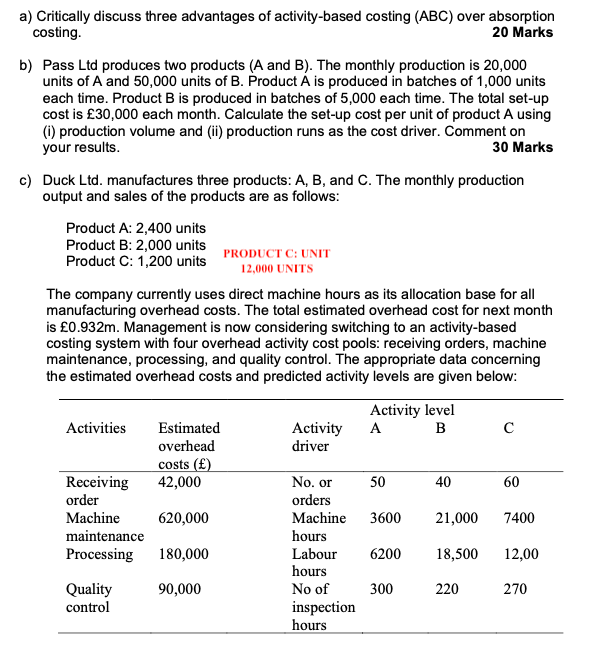

Question: PLEASE SEE THE ERROR THAT I HAVE CORRECT ON THE QUESTION. PRODUCT C: 12,000 UNITS CoursHeroTranscribedText: a) Critically discuss three advantages of activity-based costing (ABC)

PLEASE SEE THE ERROR THAT I HAVE CORRECT ON THE QUESTION. PRODUCT C: 12,000 UNITS

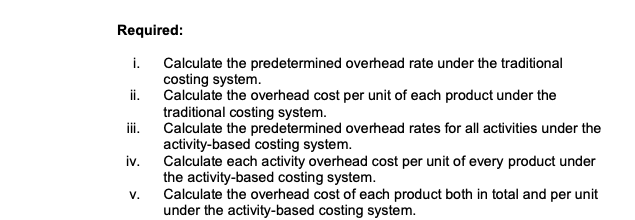

CoursHeroTranscribedText: a) Critically discuss three advantages of activity-based costing (ABC) over absorption costing. 20 Marks b) Pass Ltd produces two products (A and B). The monthly production is 20,000 units of A and 50,000 units of B. Product A is produced in batches of 1,000 units each time. Product B is produced in batches of 5,000 each time. The total set-up cost is f30,000 each month. Calculate the set-up cost per unit of product A using (i) production volume and (ii) production runs as the cost driver. Comment on your results. 30 Marks c) Duck Ltd. manufactures three products: A, B, and C. The monthly production output and sales of the products are as follows: Product A: 2,400 units Product B: 2,000 units Product C: 1,200 units PRODUCT C: UNIT 12,000 UNITS The company currently uses direct machine hours as its allocation base for all manufacturing overhead costs. The total estimated overhead cost for next month is 60.932m. Management is now considering switching to an activity-based costing system with four overhead activity cost pools: receiving orders, machine maintenance, processing, and quality control. The appropriate data concerning the estimated overhead costs and predicted activity levels are given below: Activity level Activities Estimated Activity A B C overhead driver costs (f) Receiving 42,000 No. or 50 40 60 order orders Machine 620,000 Machine 3600 21,000 7400 maintenance hours Processing 180,000 Labour 6200 18,500 12,00 hours Quality 90,000 No of 300 220 270 control inspection hoursRequired: Calculate the predetermined overhead rate under the traditional costing system. Calculate the overhead cost per unit of each product under the traditional coating system. Calculate the predetermined overhead rates for all activities under the activity-based costing system. Calculate each activity overhead cost per unit of every product under the activity-based costing system. Calculate the overhead cost of each product both in total and per unit under the activity-based costing system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts