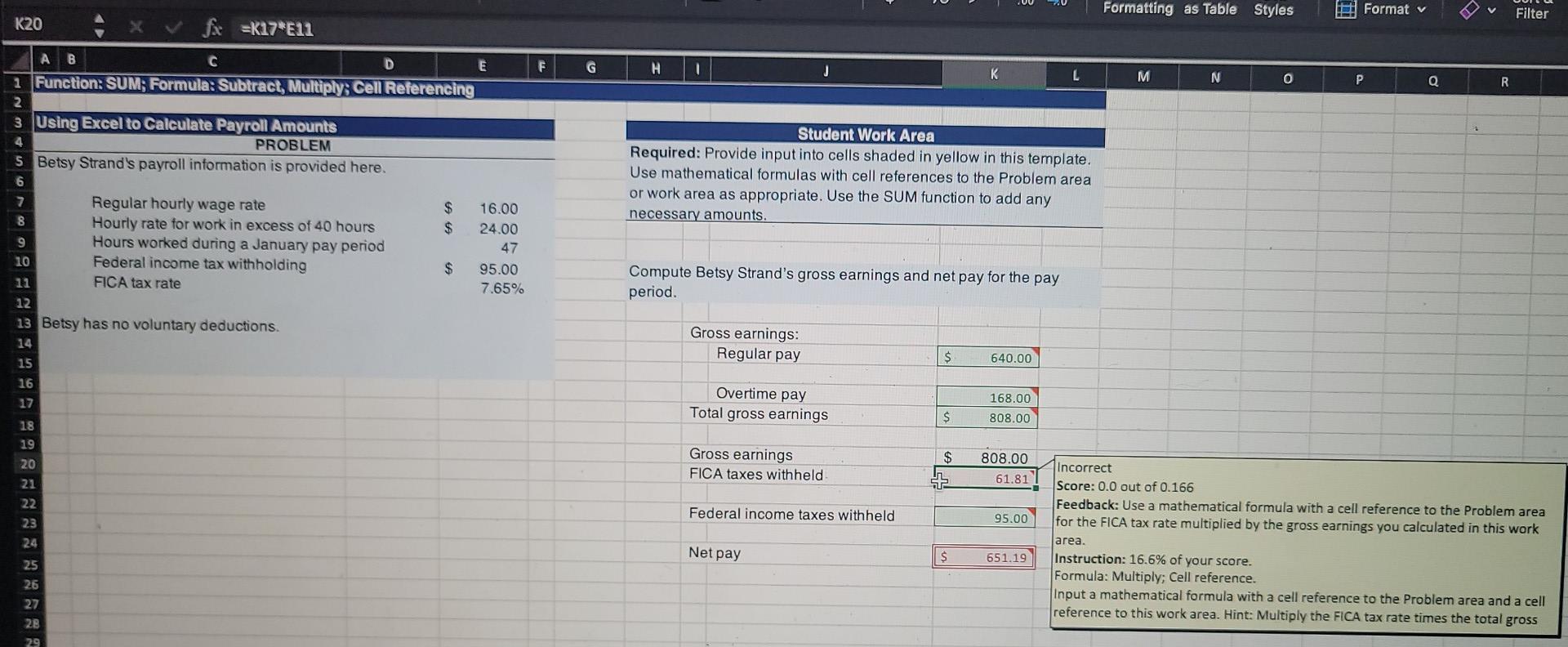

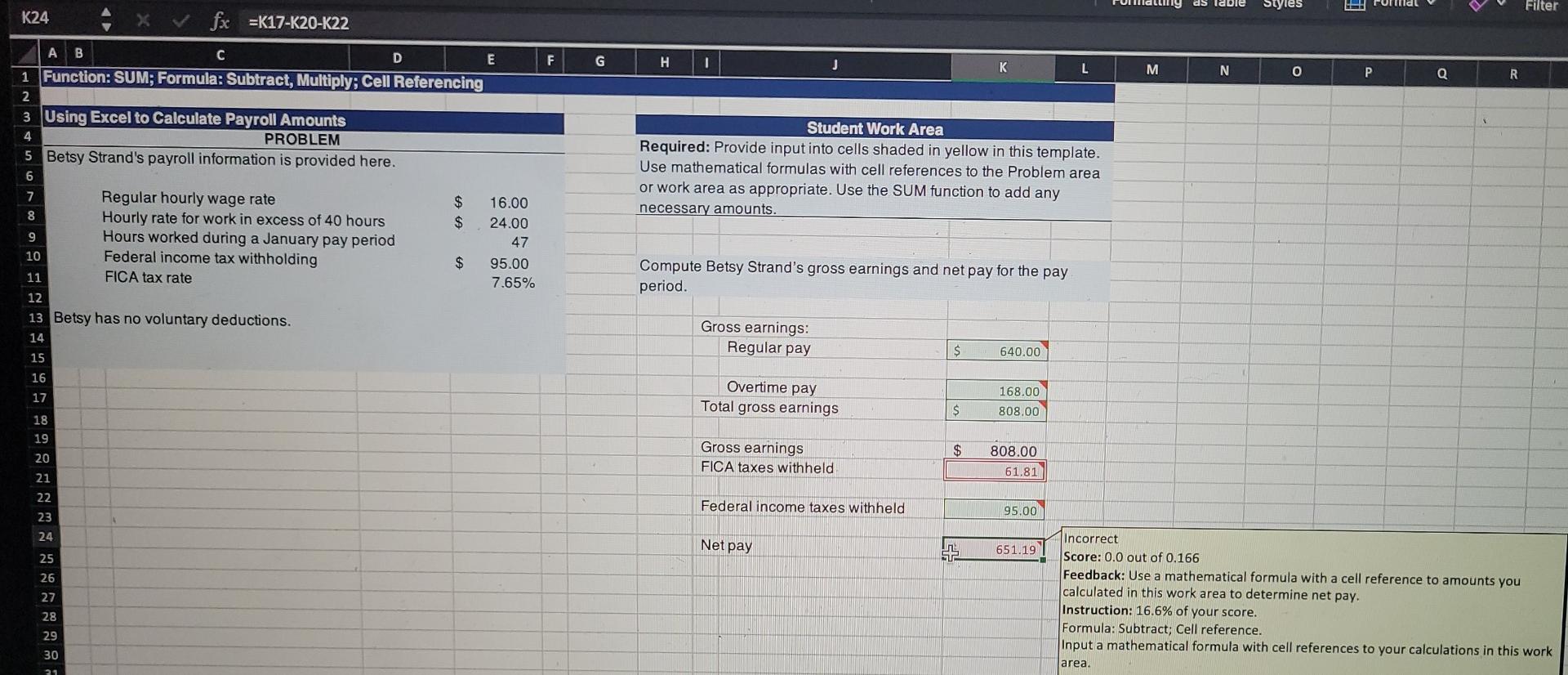

Question: Please see below. Need help with this. I need help with the two items in red. Note that cell referencing and the correct mathematical formula

Please see below. Need help with this. I need help with the two items in red. Note that cell referencing and the correct mathematical formula are needed to answer this correctly. Note that the pictures are feom the same problem.

Formatting as Table Styles Format v Filter K20 fx =K17*E11 F G H 1 L M N 0 P Q R 4 C D E 1 Function: SUM; Formula: Subtract, Multiply; Cell Referencing 2 3 Using Excel to Calculate Payroll Amounts PROBLEM 5 Betsy Strand's payroll information is provided here. 6 7 Regular hourly wage rate $ 16.00 8 Hourly rate for work in excess of 40 hours $ 24.00 9 Hours worked during a January pay period 47 10 Federal income tax withholding $ 95.00 11 FICA tax rate 7.65% 12 13 Betsy has no voluntary deductions. 14 Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem area or work area as appropriate. Use the SUM function to add any necessary amounts. Compute Betsy Strand's gross earnings and net pay for the pay period. Gross earnings: Regular pay $ 640.00 15 16 Overtime pay Total gross earnings 168.00 $ 808.00 18 19 Gross earnings FICA taxes withheld 20 808.00 $ IL 21 61.81 22 Federal income taxes withheld 23 95.00 24 Incorrect Score: 0.0 out of 0.166 Feedback: Use a mathematical formula with a cell reference to the Problem area for the FICA tax rate multiplied by the gross earnings you calculated in this work area Instruction: 16.6% of your score. Formula: Multiply; Cell reference. Input a mathematical formula with a cell reference to the Problem area and a cell reference to this work area. Hint: Multiply the FICA tax rate times the total gross Net pay $ 651.19 25 26 27 28 29 as lable Styles TOlal Filter K24 fx =K17-K20-K22 F G H I K L M N O P Q R A B D E 1 Function: SUM; Formula: Subtract, Multiply; Cell Referencing 2 3 Using Excel to Calculate Payroll Amounts PROBLEM 5 Betsy Strand's payroll information is provided here. 4 Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem area or work area as appropriate. Use the SUM function to add any necessary amounts. 6 7 8 $ $ 9 10 Regular hourly wage rate Hourly rate for work in excess of 40 hours Hours worked during a January pay period Federal income tax withholding FICA tax rate 16.00 24.00 47 95.00 7.65% $ 11 Compute Betsy Strand's gross earnings and net pay for the pay period. 12 13 Betsy has no voluntary deductions. 14 Gross earnings: Regular pay $ 640.00 15 16 17 Overtime pay Total gross earnings 168.00 $ 808.00 18 19 Gross earnings FICA taxes with held $ 20 808.00 61.81 21 22 Federal income taxes with held 95.00 23 24 Net pay 651.19 25 26 27 Incorrect Score: 0.0 out of 0.166 Feedback: Use a mathematical formula with a cell reference to amounts you calculated in this work area to determine net pay. Instruction: 16.6% of your score. Formula: Subtract; Cell reference. Input a mathematical formula with cell references to your calculations in this work area. 28 29 30 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts