Question: question number to mark it fol Prev - allows you to go back to the previous question. Next - saves your answer and allows

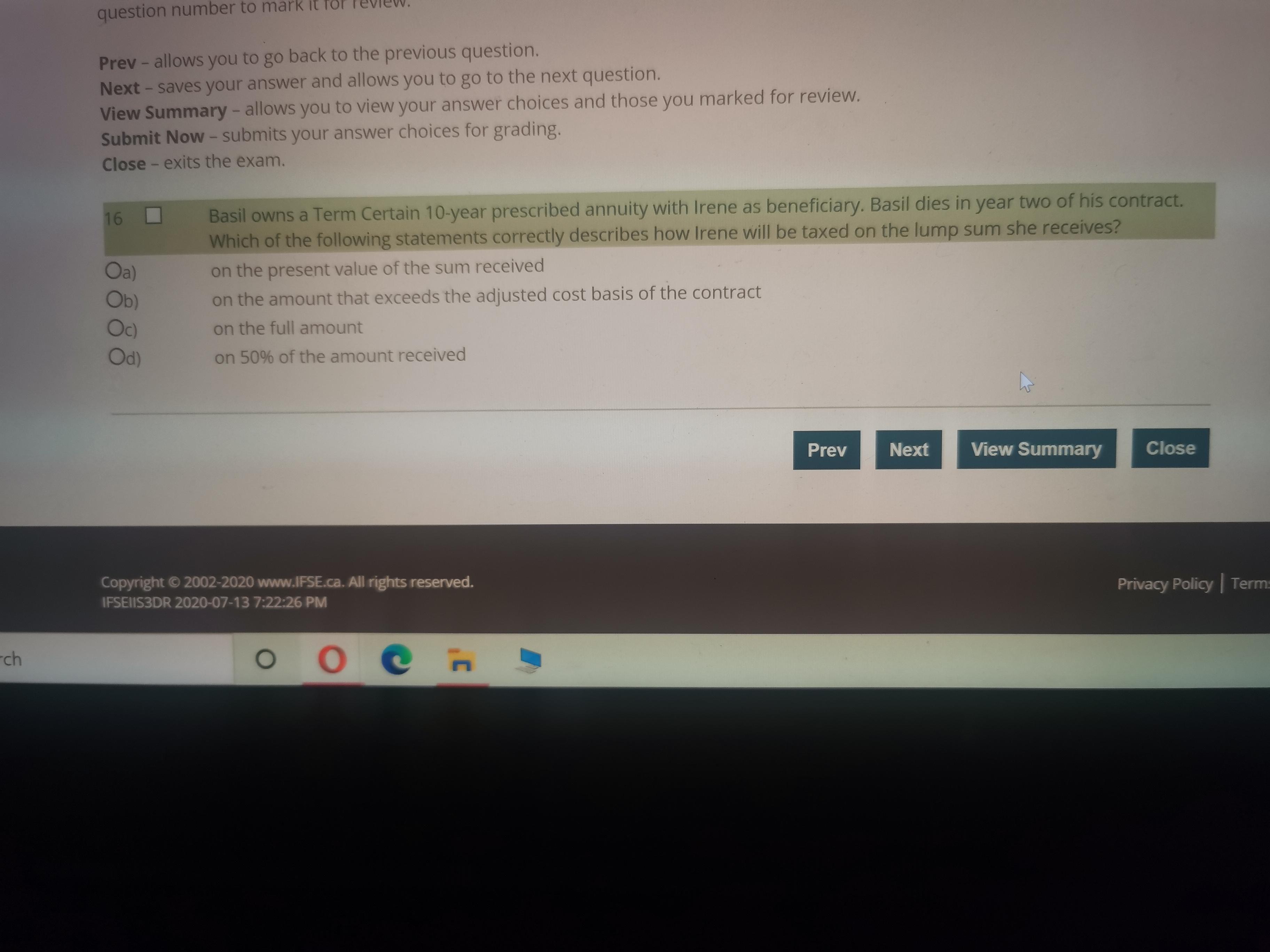

question number to mark it fol Prev - allows you to go back to the previous question. Next - saves your answer and allows you to go to the next question. View Summary-allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. 1 Close - exits the exam. Basil owns a Term Certain 10-year prescribed annuity with Irene as beneficiary. Basil dies in year two of his contract. Which of the following statements correctly describes how Irene will be taxed on the lump sum she receives? 16 Oa) Ob) on the present value of the sum received on the amount that exceeds the adjusted cost basis of the contract Oc) on the full amount Od) on 50% of the amount received Prev Next View Summary Close Copyright 2002-2020 www.IFSE.ca. All rights reserved. Privacy Policy Term: IFSEIIS3DR 2020-07-13 7:22:26 PM rch

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Its given in the question that Irene has chosen to take an immed... View full answer

Get step-by-step solutions from verified subject matter experts