Question: Please send this immediately Complete the projected income statement for the first five years of the project. Fill in the following details , Determine the

Please send this immediately

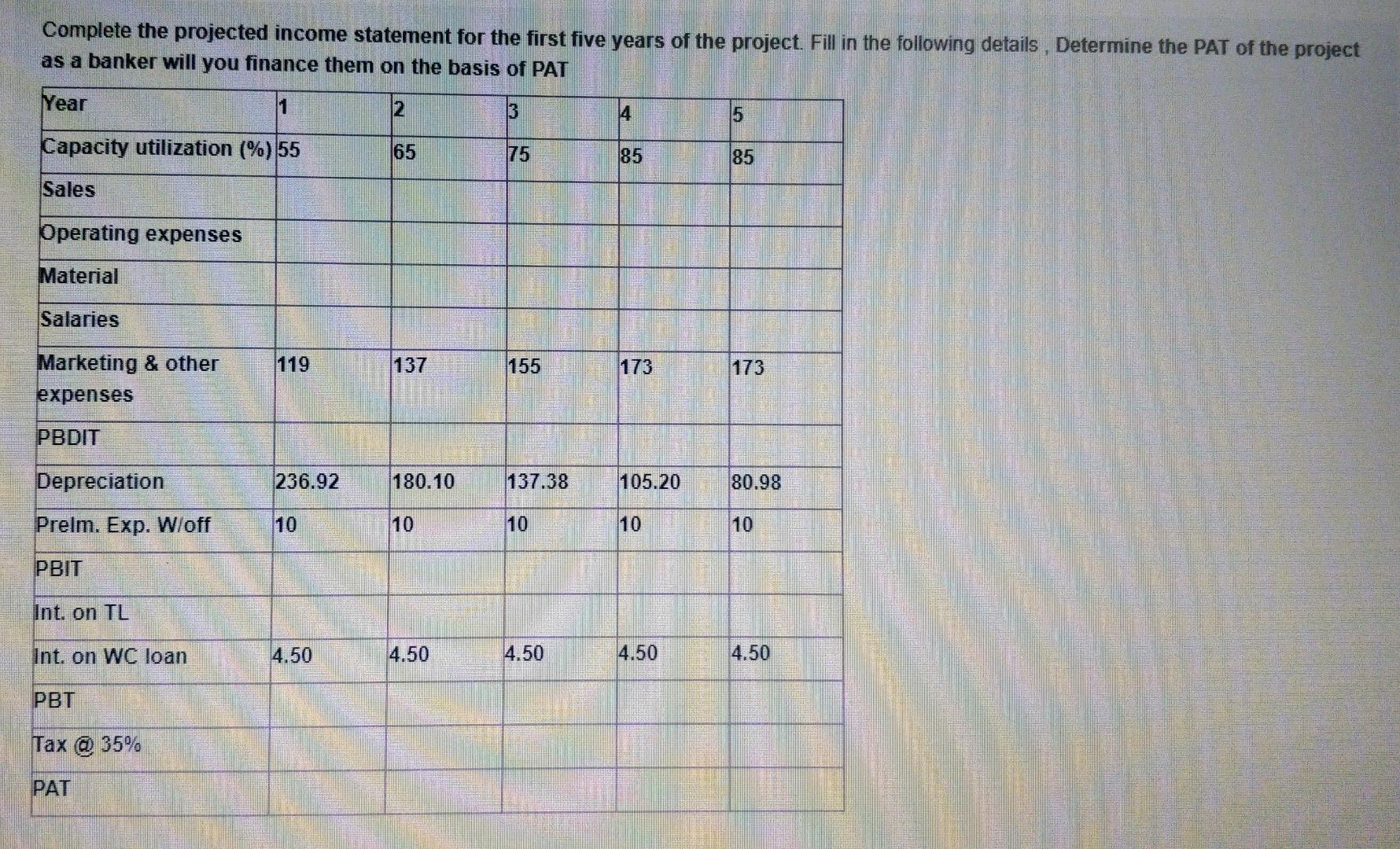

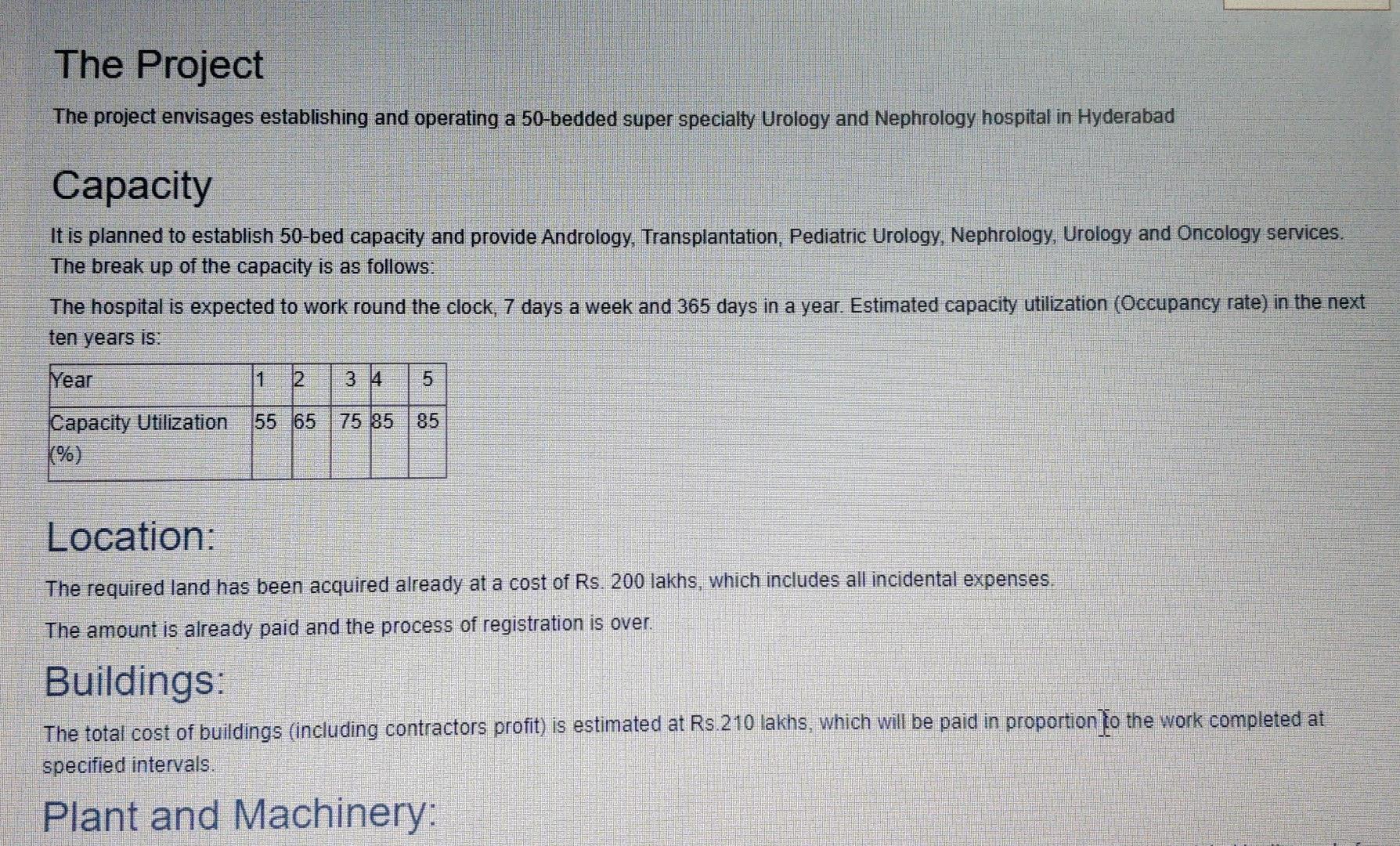

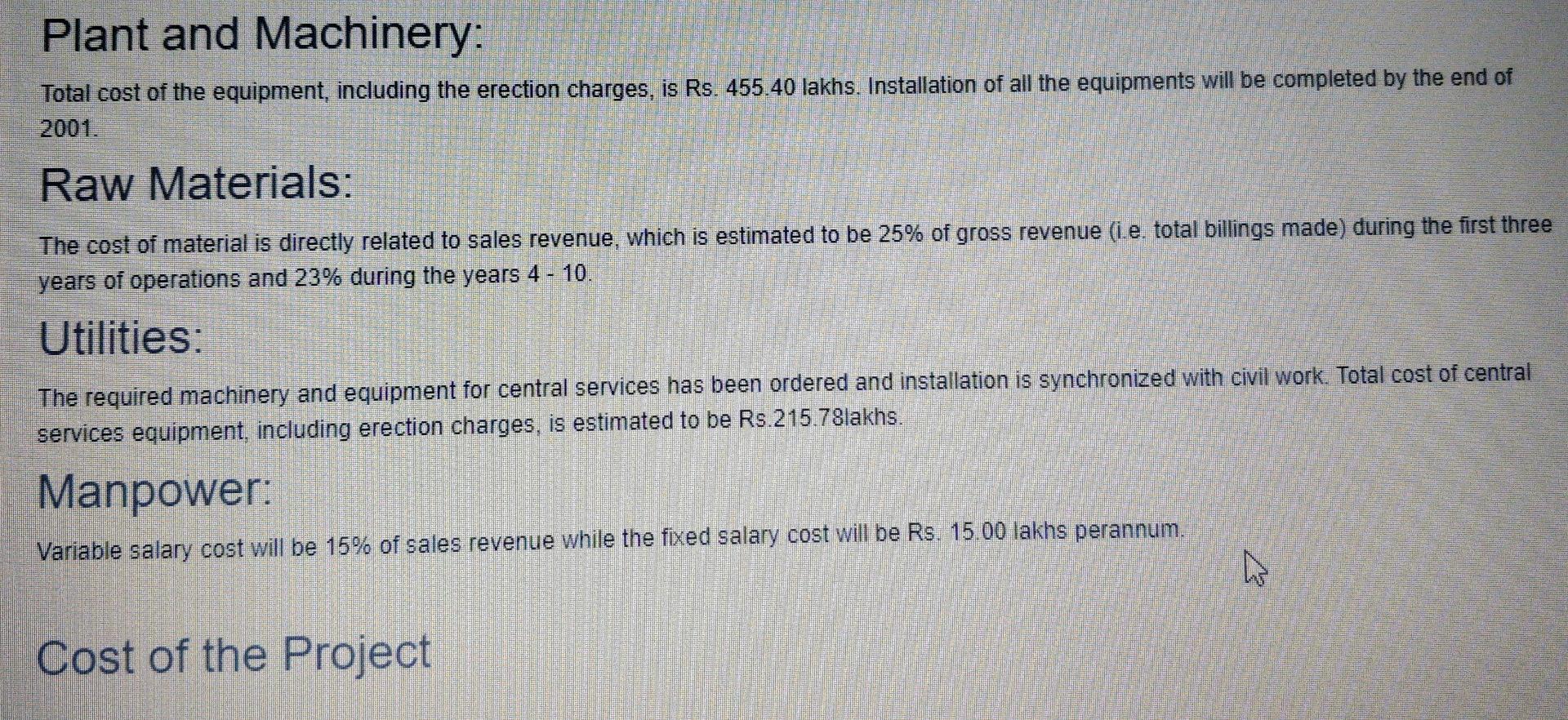

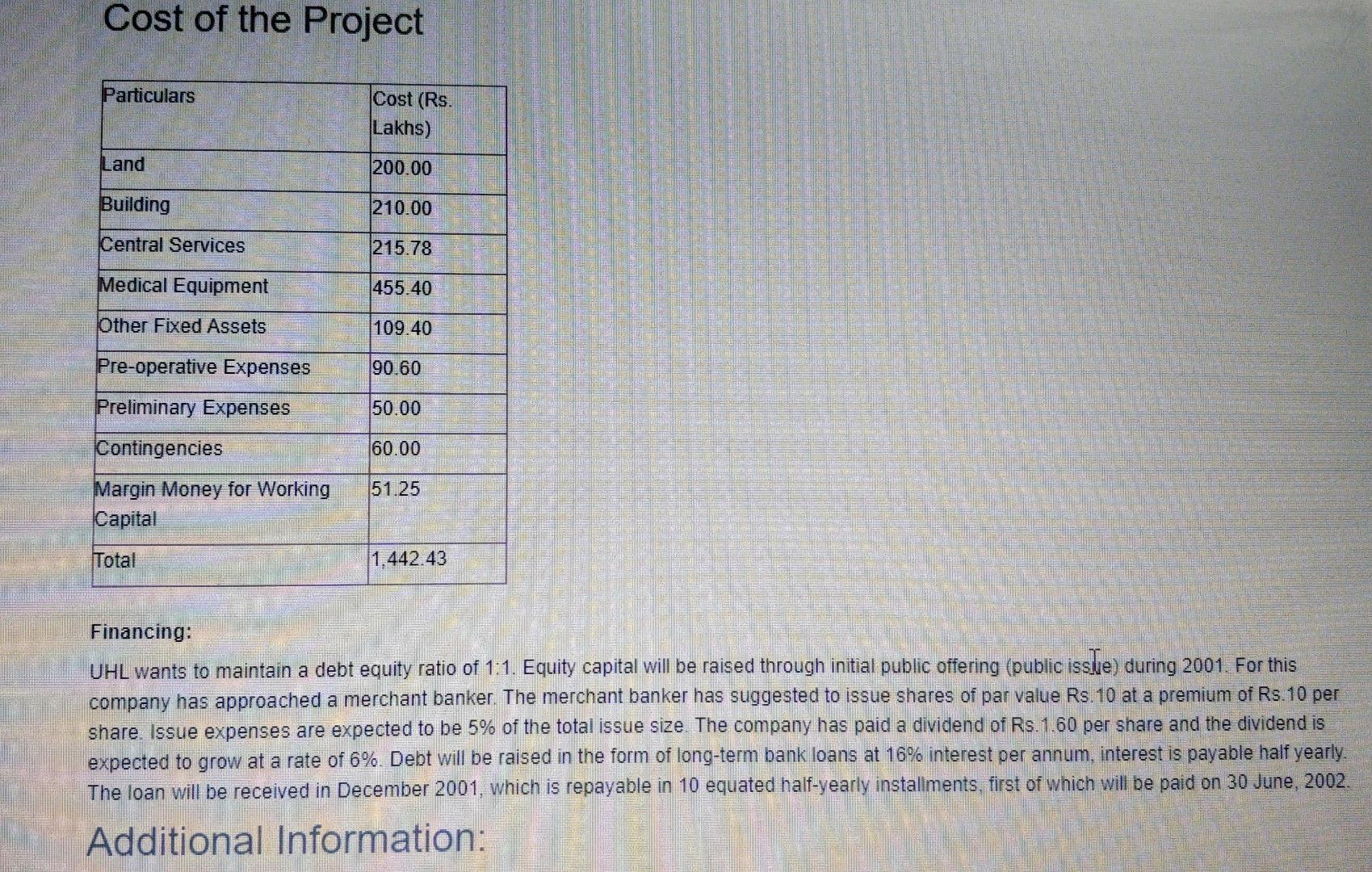

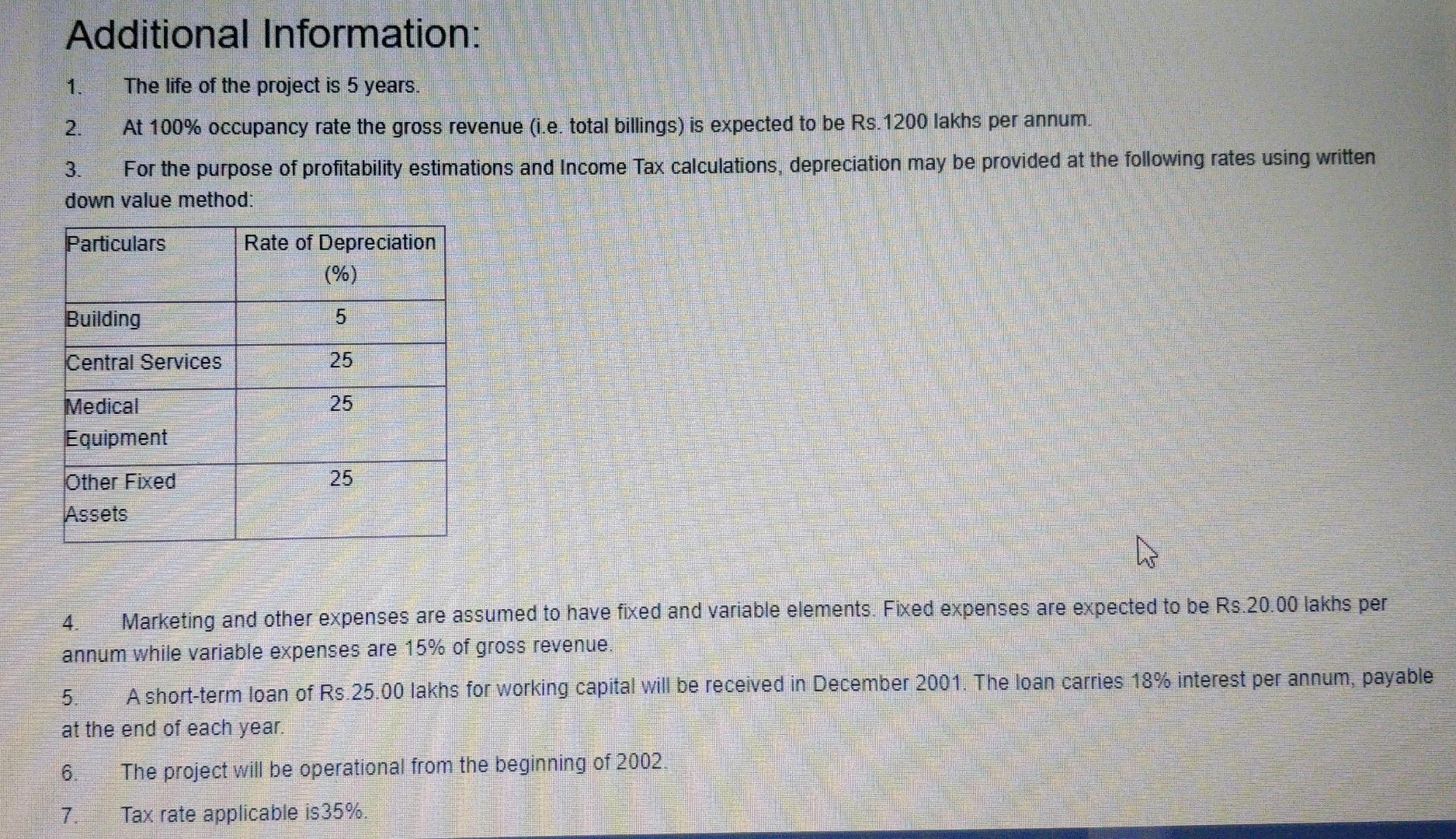

Complete the projected income statement for the first five years of the project. Fill in the following details , Determine the PAT of the project as a banker will you finance them on the basis of PAT Year 11 2 3 4 5 Capacity utilization (%) 55 65 75 85 85 Sales Operating expenses Material Salaries 119 1137 155 173 173 Marketing & other expenses PBDIT Depreciation 236.92 180.10 137.38 105.20 80.98 Prelm. Exp. W/off 10 10 10 10 10 PBIT Int. on TL Int. on WC loan 4.50 4.50 4.50 4.50 4.50 PBT Tax @ 35% PAT The Project The project envisages establishing and operating a 50-bedded super specialty Urology and Nephrology hospital in Hyderabad Capacity It is planned to establish 50-bed capacity and provide Andrology, Transplantation, Pediatric Urology, Nephrology, Urology and Oncology services. The break up of the capacity is as follows: The hospital is expected to work round the clock, 7 days a week and 365 days in a year. Estimated capacity utilization (Occupancy rate) in the next ten years is Year 1 3 4 5 ON 5 55 65 75 85 85 Capacity Utilization (%) Location: The required land has been acquired already at a cost of Rs. 200 lakhs, which includes all incidental expenses The amount is already paid and the process of registration is over. Buildings: The total cost of buildings (including contractors profit) is estimated at Rs.210 lakhs, which will be paid in proportion to the work completed at specified intervals. Plant and Machinery: Plant and Machinery: Total cost of the equipment, including the erection charges, is Rs. 455.40 lakhs. Installation of all the equipments will be completed by the end of 2001. Raw Materials: The cost of material is directly related to sales revenue, which is estimated to be 25% of gross revenue (ie, total billings made) during the first three years of operations and 23% during the years 4 - 10. Utilities: The required machinery and equipment for central services has been ordered and installation is synchronized with civil work. Total cost of central services equipment, including erection charges, is estimated to be Rs.215.78lakhs. Manpower: Variable salary cost will be 15% of sales revenue while the fixed salary cost will be Rs. 15.00 lakhs perannum. w Cost of the Project Cost of the Project Particulars Cost (Rs. Lakhs) Land 200.00 Building 210.00 Central Services 215.78 Medical Equipment 1455.40 Other Fixed Assets 109.40 Pre-operative Expenses 90.60 50.00 Preliminary Expenses Contingencies 60.00 51.25 Margin Money for Working Capital Total 1.442.43 Financing: UHL wants to maintain a debt equity ratio of 1:1. Equity capital will be raised through initial public offering (public issue) during 2001. For this company has approached a merchant banker. The merchant banker has suggested to issue shares of par value Rs. 10 at a premium of Rs. 10 per share. Issue expenses are expected to be 5% of the total issue size. The company has paid a dividend of Rs.1.60 per share and the dividend is expected to grow at a rate of 6%. Debt will be raised in the form of long-term bank loans at 16% interest per annum, interest is payable half yearly. The loan will be received in December 2001, which is repayable in 10 equated half-yearly installments, first of which will be paid on 30 June, 2002. Additional Information: Additional Information: The life of the project is 5 years. 2. At 100% occupancy rate the gross revenue (i.e. total billings) is expected to be Rs. 1200 lakhs per annum. 3. For the purpose of profitability estimations and Income Tax calculations, depreciation may be provided at the following rates using written down value method: Particulars Rate of Depreciation (%) Building 5 Central Services 25 Medical Equipment 25 Other Fixed Assets Marketing and other expenses are assumed to have fixed and variable elements. Fixed expenses are expected to be Rs.20.00 lakhs per annum while variable expenses are 15% of gross revenue. 5. A short-term loan of Rs. 25.00 lakhs for working capital will be received in December 2001. The loan carries 18% est per annum, payable at the end of each year. 6. The project will be operational from the beginning of 2002. 7 Tax rate applicable is 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts