Question: please send full answer Flounder Company's bank statement for the month ended January 31 showed a balance per bank of $34,728. The company's Cash balance

please send full answer

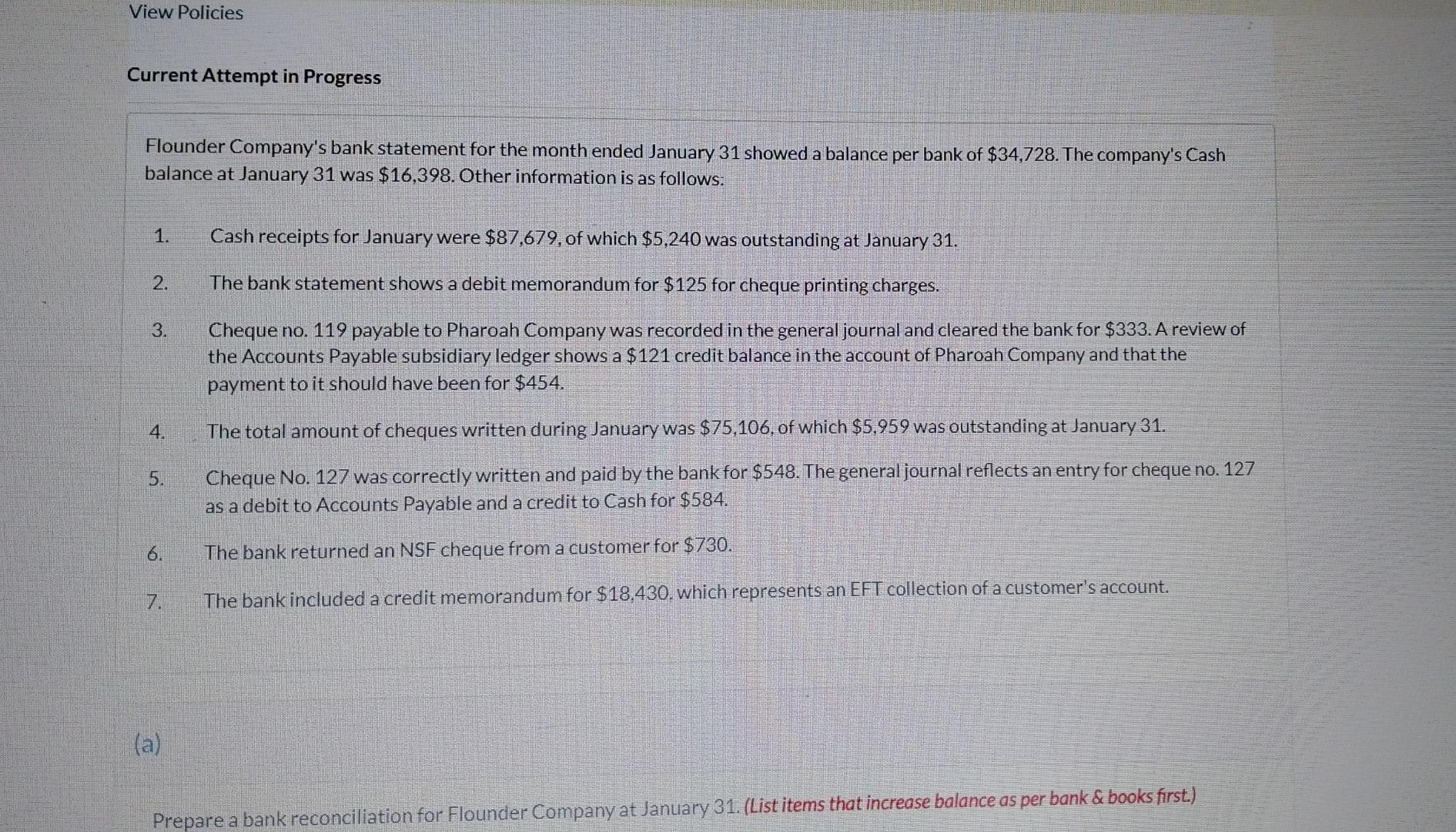

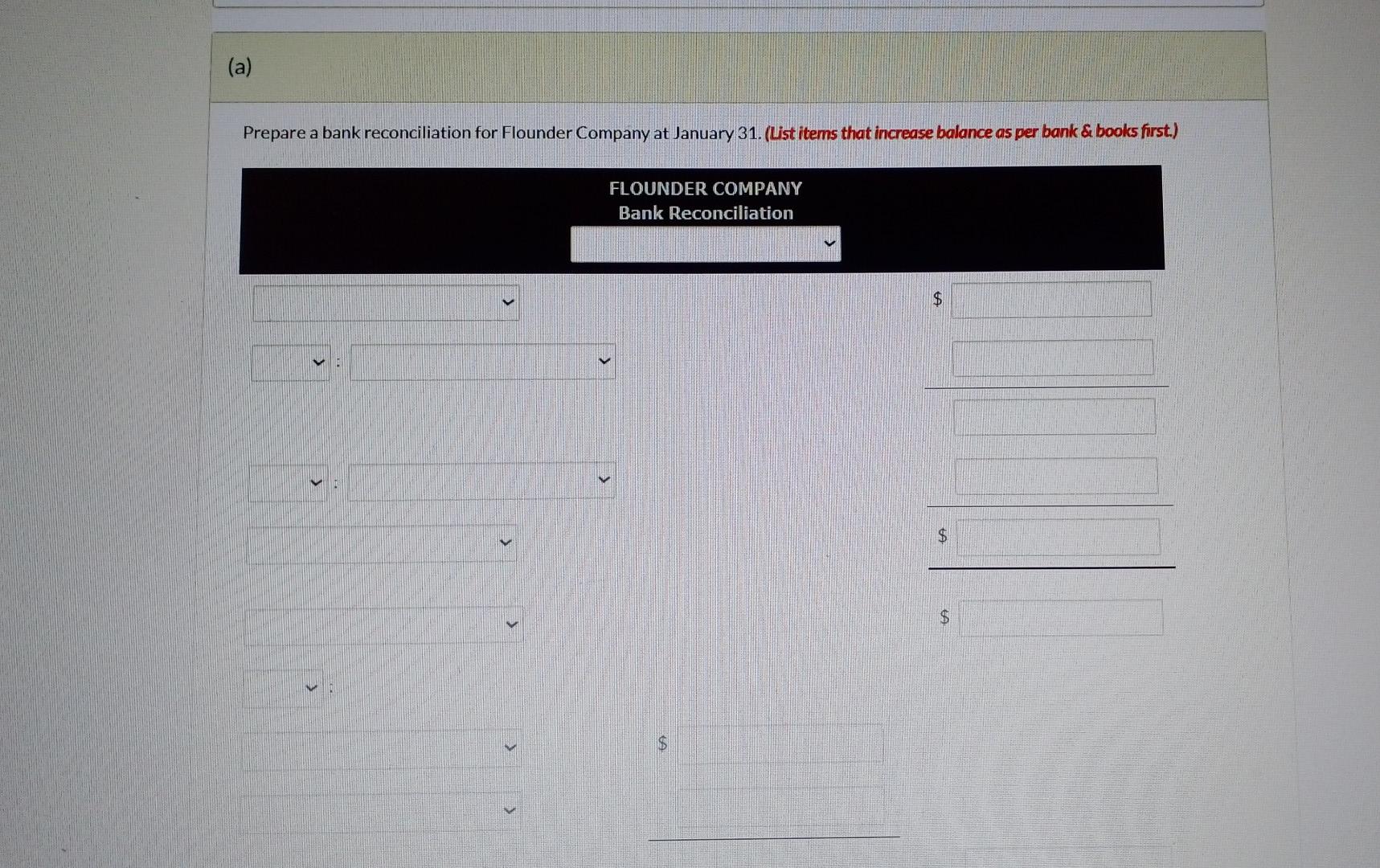

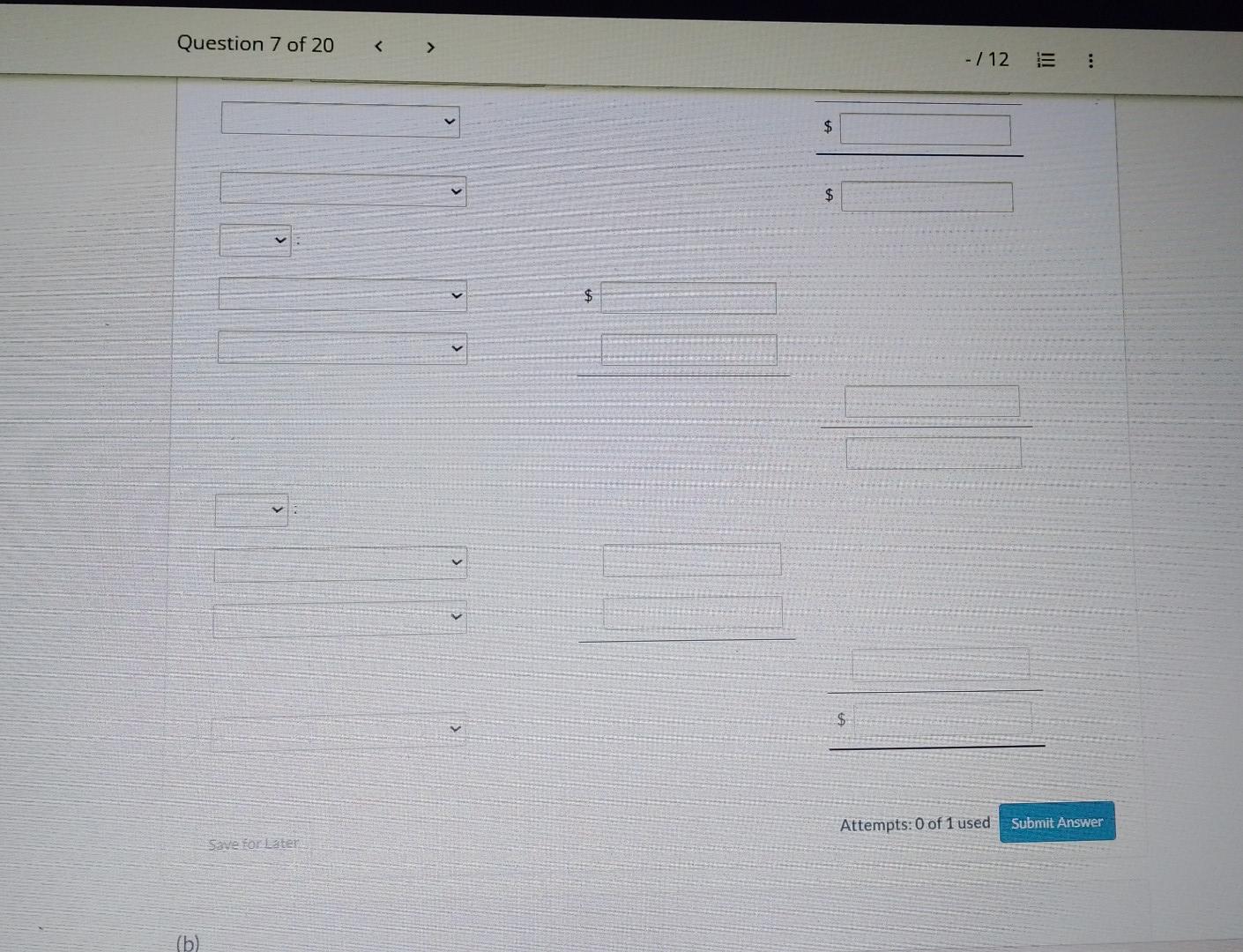

Flounder Company's bank statement for the month ended January 31 showed a balance per bank of $34,728. The company's Cash balance at January 31 was $16,398. Other information is as follows: 1. Cash receipts for January were $87,679, of which $5,240 was outstanding at January 31. 2. The bank statement shows a debit memorandum for $125 for cheque printing charges. 3. Cheque no. 119 payable to Pharoah Company was recorded in the general journal and cleared the bank for $333. A review of the Accounts Payable subsidiary ledger shows a $121 credit balance in the account of Pharoah Company and that the payment to it should have been for $454. 4. The total amount of cheques written during January was $75,106, of which $5,959 was outstanding at January 31 . 5. Cheque No. 127 was correctly written and paid by the bank for $548. The general journal reflects an entry for cheque no. 127 as a debit to Accounts Payable and a credit to Cash for $584. 6. The bank returned an NSF cheque from a customer for $730. 7. The bank included a credit memorandum for $18,430, which represents an EFT collection of a customer's account. Prepare a bank reconciliation for Flounder Company at January 31. (Uist items that increase balance as per bank \& books first.) Question 7 of 20 112 v $ save forlater Attempts: 0 of 1 used Submit Answer (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts