Question: Please select the correct multiple choice for each question. Thank you will give good ratings for accuracy tu cicu CORMN Stock n margin at $14

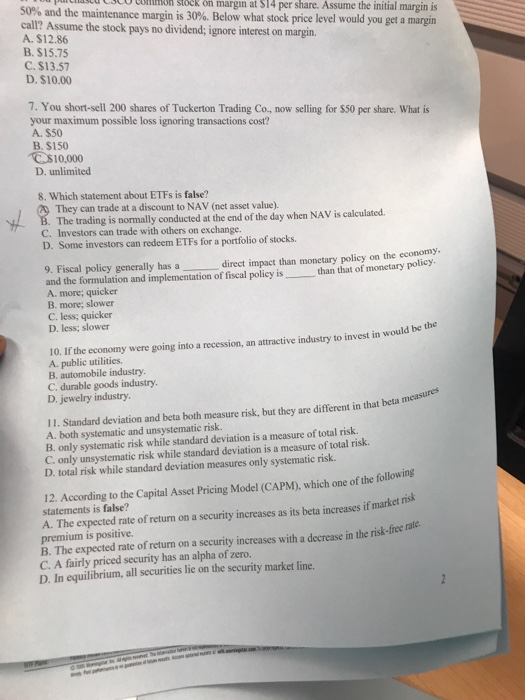

tu cicu CORMN Stock n margin at $14 per share. Assume the initial margin is the maintenance margin is 30%. Below what stock price level would you get a margin 50% and call? Assume the stock pays no dividend; ignore interest on margin. A. $12.86 B. $15.75 C. $13.57 D. $10.00 7. You short-sell 200 shares of Tuckerton Trading Co., now selling for $50 per share. What is your maximum possible loss ignoring transactions cost? A. $50 B. $150 10,000 D. unlimited 8. Which statement about ETFs is false? They can trade at a discount to NAV (net asset value). The trading is normally conducted at the end of the day when NAV is calculated. C. Investors can trade with others on exchange. D. Some investors can redeem ETFs for a portfolio of stocks. direct impact than monetary policy on the economy than that of monetary policy 9. Fiscal policy generally has a and the formulation and implementation of fiscal policy is A- more; quicker B. more; slower C. less; quicker D. less; slower 10. If the economy were going into a recession, an attractive industry to invest in would A. public utilities. B. automobile industry C, durable goods industry. D. jewelry industry. 11. Standard deviation and beta both measure risk, but they are different in that beta m A. both systematic and unsystematie risk B. only systematic risk while standard deviation is a measure of total risk. C. only unsystematic risk while standard deviation is a measure of total risk. D. total risk while standard deviation measures only systematic risk. 12. According to the Capital Asset Pricing Model (CAPM), which one of the follow statements is false? A. The expected rate of returm on a security increases as its beta increases it premium is positive. market ris B. The expected ate of retum on a security increases with a decerease in the risk-five mate The expected rate of return on a security increases with a decrease in C. A fairly priced security has an alpha of zero. D. In equilibrium, all securities lie on the security market line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts