Question: Please see problem in first photo and answer yellow cells in second photo. 3,5 Interpreting Management Reports: Capital Investment Analysis C4. Angelo Bank is planning

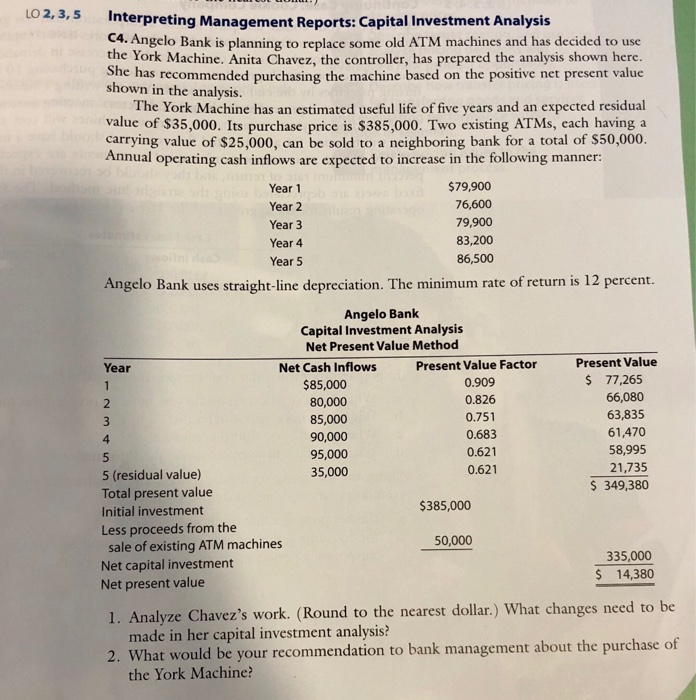

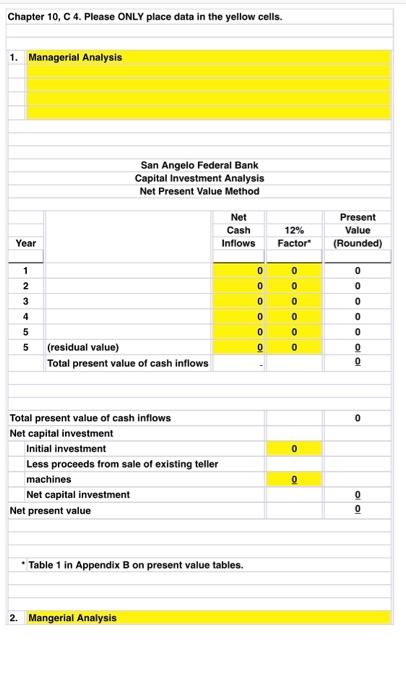

3,5 Interpreting Management Reports: Capital Investment Analysis C4. Angelo Bank is planning to replace some old ATM machines and has decided to use the York Machine. Anita Chavez, the controller, has prepared the analysis shown here. She has recommended purchasing the machine based on the positive net present value shown in the analysis. The York Machine has an estimated useful life of five years and an expected residual value of $35,000. Its purchase price is $385,000. Two existing ATMs, each having a carrying value of $25,000, can be sold to a neighboring bank for a total of $50,000. Annual operating cash inflows are expected to increase in the following manner: Year 1 Year 2 Year 3 Year 4 Year 5 $79,900 76,600 79,900 83,200 86,500 Angelo Bank uses straight-line depreciation. The minimum rate of return is 12 percent. Angelo Bank Capital Investment Analysis Net Present Value Method Present Value Net Cash Inflows $85,000 80,000 85,000 90,000 95,000 35,000 Present Value Factor 0.909 0.826 0.751 0.683 0.621 0.621 Year $ 77,265 66,080 63,835 61,470 58,995 21,735 349,380 4 5 (residual value) Total present value Initial investment Less proceeds from the sale of existing ATM machines Net capital investment Net present value $385,000 50,000 335,000 14,380 1. Analyze Chavez's work. (Round to the nearest dollar.) What changes need to be made in her capital investment analysis? 2. What would be your recommendation to bank management about the purchase of the York Machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts