Question: please send full answer Current Attempt in Progress The following is Cullumber Cycle Repair Shop's trial balance at January 31, 2024, the company's fiscal year

please send full answer

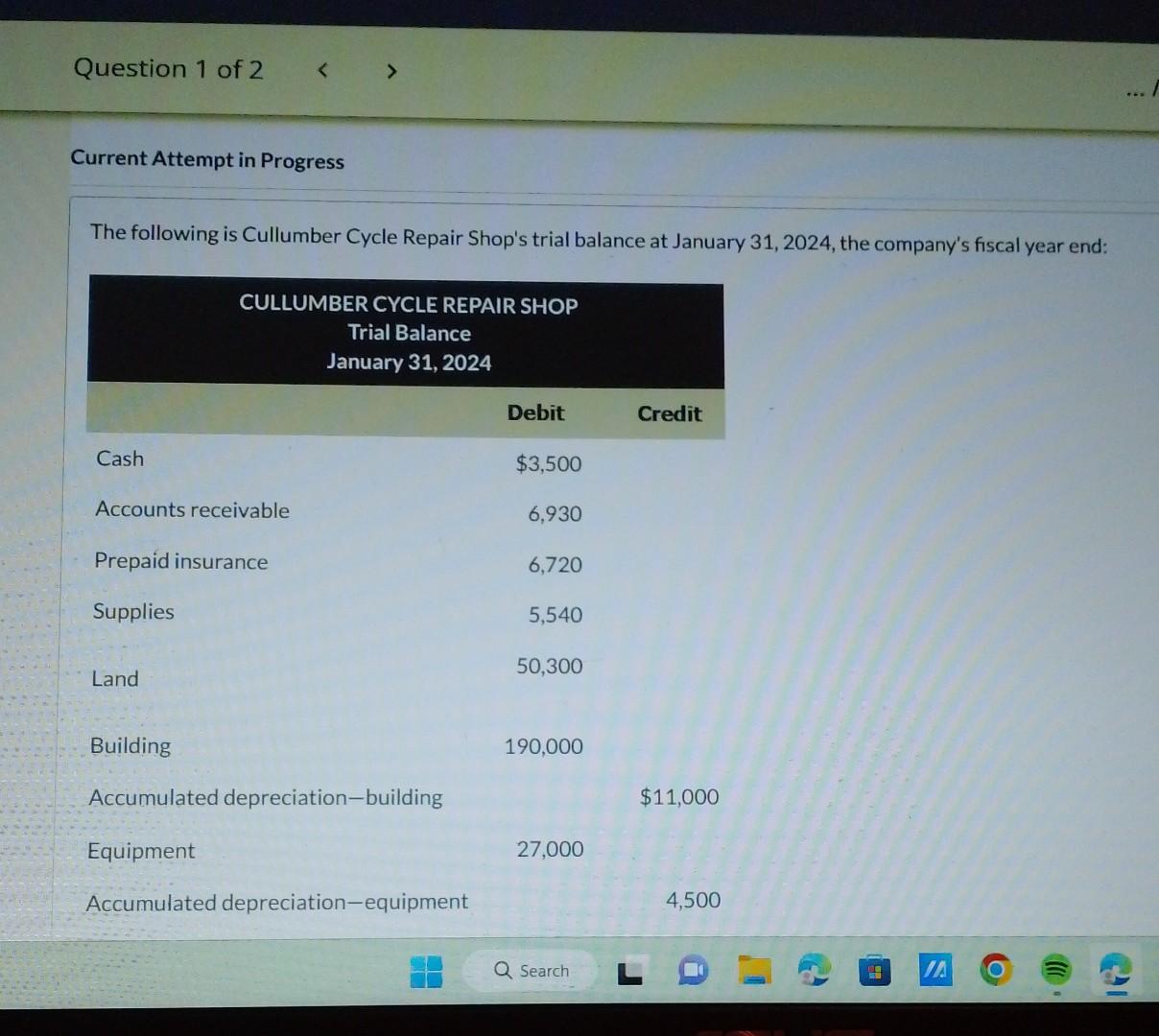

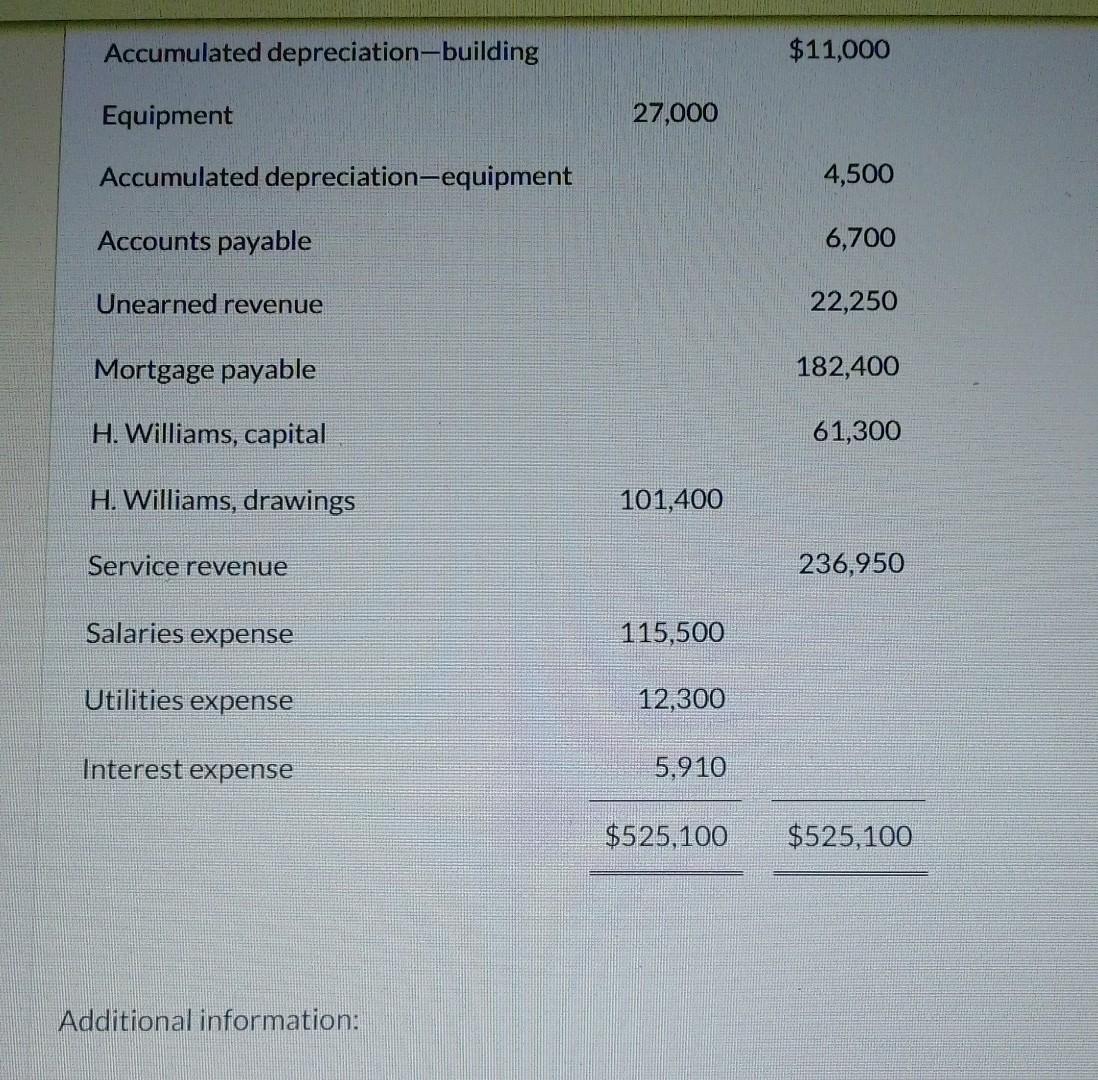

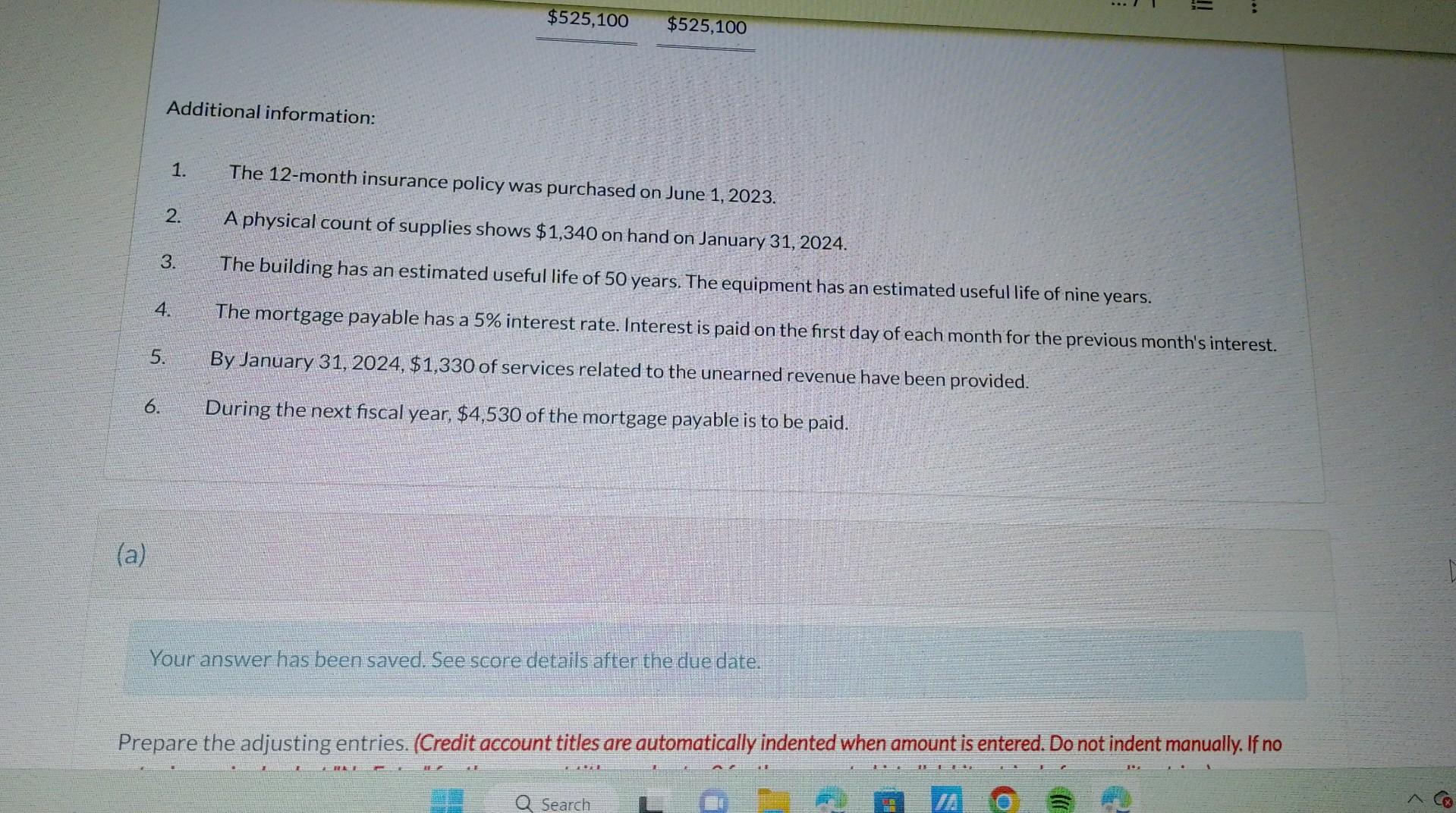

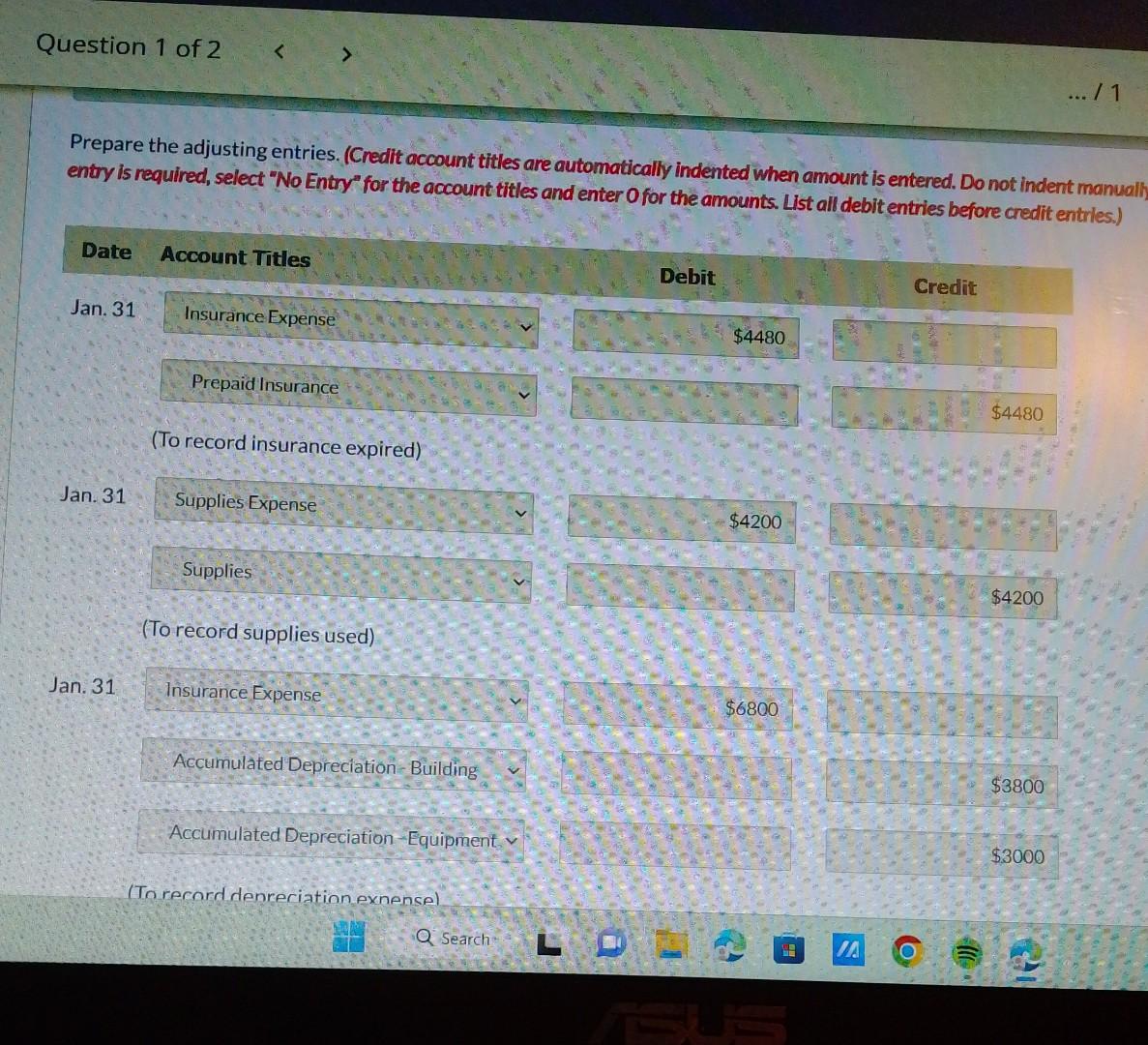

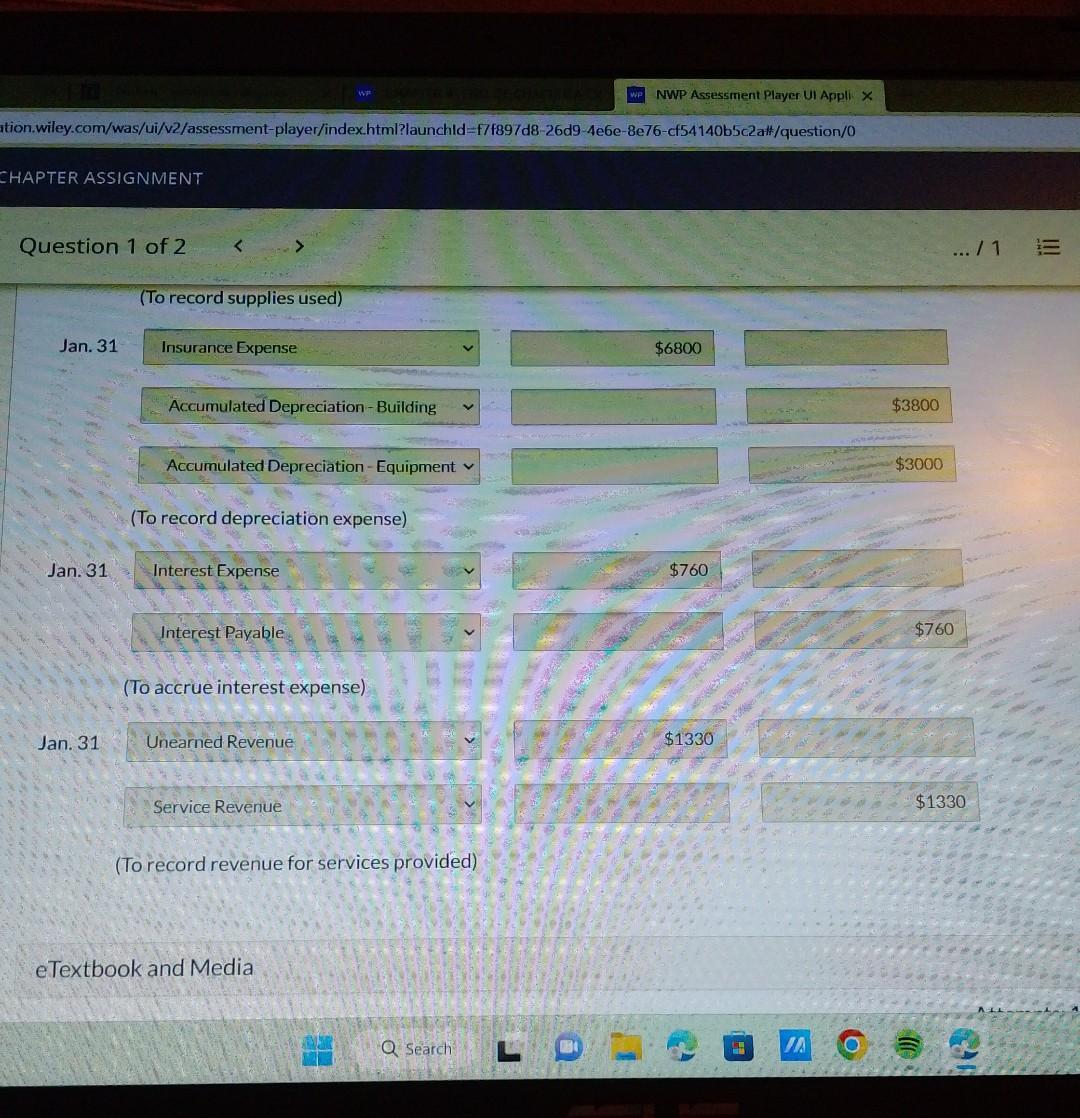

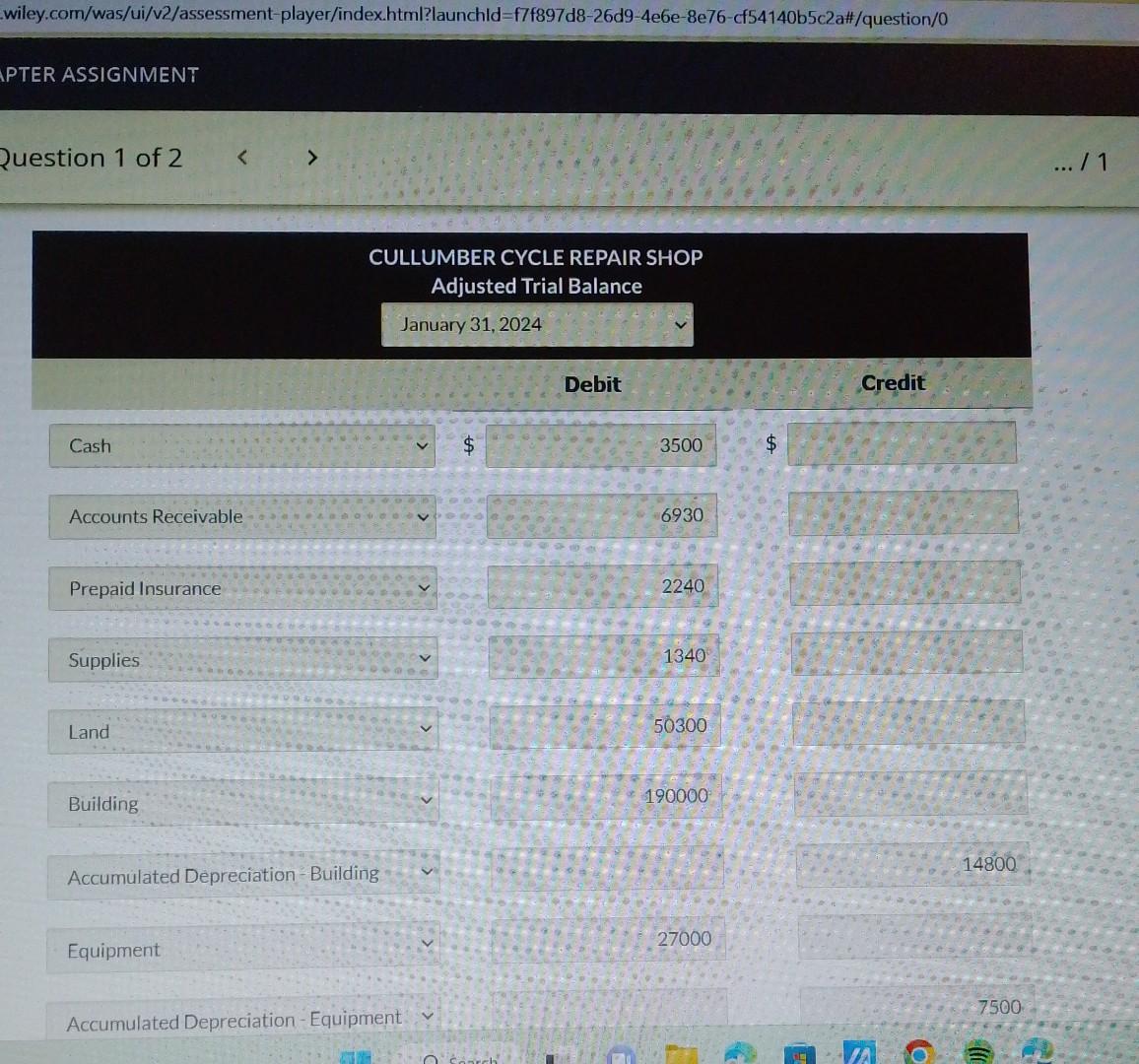

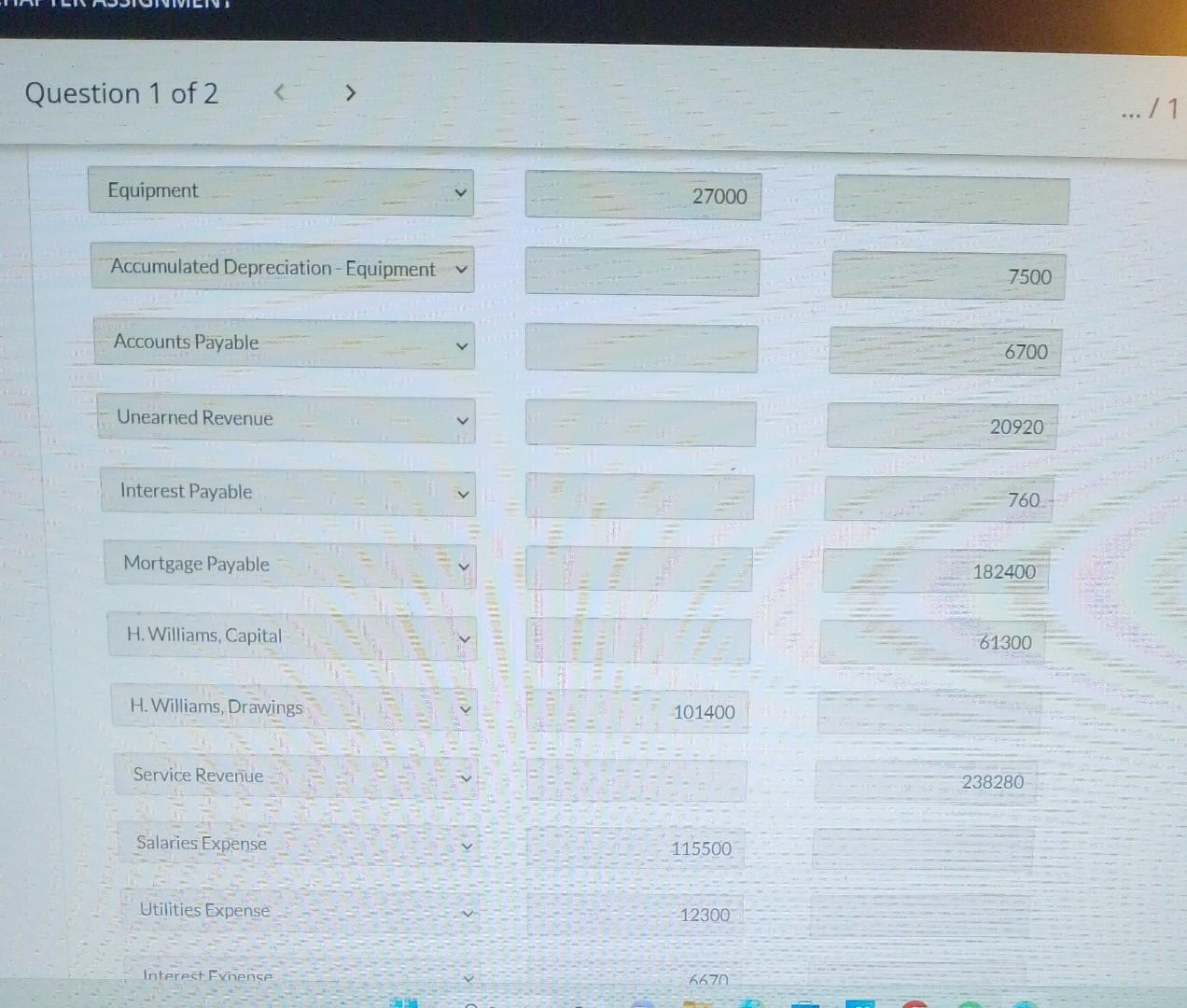

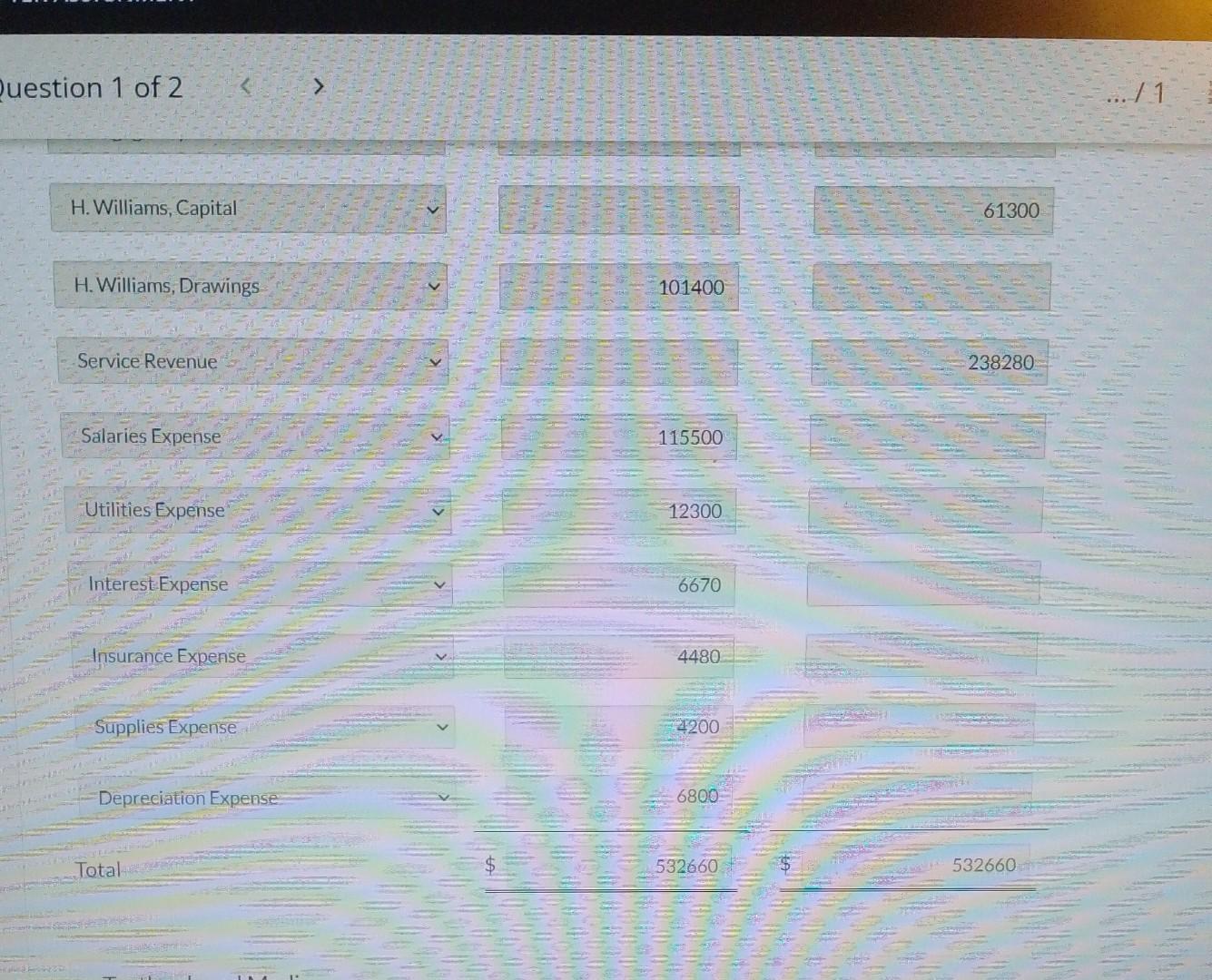

Current Attempt in Progress The following is Cullumber Cycle Repair Shop's trial balance at January 31, 2024, the company's fiscal year end: Additional information: Additional information: 1. The 12-month insurance policy was purchased on June 1,2023. 2. A physical count of supplies shows $1,340 on hand on January 31,2024. 3. The building has an estimated useful life of 50 years. The equipment has an estimated useful life of nine years. 4. The mortgage payable has a 5% interest rate. Interest is paid on the first day of each month for the previous month's interest. 5. By January 31,2024,$1,330 of services related to the unearned revenue have been provided. 6. During the next fiscal year, $4,530 of the mortgage payable is to be paid. Prepare the adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manual entry is required, select "No Entry" for the account titles and enter of for the amounts. List all debit entries before credit entrles.) (To record supplies used) Jan. 31 (To record depreciation expense) Jan. 31 (To accrue interest expense) Jan. 31 (To record revenue for services provided) wiley.com/was/ui/v2/assessment-player/index.html?launchld=f7f897d8-26d9-4e6e-8e76-cf54140b5c2a\#/question/0 PTER ASSIGNMENT Question 1 of 2 CULLUMBER CYCLE REPAIR SHOP Adjusted Trial Balance January 31, 2024 Debit Credit Cash $3500$ Accounts Receivable 6930 Prepaid Insurance 2240 Supplies 1340 Land 50300 Building 190000 Accumulated Depreciation - Building 14800 27000 Equipment 7500 Accumulated Depreciation - Equipment Question 1 of 2 Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Revenue Interest Payable Mortgage Payable H. Williams, Capital H. Williams, Drawings 101400 Service Revenue 238280 Salaries Expense 115500 Utilities Expense 12300 Interect Fxinee K 67n uestion 1 of 2 H. Williams, Capital 61300 H. Williams, Drawings 101400 Service Revenue 238280 Salaries Expense 115500 Utilities Expense 12300 Interest Expense 6670 Insurance Expense 4480 Supplies Expense Depreciation Expense 6800 Total $ 532660=$ 532660 sed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts