Question: Please see excel screen shot attachments. Question 1 The Equity market is a subsector of the A commodity market B capital market C derivatives market

Please see excel screen shot attachments.

Question

1 The Equity market is a subsector of the

A commodity market

B capital market

C derivatives market

D money market

E None of the options are correct

2 Amunicipal bond4.2% . You have a marginal tax rate of 40%. You are considering to invest in a corporate bond that carry the same risk as the municipal bond. You will invest in the corporate bondif its rate is higher than

A 4%

B 5%

C 6%

D 7%

E Cannot be determined from the information given

3 You purchased a gold futures contract at a price of $1650 per ounce.There are 100 ounces per contract . At the time of expiration, the gold price was $1625.Your profit or loss ( in red)

A $25.00

B $25.00

C $2,500.00

D $2,500.00

E Cannot be determined from the information given

4 A put option

A gives the rightto sell the underlying asset at the exercise price on or before the expiration date

B gives the rightto buy the underlying asset at the exercise price on or before the expiration date

C increases in value as the stock declines

D A and C

E B and C

5 CDOs are

A Pooled debt instrument designed to share bank lending risk with other investors

B provide better transparency regarding their investment risk

C they were helpful in mitigating the 2008 financial crisis

D none of the above

6 You call broker to buy 200 shares of IBM. This transaction takes place in

A in the primary market

B in the international money market

C in the secondary market

D between you and IBM

E in any of the above markets

7 The number of authorized shares

A is less than Lessoutstanding share

B is more than Lessoutstanding share

C is equal to outstanding share

D Is equal to the number of shares allowed to trade.

8 ECNs

A are regulated as exchanges

B are regulated as Brokerage firms

C are allowed to trade ahead of their customer orders

D All the above

9 Order Internalization

A takes place on stock exchamges

B takes place both on ECNs and stock exchanges

C is a process in which orders by different trading units are match inside the institution

D has nothing to do with stock trading

10 The primary market

A is the market in which prime securities are traded

B in the primary market and second hand securities can be traded

C includes stock exchanges and ECNs

D A market in which first issue securites are traded

11 Initial margins

A are required in short sales transaction

B are required in initiating a position in futures contract

C Are rquired by the Federal Reserve System

D All of the above

E None of the above

12 You bought PG stock at $15 per share.Your losses could be minimized by placing a

A limit-sell order

B limit-buy order

C stop-buy order

D day-order

E None of the options are correct

13 The bid ask spread

A is the difference between the 10-years rate and the tw-years rate

B is the difference between the bid price and the ask price

C is the difference between the ask price and the bid price

D constitutes part of trading cost

E C and D

14 You want to purchase EEM stock at $40 from your broker using as little of your own money as possible.If initial margin is 60% and you have $7,200 to invest, how many shares can you buy?

A 180 shares

B 300 shares

C 360 shares

D 150 shares

15 You sold short 500 shares of common stock at $30 per share.The initial margin is 50% and the maintenance margin is 30%. Your initial investment is

A $4,500

B $15,000

C $5,600

D $7,500

16 The following is not an instrument for monetary policy

A Changing percentage of reserves (deposits) that banks and thrifts must hold in cash or in deposits at the Federal Reserve.

B the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Fed

C an open market operation by the Fed

D None of the above

E The process of issueing paper currency by the US Treasury Dpartment

17 You purchased a share of stock for $50. One year later you received $2.5 as a dividend and sold the share for $54. Your holding-period return is ?

A 0.05

B 0.08

C 0.13

D 0.14

E None of the above

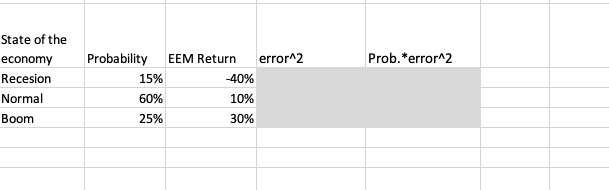

18 You have been given this probability distribution for the holding-period return for EEM stock: You invest $100 in the stock. The expected return on your investmenst is

A 10.00%

B 7.50%

C 15.00%

E 4.00%

19 You have been given this probability distribution for the holding-period return for EEM stock: You invest $100 in the stock. The standard deviation on your investment return is : (Hint you may calculate the values in the grey-highlighted area to answer this question)

A $15.23

B $29.34

C $21.65

D None if the above

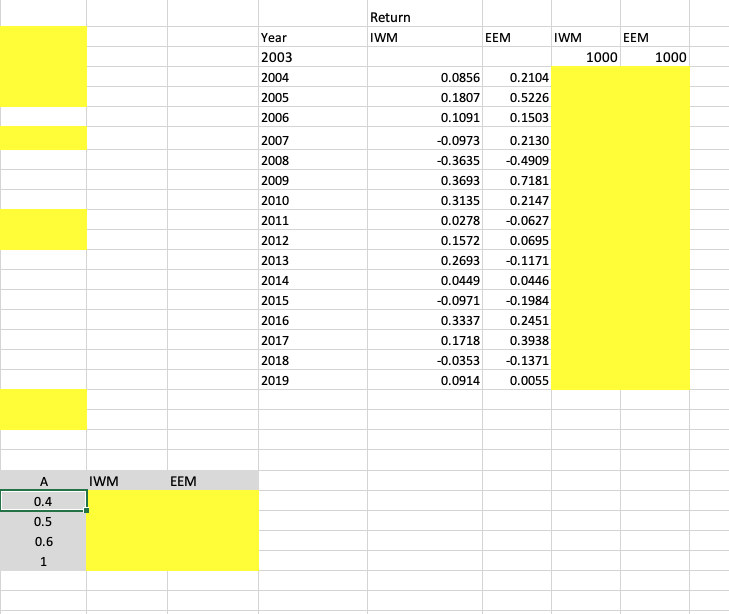

Use the data in the range H141:J158 to answer questions 20 to 23 in the highlighted cells in columnE using 4-digits accuracy.

20 The mean of IWM return is

21 The mean of EEM return is

22 The standard deviation of IWM return is

23 The standard deviation of EEM reurn

Assume that you start with a $1000 dollar invested in each ETF at the end of 2003.Calculate the evolution of your inves value over time in the yellow highlighted area in columns K and L. The terminal Value of your investment rounded to cents to the following

24 IWM

25 EEM

26 The annual growth rate of your investment can be measured by

A The annual nean of your annual return

B The maximum return minus the minimum return

C Thea nnualgeometric mean of your return

D All of the above

27 The annual growth of your investment in IWM is

28 The annual growth of your investment in EEM is

Assume an investor with a utility of the form U= E -0.5As2 . For the risk aversion values of A in the grey table, calculate the utilities of IWM and EEM and answer the Questions 29

29 The risk aversion for which an investor is indifferent between IWM and EEM is

A less than 0.4

B more than 0.6

C more than 0.4 and less than 0.5

D mor ethan 0.5 and less than 0.6

E There is no risk aversion A for wich the investor is indifferent between IWM and EEM

30 Assume that you can borrow and lend at a riskless rate of 3.6%. If you invest 60% un IWM and 40% in the risk free asset. The mean of your portfolio is

A 2.16%

B 1.44%

C 1.80%

D None of the above

31 The standard deviation of the portfolio in Question 30 is

A 7.56%

B 11.72%

C 11.34%

D None of the above

32 if you have $10000,you borrow $5000 at the risk free rate of 3.6% from your broker, and you invest $15000 in IWM. The mean of your portfolio

A $975.76

B $1,283.65

C $1,210.71

D None of the above.

33 The standard deviation of the portfolio in Question 32 is

A $1,889.92

B $2,834.88

C $4,394.65

D None of the above

34 If you were forced to choose between the portfolio in Question 32 and investing $10000 EEM,

A You will prefer EEM regardless of your risk aversion

B you will prefer EEM if you are risk nuetral

C You will prefer the portfolio in Question 32 regardless of your risk aversion

D You will prefer the portfolio in Question 32 if you are risk nuetral

E C and D

35 Assume a single factor model where IWM is the single factor. Assume also that the beta of EEM with respect to IWM is 1.12. the alpha of EEM is

A 1.38%

B 0.21%

C negative

D None of the above

36 Assume a single factor model where IWM is the single factor. Assume also that the beta of EEM with respect to IWM is 1.12. theresidual risk of EEM is

A 0.0000

B 0.0000

C 0.0000

D None of the above.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts