Question: Please send me the answer!! could you answer all this question? TD Finance In-Class Exercises Capital Structure 1. Consider a project with free cash flows

Please send me the answer!!

could you answer all this question?

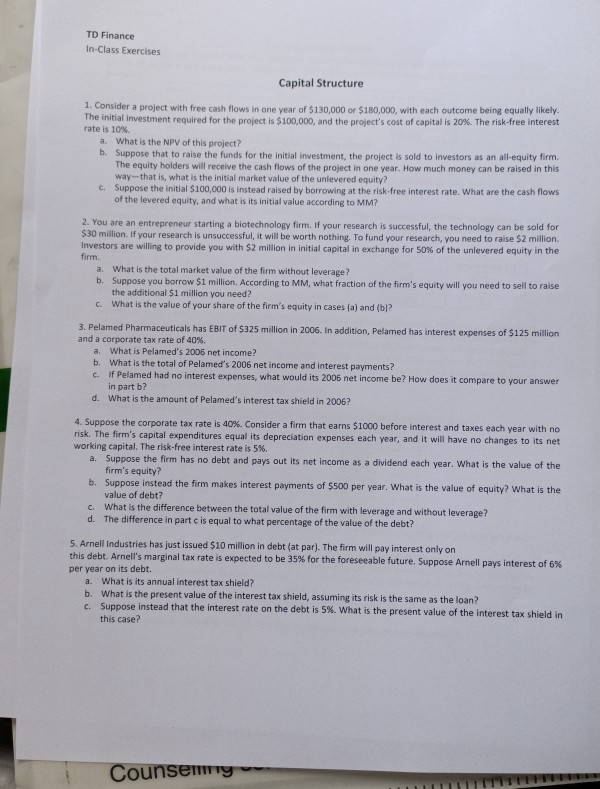

TD Finance In-Class Exercises Capital Structure 1. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely The initial investment required for the project is $100,000, and the project's cost of capital is 20%. The risk-free interest rate is 10% a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this way-that is, what is the initial market value of the unlevered equity? c. Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to MM? 2. You are an entrepreneur starting a biotechnology firm. If your research is successful, the technology can be sold for $30 million. If your research is unsuccessful, it will be worth nothing. To fund your research, you need to raise $2 million. Investors are willing to provide you with $2 million in initial capital in exchange for 50% of the unlevered equity in the firm a. What is the total market value of the firm without leverage? b. Suppose you borrow $1 million. According to MM, what fraction of the firm's equity will you need to sell to raise the additional $1 million you need? c. What is the value of your share of the firm's equity in cases (a) and (b)? 3. Pelamed Pharmaceuticals has EBIT of 5325 million in 2006. In addition, Pelamed has interest expenses of $125 million and a corporate tax rate of 40% a. What is Pelamed's 2006 net income? b. What is the total of Pelamed's 2006 net income and interest payments? c. if Pelamed had no interest expenses, what would its 2006 net income be? How does it compare to your answer in part b? d. What is the amount of Pelamed's interest tax shield in 2006? 4. Suppose the corporate tax rate is 40%. Consider a firm that earns $1000 before interest and taxes each year with no risk. The firm's capital expenditures equal its depreciation expenses each year, and it will have no changes to its net working capital. The risk-free interest rate is 5%. a. Suppose the firm has no debt and pays out its net income as a dividend each year. What is the value of the firm's equity? b. Suppose instead the firm makes interest payments of $500 per year. What is the value of equity? What is the value of debt? c. What is the difference between the total value of the firm with leverage and without leverage? d. The difference in partc is equal to what percentage of the value of the debt? 5. Arnell Industries has just issued $10 million in debt (at par). The firm will pay interest only on this debt. Arnell's marginal tax rate is expected to be 35% for the foreseeable future. Suppose Arnell pays interest of 6% per year on its debt. a. What is its annual interest tax shield? b. What is the present value of the interest tax shield, assuming its risk is the same as the loan? c. Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Counsem - TD Finance In-Class Exercises Capital Structure 1. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely The initial investment required for the project is $100,000, and the project's cost of capital is 20%. The risk-free interest rate is 10% a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this way-that is, what is the initial market value of the unlevered equity? c. Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to MM? 2. You are an entrepreneur starting a biotechnology firm. If your research is successful, the technology can be sold for $30 million. If your research is unsuccessful, it will be worth nothing. To fund your research, you need to raise $2 million. Investors are willing to provide you with $2 million in initial capital in exchange for 50% of the unlevered equity in the firm a. What is the total market value of the firm without leverage? b. Suppose you borrow $1 million. According to MM, what fraction of the firm's equity will you need to sell to raise the additional $1 million you need? c. What is the value of your share of the firm's equity in cases (a) and (b)? 3. Pelamed Pharmaceuticals has EBIT of 5325 million in 2006. In addition, Pelamed has interest expenses of $125 million and a corporate tax rate of 40% a. What is Pelamed's 2006 net income? b. What is the total of Pelamed's 2006 net income and interest payments? c. if Pelamed had no interest expenses, what would its 2006 net income be? How does it compare to your answer in part b? d. What is the amount of Pelamed's interest tax shield in 2006? 4. Suppose the corporate tax rate is 40%. Consider a firm that earns $1000 before interest and taxes each year with no risk. The firm's capital expenditures equal its depreciation expenses each year, and it will have no changes to its net working capital. The risk-free interest rate is 5%. a. Suppose the firm has no debt and pays out its net income as a dividend each year. What is the value of the firm's equity? b. Suppose instead the firm makes interest payments of $500 per year. What is the value of equity? What is the value of debt? c. What is the difference between the total value of the firm with leverage and without leverage? d. The difference in partc is equal to what percentage of the value of the debt? 5. Arnell Industries has just issued $10 million in debt (at par). The firm will pay interest only on this debt. Arnell's marginal tax rate is expected to be 35% for the foreseeable future. Suppose Arnell pays interest of 6% per year on its debt. a. What is its annual interest tax shield? b. What is the present value of the interest tax shield, assuming its risk is the same as the loan? c. Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Counsem

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts