Question: please send working notes Located in Moose Jaw, Saskatchewan, Paperclip Office Supplies, has a December 31 year-end and prepares annual financial statements. They gathered the

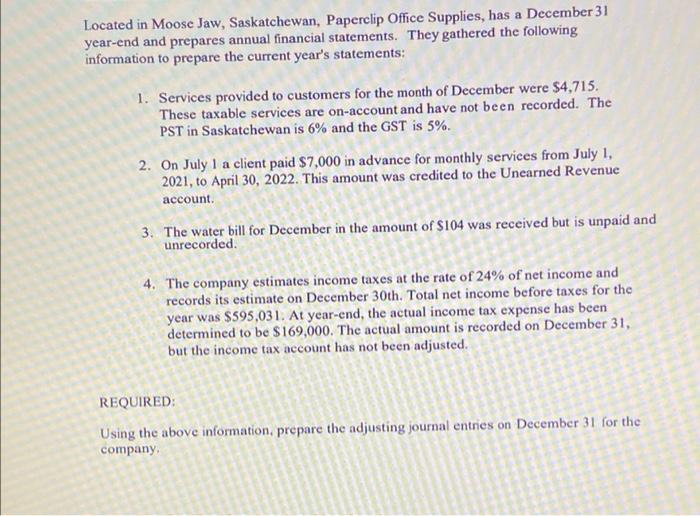

Located in Moose Jaw, Saskatchewan, Paperclip Office Supplies, has a December 31 year-end and prepares annual financial statements. They gathered the following information to prepare the current year's statements: 1. Services provided to customers for the month of December were $4,715. These taxable services are on-account and have not been recorded. The PST in Saskatchewan is 6% and the GST is 5%. 2. On July 1 a client paid $7,000 in advance for monthly services from July 1, 2021, to April 30, 2022. This amount was credited to the Unearned Revenue 000 in the oft is 5% account 3. The water bill for December in the amount of $104 was received but is unpaid and unrecorded 4. The company estimates income taxes at the rate of 24% of net income and records its estimate on December 30th. Total net income before taxes for the year was $595,031. At year-end, the actual income tax expense has been determined to be $169,000. The actual amount is recorded on December 31, but the income tax account has not been adjusted. REQUIRED: Using the above information, prepare the adjusting journal entres on December 31 for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts