Question: Please see the comment box Question 2 Fin Group Bhd issued 100,000, 8% convertible loan stock on 1 January 2019 at face value of RM1,000

Please see the comment box

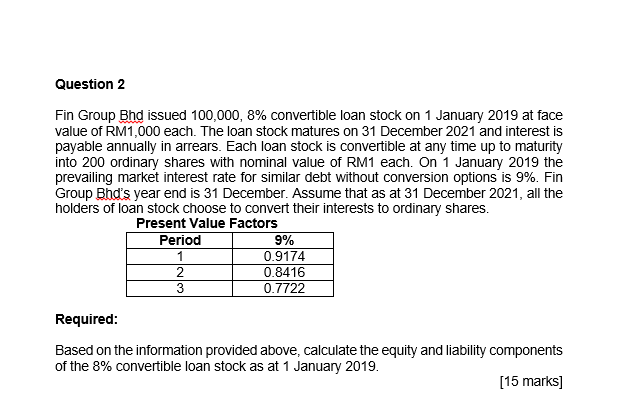

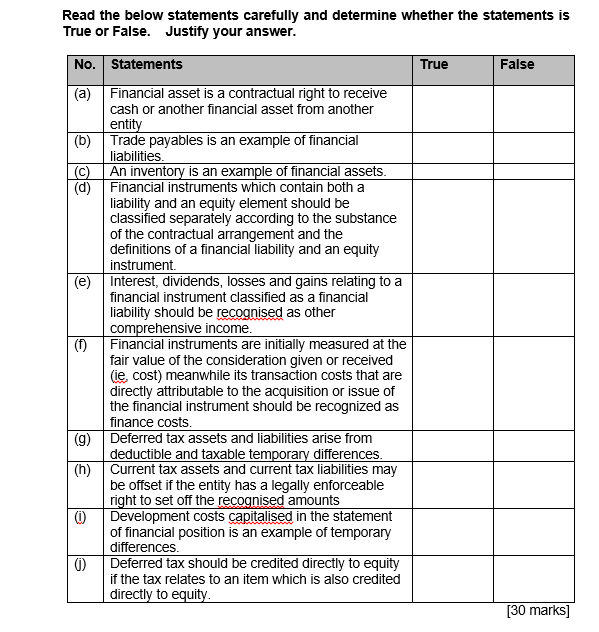

Question 2 Fin Group Bhd issued 100,000, 8% convertible loan stock on 1 January 2019 at face value of RM1,000 each. The loan stock matures on 31 December 2021 and interest is payable annually in arrears. Each loan stock is convertible at any time up to maturity into 200 ordinary shares with nominal value of RM1 each. On 1 January 2019 the prevailing market interest rate for similar debt without conversion options is 9%. Fin Group Bhd's year end is 31 December. Assume that as at 31 December 2021, all the holders of loan stock choose to convert their interests to ordinary shares. Present Value Factors Period 9% 0.9174 0.8416 0.7722 Required: Based on the information provided above, calculate the equity and liability components of the 8% convertible loan stock as at 1 January 2019. [15 marks]Read the below statements carefully and determine whether the statements is True or False. Justify your answer. No. Statements True False (a Financial asset is a contractual right to receive cash or another financial asset from another entity (b Trade payables is an example of financial liabilities. C An inventory is an example of financial assets (d) Financial instruments which contain both a liability and an equity element should be classified separately according to the substance of the contractual arrangement and the definitions of a financial liability and an equity instrument. (e) Interest, dividends, losses and gains relating to a financial instrument classified as a financial liability should be recognised as other comprehensive income (f) Financial instruments are initially measured at the fair value of the consideration given or received (ie, cost) meanwhile its transaction costs that are directly attributable to the acquisition or issue of the financial instrument should be recognized as finance costs. (9) Deferred tax assets and liabilities arise from deductible and taxable temporary differences (h) Current tax assets and current tax liabilities may be offset if the entity has a legally enforceable right to set off the recognised amounts Development costs capitalised in the statement of financial position is an example of temporary differences. () Deferred tax should be credited directly to equity if the tax relates to an item which is also credited directly to equity. (30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts