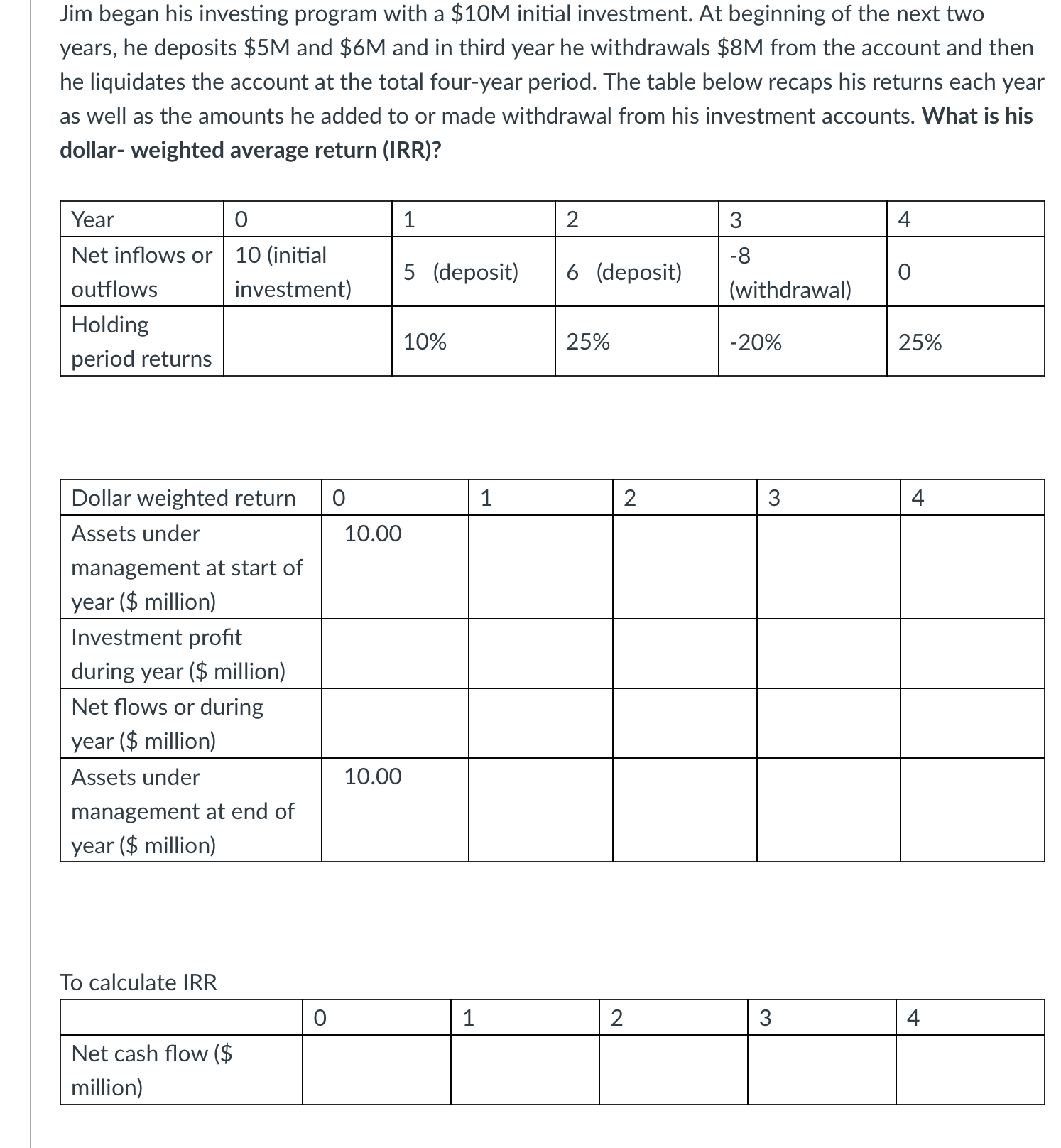

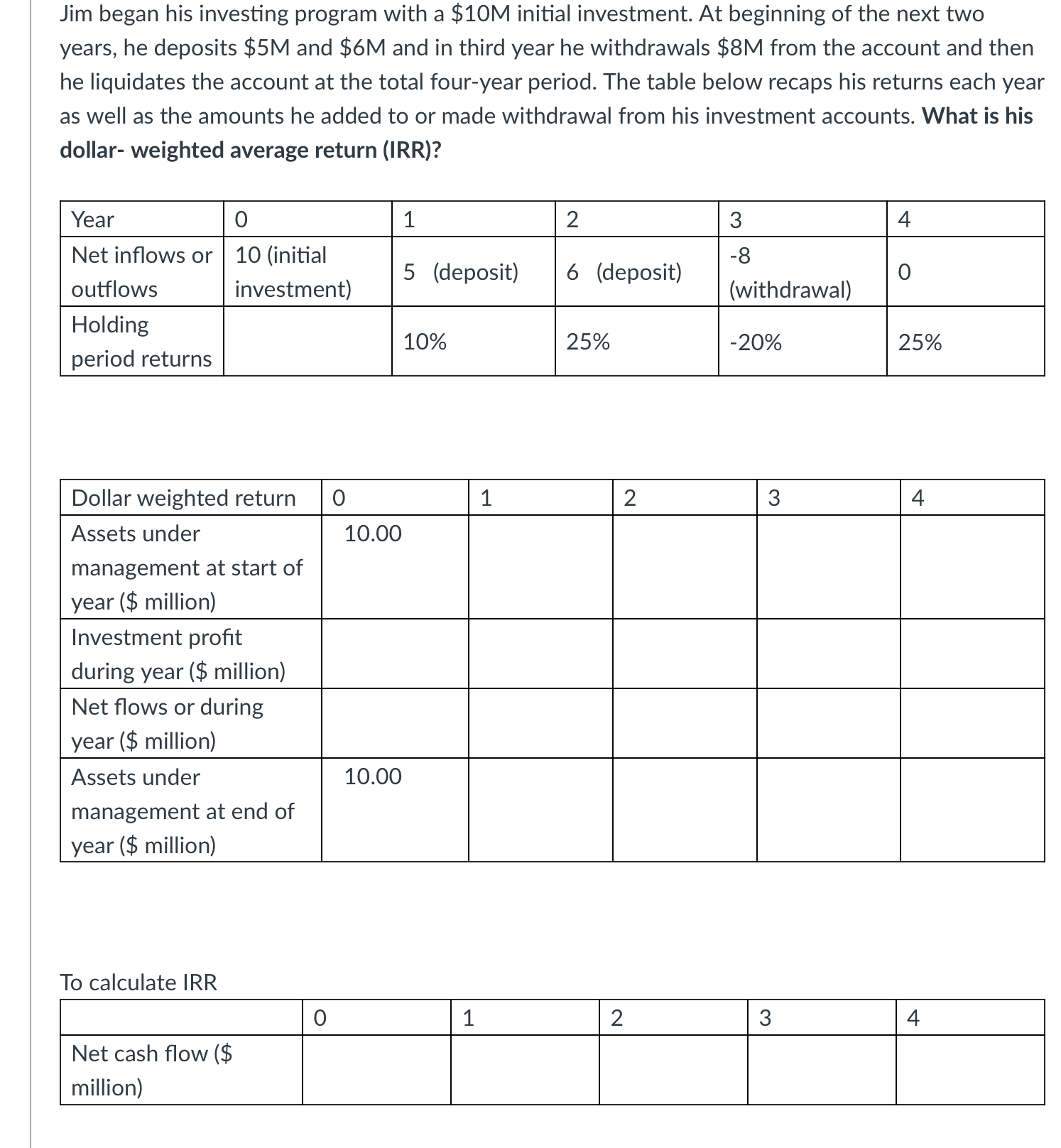

Jim began his investing program with a $10M initial investment. At beginning of the next two years, he deposits $5M and $6M and in third year he withdrawals $8M from the account and then he liquidates the account at the total four-year period. The table below recaps his returns each year as well as the amounts he added to or made withdrawal from his investment accounts. What is his dollar- weighted average return (IRR)? Year O 1 2 3 4 Net inflows or 10 (initial -8 5 (deposit) 6 (deposit) O outflows investment) (withdrawal) Holding 10% 25% -20% 25% period returns Dollar weighted return 0 1 2 3 4 Assets under 10.00 management at start of year ($ million) Investment profit during year ($ million) Net flows or during year ($ million) Assets under 10.00 management at end of year ($ million) To calculate IRR 0 1 2 3 4 Net cash flow ($ million)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts