Question: Please see questions below A bond has a face value of $1000 and makes annual coupon payments of $50. (The first coupon is to be

Please see questions below

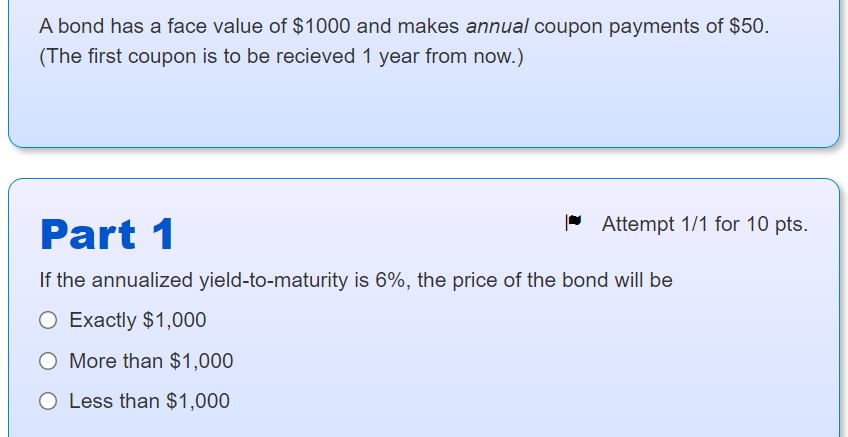

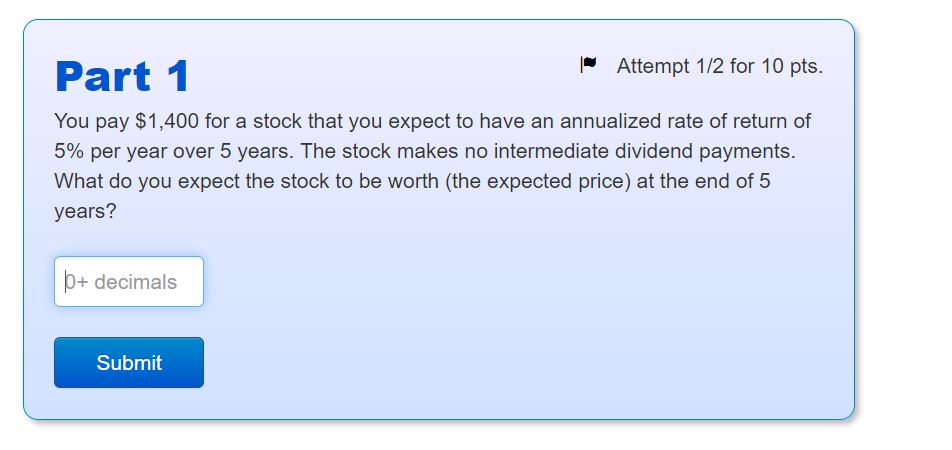

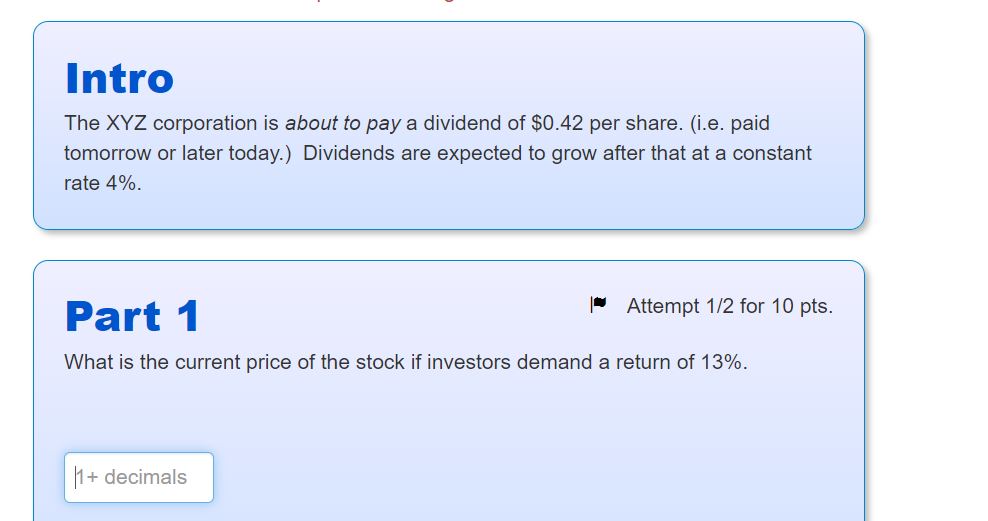

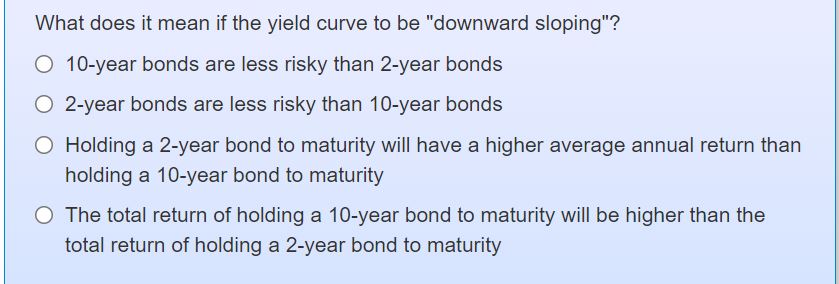

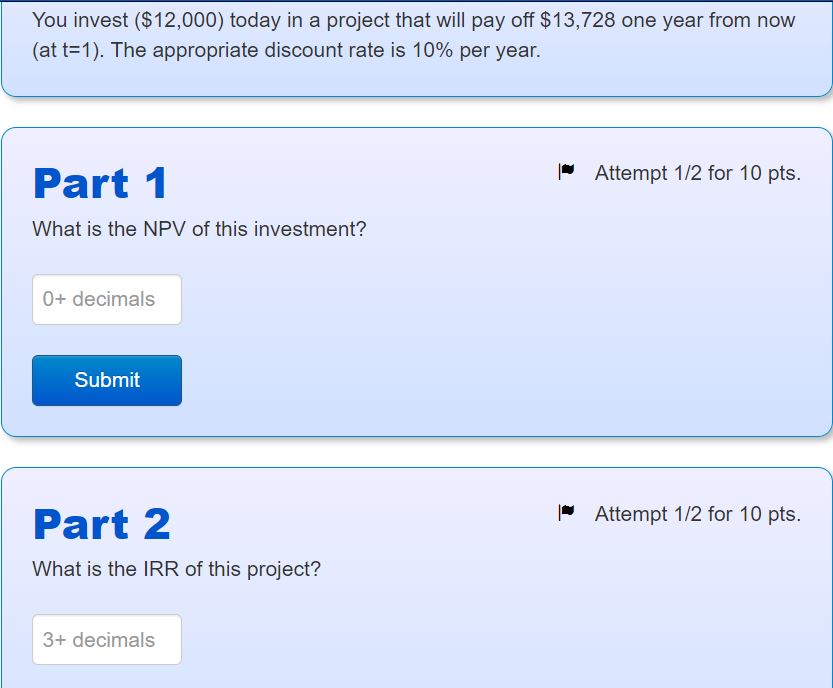

A bond has a face value of $1000 and makes annual coupon payments of $50. (The first coupon is to be recieved 1 year from now.) Part 1 | Attempt 1/1 for 10 pts. If the annualized yield-to-maturity is 6%, the price of the bond will be O Exactly $1,000 O More than $1,000 O Less than $1,000Part 1 Attempt 1/2 for 10 pts. You pay $1,400 for a stock that you expect to have an annualized rate of return of 5% per year over 5 years. The stock makes no intermediate dividend payments. What do you expect the stock to be worth (the expected price) at the end of 5 years? p+ decimals SubmitIntro The XYZ corporation is about to pay a dividend of $0.42 per share. (i.e. paid tomorrow or later today.) Dividends are expected to grow after that at a constant rate 4%. Part 1 |~ Attempt 1/2 for 10 pts. What is the current price of the stock if investors demand a return of 13%. |1+ decimalsWhat does it mean if the yield curve to be "downward sloping"? C) 10-year bonds are less risky than 2-year bonds O 2-year bonds are less risky than 10-year bonds O Holding a 2-year bond to maturity will have a higher average annual return than holding a 10-year bond to maturity O The total return of holding a 10-year bond to maturity will be higher than the total return of holding a 2-year bond to maturity You invest ($12,000) today in a project that will pay off $13,728 one year from now (at t=1). The appropriate discount rate is 10% per year. Part 1 Attempt 1/2 for 10 pts. What is the NPV of this investment? 0+ decimals Submit Part 2 | Attempt 1/2 for 10 pts. What is the IRR of this project? 3+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts