Question: Please see the attachments and refer to Appendix A & B to answer the questions. You you don't have to give an explanation. Just the

Please see the attachments and refer to Appendix A & B to answer the questions.

You you don't have to give an explanation. Just the answers just be sufficient. Thank you!!

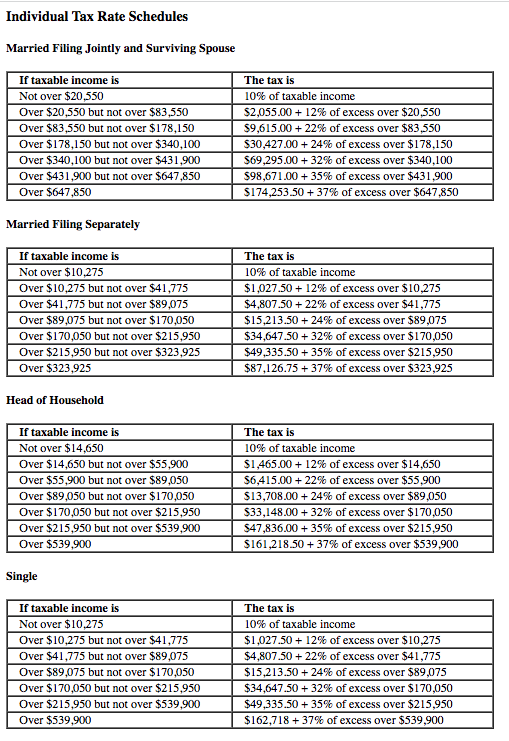

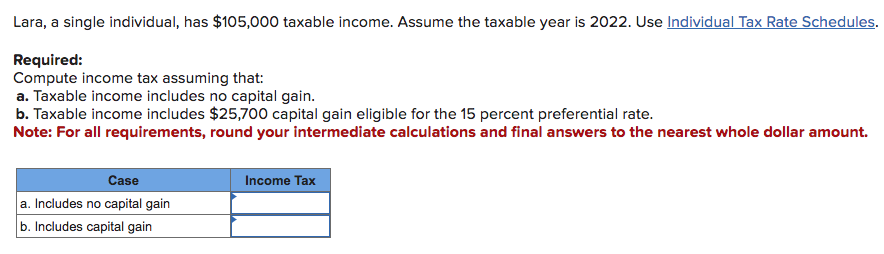

Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse If taxable income is The tax is Not over $20,550 10% of taxable income Over $20,550 but not over $83,550 $2,055.00 + 12% of excess over $20,550 Over $83,550 but not over $178,150 $9,615.00 + 22% of excess over $83,550 Over $178,150 but not over $340,100 $30,427.00 + 24% of excess over $178,150 Over $340,100 but not over $431,900 $69,295.00 + 32% of excess over $340,100 Over $431,900 but not over $647,850 598,671.00 + 35% of excess over $431,900 Over $647,850 $174,253.50+ 37% of excess over $647,850 Married Filing Separately If taxable income is The tax is Not over $10,275 10% of taxable income Over $10,275 but not over $41,775 $1,027.50 + 12% of excess over $10,275 Over $41,775 but not over $89,075 $4,807.50 + 22% of excess over $41,775 Over $89,075 but not over $170,050 $15,213.50 + 24% of excess over $89,075 Over $170,050 but not over $215,950 $34,647.50 + 32% of excess over $170,050 Over $215,950 but not over $323,925 $49,335.50 + 35% of excess over $215,950 Over $323,925 $87,126.75 + 37% of excess over $323,925 Head of Household If taxable income is The tax is Not over $14,650 10% of taxable income Over $14,650 but not over $55,900 $1,465.00 + 12% of excess over $14,650 Over $55,900 but not over $89,050 $6,415.00 + 22% of excess over $55,900 Over $89,050 but not over $170,050 $13,708.00 + 24% of excess over $89,050 Over $170,050 but not over $215,950 $33,148.00 + 32% of excess over $170,050 Over $215,950 but not over $539,900 $47,836.00 + 35% of excess over $215,950 Over $539,900 $161,218.50 + 37% of excess over $539,900 Single If taxable income is The tax is Not over $10,275 10% of taxable income Over $10,275 but not over $41,775 $1,027.50 + 12% of excess over $10,275 Over $41,775 but not over $89,075 $4,807.50+ 22% of excess over $41 ,775 Over $89,075 but not over $170,050 $15,213.50 + 24% of excess over $89,075 Over $170,050 but not over $215,950 $34,647.50 + 32% of excess over $170,050 Over $215,950 but not over $539,900 $49,335.50 + 35% of excess over $215,950 Over $539,900 $162,718 + 37% of excess over $539,900Lara. a single individual. has $105,000 taxable income. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Required: Compute income tax assuming that: a. Taxable income includes no capital gain. b. Taxable income includes $25,700 capital gain eligible for the 15 percent preferential rate. Note: For all requirements. round your intermediate calculations and nal answers to the nearest whole dollar amount. a. Includes no capital gain _ b. Includes capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts