Question: please send solution for the most desirible alternative? thank you Two hazardous environment facilities are being evaluated, with the projected life of each facility being

please send solution for the most desirible alternative?

thank you

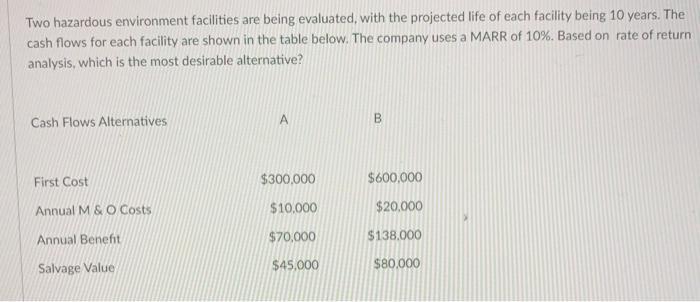

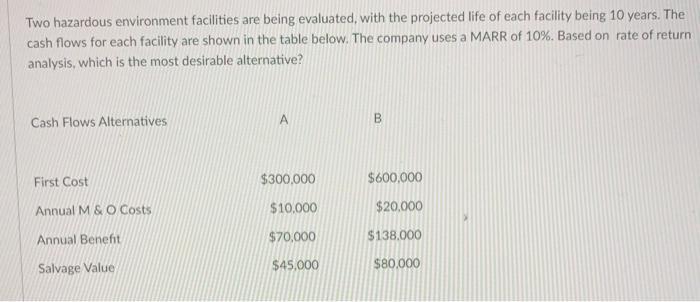

Two hazardous environment facilities are being evaluated, with the projected life of each facility being 10 years. The cash flows for each facility are shown in the table below. The company uses a MARR of 10%. Based on rate of return analysis, which is the most desirable alternative? Cash Flows Alternatives A B First Cost $300,000 $600,000 Annual M & O Costs $10,000 $20,000 Annual Benefit $70,000 $138.000 Salvage Value $45.000 $80,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock