Question: please share in excel calculation for better understanding a) The GasPro makes gas. All direct materials and conversion costs are applied to all of the

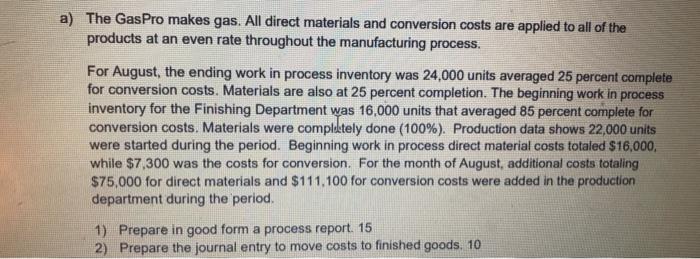

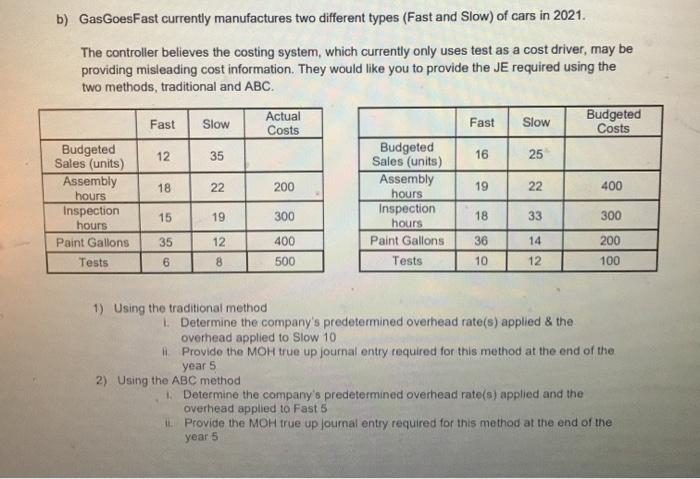

a) The GasPro makes gas. All direct materials and conversion costs are applied to all of the products at an even rate throughout the manufacturing process. For August, the ending work in process inventory was 24,000 units averaged 25 percent complete for conversion costs. Materials are also at 25 percent completion. The beginning work in process inventory for the Finishing Department was 16,000 units that averaged 85 percent complete for conversion costs. Materials were completely done (100%). Production data shows 22,000 units were started during the period. Beginning work in process direct material costs totaled $16,000, while $7 300 was the costs for conversion. For the month of August, additional costs totaling $75,000 for direct materials and $111.100 for conversion costs were added in the production department during the period. 1) Prepare in good form a process report. 15 2) Prepare the journal entry to move costs to finished goods. 10 b) GasGoesFast currently manufactures two different types (Fast and Slow) of cars in 2021. The controller believes the costing system, which currently only uses test as a cost driver, may be providing misleading cost information. They would like you to provide the JE required using the two methods, traditional and ABC. Fast Slow Actual Costs Fast Slow Budgeted Costs 12 35 16 25 18 22 200 19 22 400 Budgeted Sales (units) Assembly hours Inspection hours Paint Gallons Tests Budgeted Sales (units) Assembly hours Inspection hours Paint Gallons Tests 15 19 300 18 33 300 35 12 400 14 36 10 200 100 6 8 500 12 1) Using the traditional method 1. Determine the company's predetermined overhead rate(s) applied & the overhead applied to Slow 10 Provide the MOH true up journal entry required for this method at the end of the 2) Using the ABC method Determine the company's predetermined overhead rate(s) applied and the overhead applied to Fast 5 Provide the MOH true up Journal entry required for this method at the end of the year 5 year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts