Question: Please send the complete and clear/correct answer. I posted questions on chegg and had to pay a lot, but for some questions i just didnt

Please send the complete and clear/correct answer. I posted questions on chegg and had to pay a lot, but for some questions i just didnt get the correct answers. Please send answer correctly. Don't want my money and time to go wasted.Thank you

Please send the complete and clear/correct answer. I posted questions on chegg and had to pay a lot, but for some questions i just didnt get the correct answers. Please send answer correctly. Don't want my money and time to go wasted.Thank you

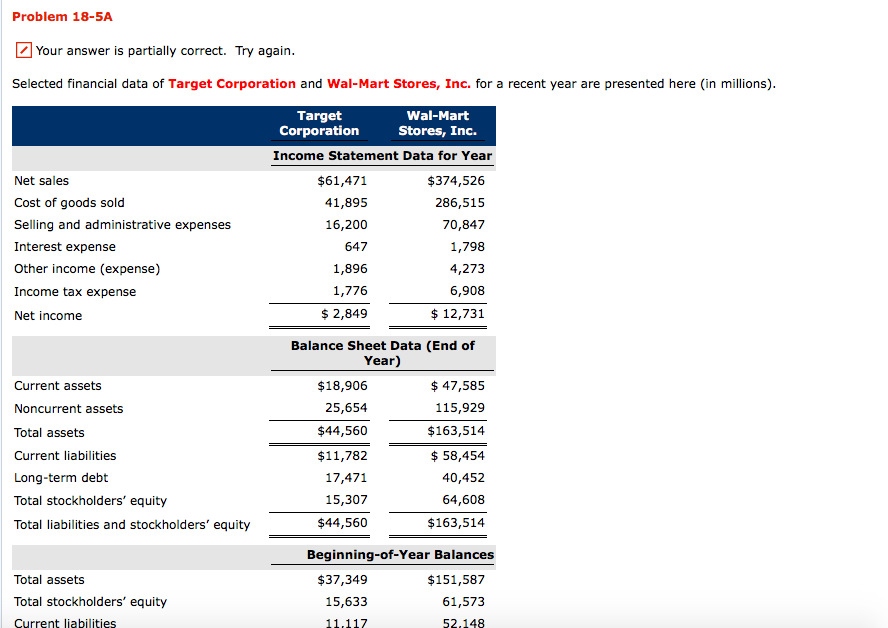

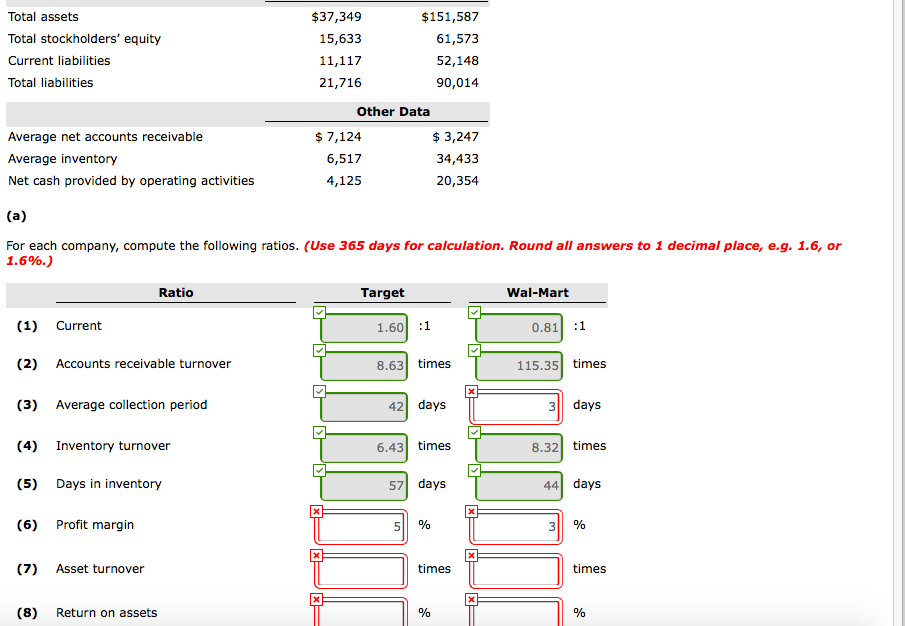

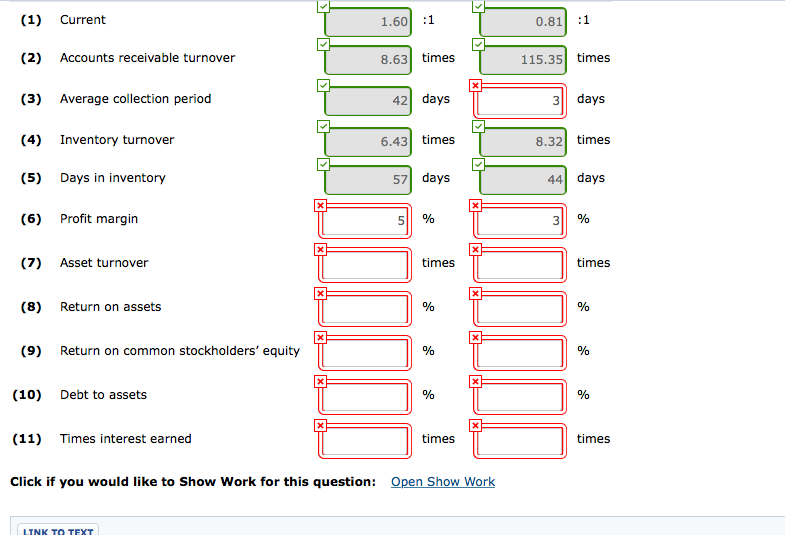

Problem 18-5A Your answer is partially correct. Try again Selected financial data of Target Corporation and Wal-Mart Stores, Inc. for a recent year are presented here (in millions) Target Corporation Wal-Mart Stores, Inc. Income Statement Data for Year Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income $61,471 41,895 16,200 647 1,896 1,776 $ 2,849 $374,526 286,515 70,847 1,798 4,273 6,908 12,731 Balance Sheet Data (End of Year) Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity $18,906 25,654 $44,560 $11,782 17,471 15,307 $44,560 $47,585 115,929 $163,514 $58,454 40,452 64,608 $163,514 Beginning-of-Year Balances $37,349 Total assets Total stockholders' equity Current liabilities $151,587 61,573 15,633 Total assets Total stockholders' equity Current liabilities Total liabilities $37,349 15,633 11,117 21,716 $151,587 61,573 52,148 90,014 Other Data Average net accounts receivable Average inventory Net cash provided by operating activities $ 7,124 6,517 4,125 $3,247 34,433 20,354 For each company, compute the following ratios. (Use 365 days for calculation. Round all answers to 1 decimal place, e.g. 1.6, or 1.696.) Ratio Target Wal-Mart (1) Current 1.601 0.81 :1 (2) Accounts receivable turnover 8.63 times 115.35 times 3 days 8.32 times 44 days 311 % (3) Average collection period 42 days 6.43 times 57 days (4) Inventory turnover (5) Days in inventory (6) Profit margin 511 % (7) Asset turnover times times (8) Return on assets (1) Current 1.60 :1 0.8 :1 (2) Accounts receivable turnover 8.63 times 115.35 times 3 days 8.32 times 44 days (3) Average collection period 42 days 6.43 times 57 days (4) Inventory turnover (5) Days in inventory (6) Profit margin 511 % 311 % (7) Asset turnover times times (8) Return on assets (9) Return on common stockholders' equity (10) Debt to assets (11) Times interest earned times times Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts