Question: Please send me the resolved excel program, not images Assignment Question One X company has a following beginning balances Cash 40,000, A/R 8,000, Inventory 22000,

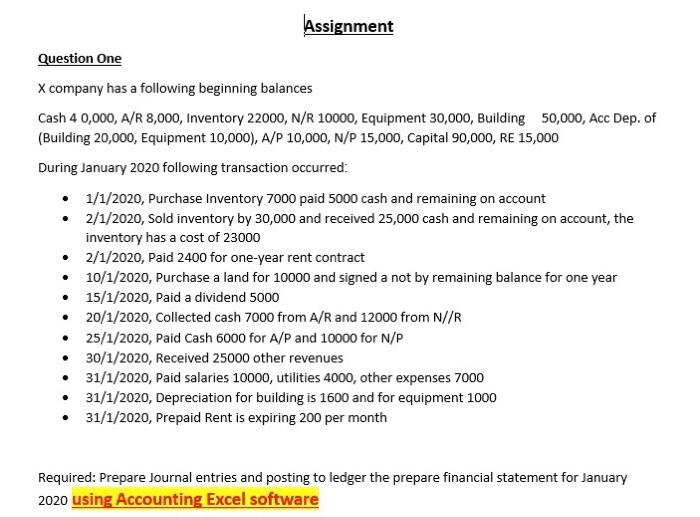

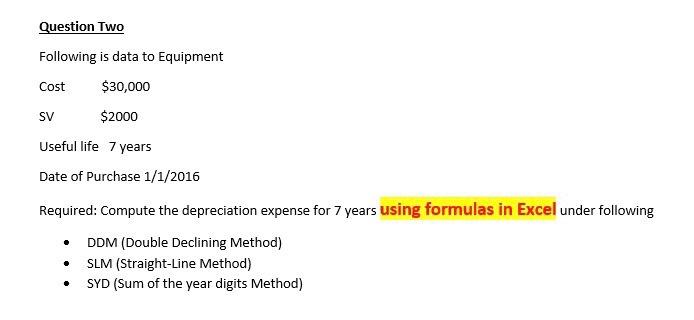

Assignment Question One X company has a following beginning balances Cash 40,000, A/R 8,000, Inventory 22000, N/R 10000, Equipment 30,000, Building 50,000, Acc Dep. of (Building 20,000, Equipment 10,000), A/P 10,000, N/P 15,000, Capital 90,000, RE 15,000 During January 2020 following transaction occurred: 1/1/2020, Purchase Inventory 7000 paid 5000 cash and remaining on account 2/1/2020, Sold inventory by 30,000 and received 25,000 cash and remaining on account, the inventory has a cost of 23000 2/1/2020, Paid 2400 for one-year rent contract 10/1/2020, Purchase a land for 10000 and signed a not by remaining balance for one year 15/1/2020, Paid a dividend 5000 20/1/2020, Collected cash 7000 from A/R and 12000 from N//R 25/1/2020, Paid Cash 6000 for A/P and 10000 for N/P 30/1/2020, Received 25000 other revenues 31/1/2020, Paid salaries 10000, utilities 4000, other expenses 7000 31/1/2020, Depreciation for building is 1600 and for equipment 1000 31/1/2020, Prepaid Rent is expiring 200 per month Required: Prepare Journal entries and posting to ledger the prepare financial statement for January 2020 using Accounting Excel software Question Two Following is data to Equipment Cost $30,000 SV $2000 Useful life 7 years Date of Purchase 1/1/2016 Required: Compute the depreciation expense for 7 years using formulas in Excel under following DDM (Double Declining Method) SLM (Straight-Line Method) SYD (Sum of the year digits Method)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts