Question: please send me the answer i have 5 minutes left in my exam You are considering acquiring a firm that you believe can generate expected

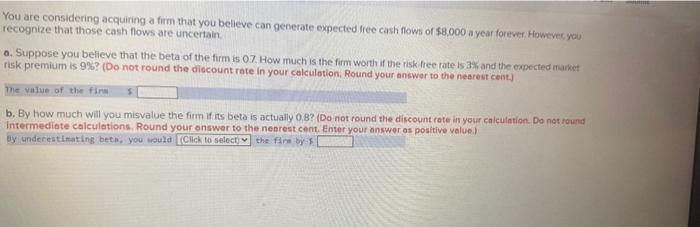

You are considering acquiring a firm that you believe can generate expected free cash flows of $8.000 a year forever. Howtvec you recognize that those cash flows are uncertain a. Suppose you believe that the beta of the firm is 07 . How much is the firm worth if the risk free rate is 3% and the expected market risk premium is 9% ? (Do not round the diccount rate in your calculotion. Round your answer to the neerest cent). The vatue of the firm 5 b. By how much will you misvalue the firm if its beta is actually 0.8 ? (Do not round the discount rate in your eniculation. Do net round intermediate calculations. Round your onswer to the nearest cent. Enter your answer as positive value. gy underestinating betie, you tould the firi by 1 You are considering acquiring a firm that you believe can generate expected free cash flows of $8.000 a year forever. Howtvec you recognize that those cash flows are uncertain a. Suppose you believe that the beta of the firm is 07 . How much is the firm worth if the risk free rate is 3% and the expected market risk premium is 9% ? (Do not round the diccount rate in your calculotion. Round your answer to the neerest cent). The vatue of the firm 5 b. By how much will you misvalue the firm if its beta is actually 0.8 ? (Do not round the discount rate in your eniculation. Do net round intermediate calculations. Round your onswer to the nearest cent. Enter your answer as positive value. gy underestinating betie, you tould the firi by 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts