Question: please send the answer as soon as possible! The shares of Fender plc are currently valued on a P/E ratio of 8. The company is

please send the answer as soon as possible!

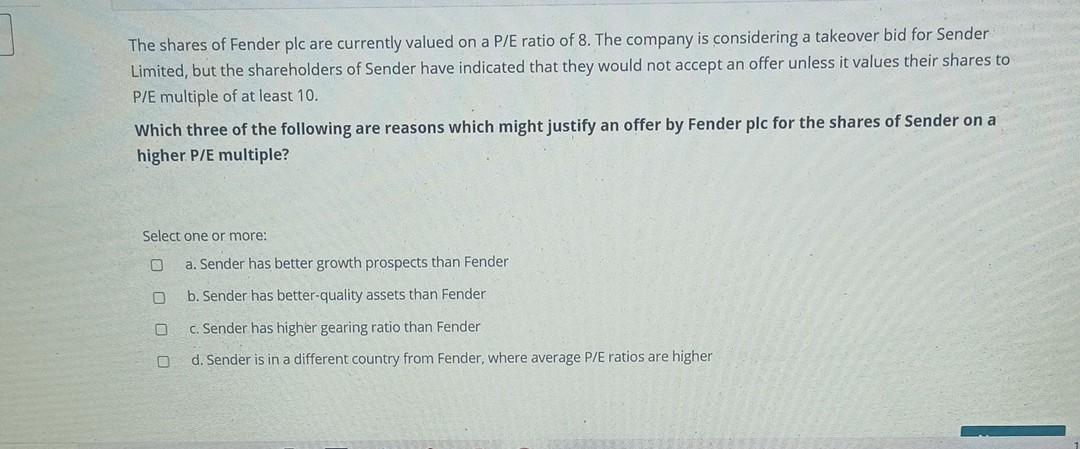

The shares of Fender plc are currently valued on a P/E ratio of 8. The company is considering a takeover bid for Sender Limited, but the shareholders of Sender have indicated that they would not accept an offer unless it values their shares to P/E multiple of at least 10. Which three of the following are reasons which might justify an offer by Fender plc for the shares of Sender on a higher P/E multiple? Select one or more: D a. Sender has better growth prospects than Fender b. Sender has better-quality assets than Fender C. Sender has higher gearing ratio than Fender d. Sender is in a different country from Fender, where average P/E ratios are higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts