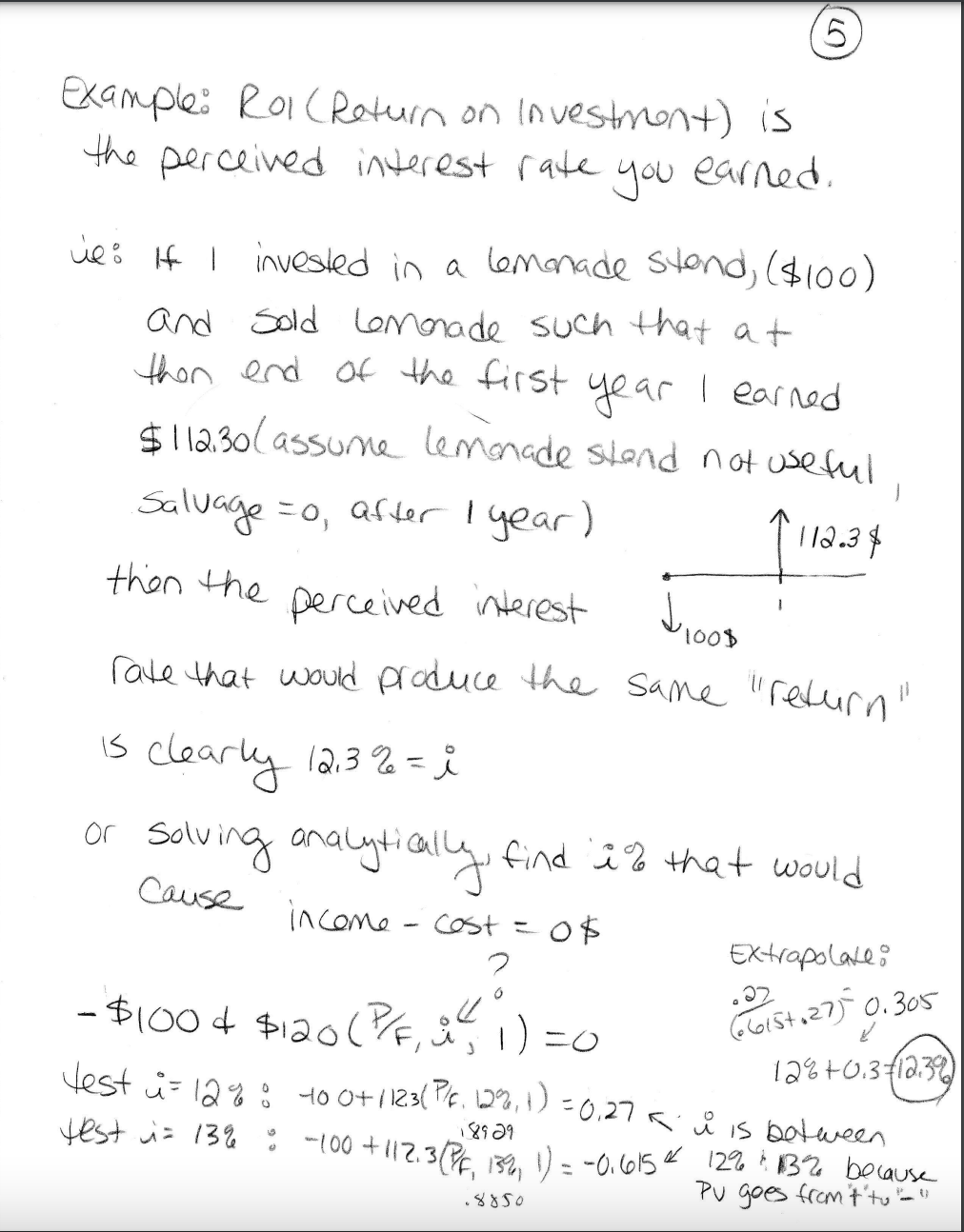

Question: Please see the attached images for question. 5 Example: Rol ( Return on Investment) is the perceived interest rate you earned. wei if I invested

Please see the attached images for question.

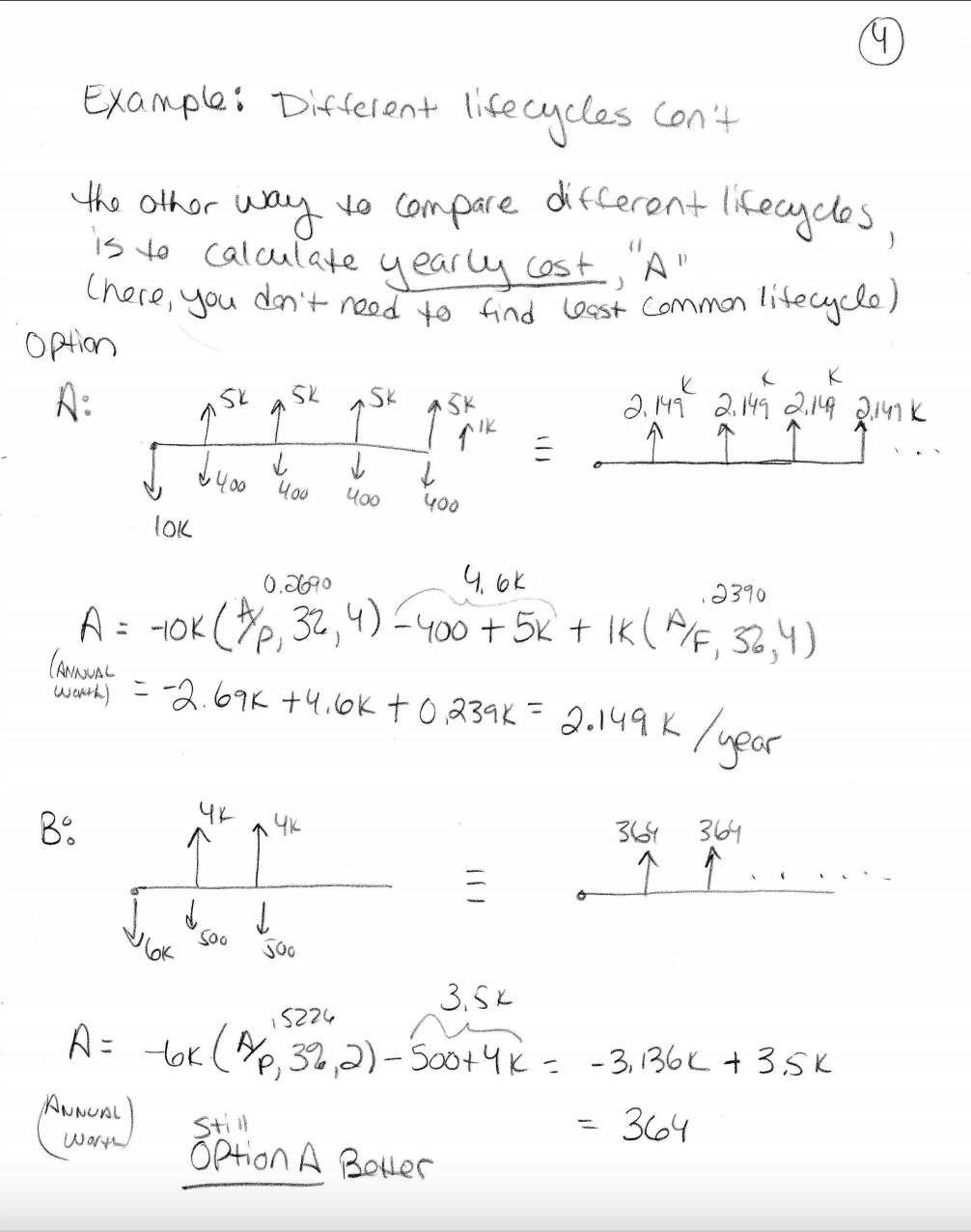

5 Example: Rol ( Return on Investment) is the perceived interest rate you earned. wei if I invested in a lemonade stand , ( $100 ) and sold lemmade such that at then end of the first year I earned $ 112.30 ( assume lemonade stand not useful Salvage = 0, after 1 year ) 112.3$ then the perceived interest 1008 rate that would produce the same " return " Is clearly 12.3 % = i or solving analytically, find i? that would cause income - cost = 0$ Extrapolate : . 27 (615+ . 27 ) 0.305 - $100 + $120 ( P/ F , i, 1 ) = 0 128+ 0.3-12.3% test i = 12% 8 40 0+ 112.3 ( P/f. 12%, 1 ) = 0.27 R i is between 18929 test i= 13% : -100 + 112.3 ( PE, 13%, 1) = - 0.615 x 12% : 13% because PV goes from't to "- " 850Example: Different lifecycles can't the other way to compare different lifecycles is to calculate yearly cost ," A " ( here, you don't need to find least common lifecycle ) option K ASK ask ASK ask 2. 149 2.149 2, 149 2 147 K MIK = T 1 400 400 400 400 lok 0. 690 4 6k 2390 A = -10K (#Xp, 32, 4) - 400+ 5K + IK( R/F, 36,4) ( ANNUAL worth ) = - 2. 69k + 4. 6k + 0. 239K = 2.149 k / year 364 364 F . . lok 50o 3. 5 x 15224 A = -LK (4/p, 3%, 2)- 500+ 4 k = -3,136k + 3.5k ANNUAL Still = 364 worth Option A Bowler

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts